Fiat versus Bitcoin – which one is better? Our current monetary system is a fiat money monetary system. Central banks are creating the base-money and commercial banks are creating the credit-money. This model is 100 years old by now. But is this system sustainable? Or is the new monetary system based on the Bitcoin a better solution?

The following key questions are analyzed in this article:

- What is the issue with our fiat monetary system?

- Why is Bitcoin the solution?

These topics are analyzed in the following way:

- First, you can watch our webinar presentation

- After that, the analysis of the fiat monetary system versus Bitcoin will follow

Webinar recording

Here is the recording of the webinar with Martin Ploom and Asse Sauga:

How does a monetary system work?

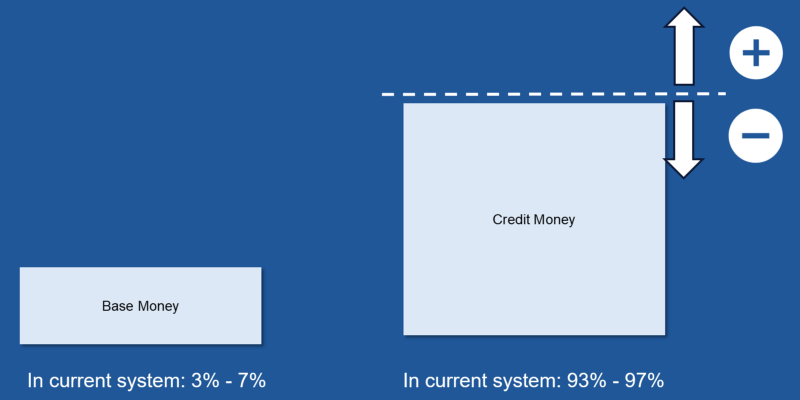

Every monetary system has a base-money and credit-money, at least it’s so for the last 5’000 years.

There are two key categories of the base-money:

- Commodity based – the big advantage here is that the governments or central banks cannot manipulate the amount of this type of money. Gold, Silver, and Bitcoin belong to this category

- Non-commodity based – our current monetary system is based on the non-commodity base-money. Central banks can create as much of the new base-money as they wish, nothing is stopping them to do this

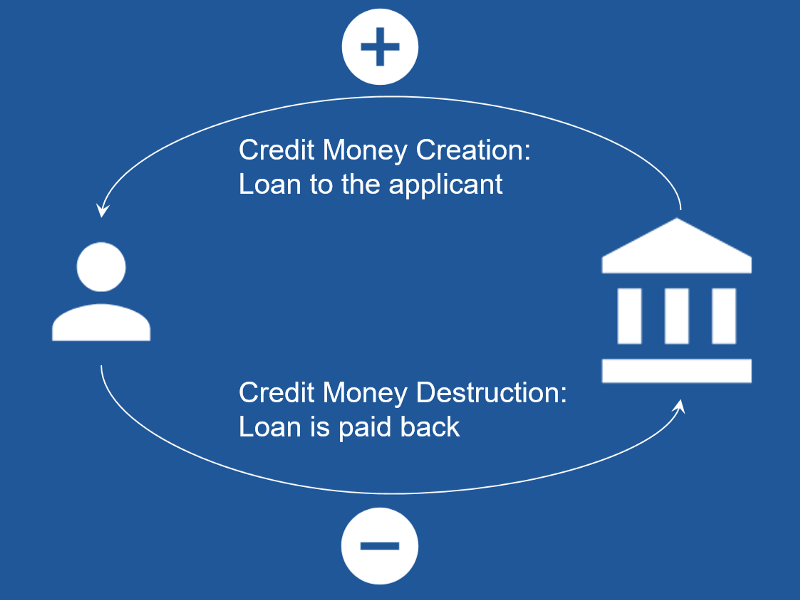

Credit-money is created and destroyed today via the lending process by the banks.

These are the key phases of credit-money history:

- The monetary system started with commodity-based money and decentral credit-money

- Then the phase with the sovereign coin-based money and decentral credit-money followed

- After that came the phase with the national-based money (either from the sovereign or central bank) and private credit-money

- The next phase was the current central banking based money and its central credit-money system

How do commercial banks create money?

Commercial Banks create credit-money via the lending process. Every time a loan is issued – new credit-money is created. Every time a loan is paid back – the respective amount of the credit money is destroyed. The issue is that at any given time the commercial banks are creating more credit-money than they are destroying. This results in continuous monetary inflation – there is more money available for the same amount of real assets. As a consequence – the asset prices will increase.

What’s the issue with the fiat money?

The key issues are:

- The continuous debasement of the base-money via QE1, QE2, QE “forever”

- The continuous creation of the credit-money by the commercial banks

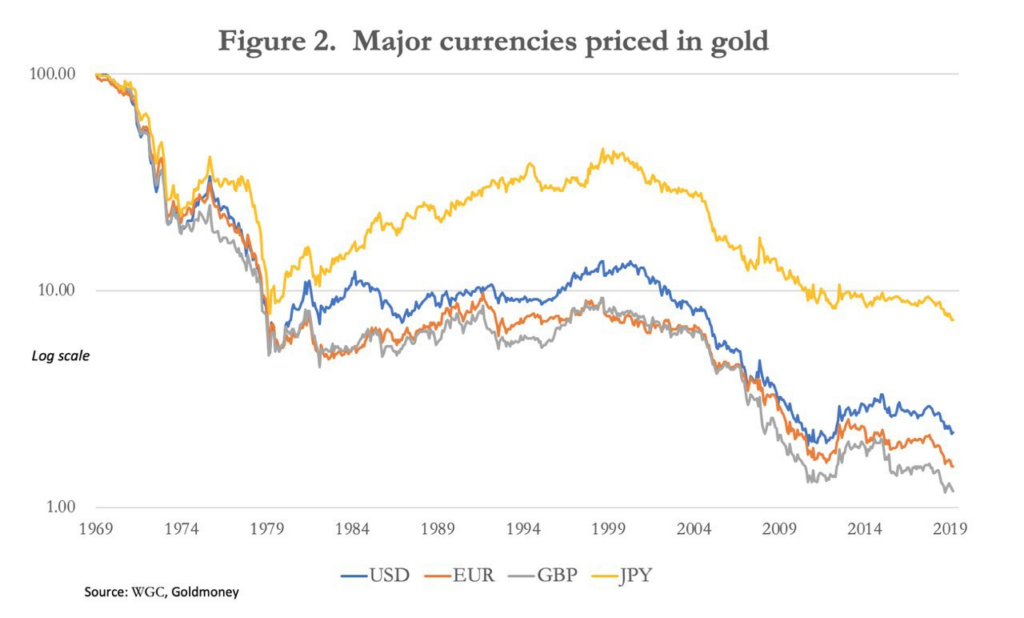

This means the same amount of base-money can buy less and less. It can be visualized in the following chart – it’s the price of major currencies in gold:

The opposite of this is a continuously growing amount of the total money (base-money plus credit-money) in the Eurozone. Of course, Eurozone has been growing during this time, but not 8 times – that’s how much the amount of the total money has been growing. As the amount of real assets is more or less constant, then this translates into real assets becoming more and more expensive.

Total money in Eurozone. Source: tradingeconomics.com

Fiat currency versus Bitcoin

Manipulation of the base-money

One of the main flaws in the current monetary system is the continuous manipulation of the base-money by the central banks, which can arbitrarily create new base-money. This results in the debasement of the money (visualized above with the price of fiat in gold).

But Bitcoin is a commodity, the amount of Bitcoin is non-manipulatable by the central banks. Central banks cannot “print new Bitcoin“. Using Bitcoin as a base-money would take away the central banking money-printing tool. In parallel, it would significantly reduce the importance of the central banks. This is the key.

The exponential growth of the credit-money

90% of the total money is credit-money. This credit-money is created via commercial bank lending. Commercial bank lending (and respective credit-money creation) is limited via the Equity to the RWA ratio (see more in the “Why is the central banking interest rate so low and why is it so high for the SME’s?“). The RWA ratio is between 8% – 12%. This results in easy leverage (fractional reserve banking) and easy ways to earn profit for commercial banks.

The amount of credit-money in the economy should not grow faster than the GDP in the economy:

- At the moment the credit-money is growing at the speed of 5%-6% per year

- The economy grows at a speed of 2% per year (worldwide averages)

This results in continuous monetary inflation because there will be continuously more money than available real assets (the amount of money is growing faster than the amount of the real assets). The ones with higher proximity to the money creation will be preferred and the ones with the low proximity to the money creation (the 90% – 95%) will be disadvantaged. See more in the article “Why do we have inequality?“.

Bitcoin doesn’t have the credit-money capability. That’s not the issue. The key is that Bitcoin will be in the competition with the continuously expanding fiat money:

- On one side, it will be continuously debased fiat money

- On another side, the non-manipulatable commodity – Bitcoin

People can choose which money they want to use.

What is an easy solution for the Fiat Monetary System?

The fix to the Fiat Monetary System would be easy:

- Non-manipulatable base-money, like the gold during the gold-standard. Bitcoin could easily serve as base-money

- Clear separation of the base-money and credit-money in the monetary system. Base-money is persistent. Commercial banks create and destroy credit-money continuously. The issue in our current system is that there is no clear separation between these two types of money…

- Mandatory convertibility of the credit-money into the base-money – this worked till 1933 in the U.S. – everyone could demand his dollars to be converted into gold (25 dollars into 1 ounce of gold) – this would limit the exponential growth of the credit-money in the economy

- Let banks issue private credit-money – like it was before the 1913 Federal Reserve Act – every commercial bank could create its credit-money. People decided which credit-money to use or not to use – people tended to use conservative banks and not the banks with aggressive lending portfolios

- Allow monetary competition – allow multiple “money types” to exist in parallel. Allow the fiat system and Bitcoin system in parallel. Let people decide on which money they want to use.

Our Webinar Series

We started with the regular webinar series with the focus on the Blockchain, Crypto lending, and coronavirus economic crisis. We host the webinar every Sunday, 15:00 CET (Central European Time):

- The first webinar – on the 29th of March – was on the topic “Coronavirus and Bitcoin price – What’s next” (only blog article, we did not record it …)

- The second webinar – on 5th of April – was on the topic “Webinar – Coronavirus market crisis – Where to invest 5’000 $“

- The third one – on the 12th of April – was on the topic “Webinar – Coronavirus crash versus 2008 financial crash – What is the difference?“

- The fourth one – on the 19th of April – was on the topic “Webinar – Why is the central bank interest rate so low and Why is it so high for the SME’s?“

- The fifth one – on the 26th of April – was on the topic “Webinar – What will happen to Bitcoin (Looming Financial Crisis) ?“

- The sixth one – this one here, on the 3rd of May – is on the topic “Webinar – Fiat currency versus Bitcoin. Why Bitcoin’s future is so bright?“