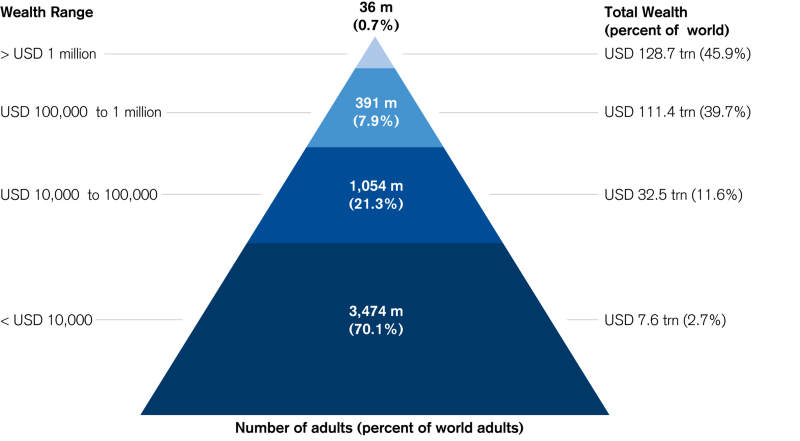

Meet the Big Blue Elephant in the room. Today, the world is to a big extent influenced by the wealth pyramid so that 1% of people own 46% of the wealth in the world. But why do we have inequality? It is known, that the rich become richer and we have got somehow used to it. We don’t question it, we see it almost as normal.

But what are the reasons for this? Why is the wealth in the world distributed so unevenly, leading to high inequality? How did it come that 3.7 billion people have only 2.7% of the world’s wealth?

One of the main reasons is our current banking system — the fiat money system. It creates the impression that stable money is available in the world, right? But behind the scenes, the amount of money is continuously expanded. The unfortunate side effect is that from the profits from the money creation accumulate in the rich class. The poor class, on the other hand, sees only inflation of prices.

Even if the poor class has an impression of stable money, relatively they can buy less and less for their money as profits from the fiat money creation accumulate to the rich class.

This is the reason for the inequality.

How is inequality created?

Why does it happen so? Key drivers for this are the following:

- The proximity to the money creation – commercial banks create money via the lending process

- Having access to the low interest-rate credit

We can summarize this as follows:

- The rich class is closer to the credit creation via commercial banks (high proximity to the money creation) and they have easier access to the credit – the rich class will get the loans at a lower interest rate

- The poor on the other side have much less access to the credit (low proximity to the money creation) or they have access on very challenging terms (i.e. high interest-rate)

- 20% of GDP receives 80% of credit money (corporations and rich individuals) and vice versa in modern economies — i.e. the credit is not equally distributed in the society. See our analysis “Why is the central bank interest rate is so low and why is the interest rate so high for the SME’s?“

- Credit is, not always, but very often, the basis for wealth creation

The rich class can access bank credit with a low interest-rate. This allows the rich class to acquire the assets at a relatively low cost. As the total amount of money is continuously growing in the fiat monetary system, but the amount of the real assets remains constant, then the amount of money per real asset is continuously growing. This is inflation. And this inflation will damage the poor as opposed to the rich.

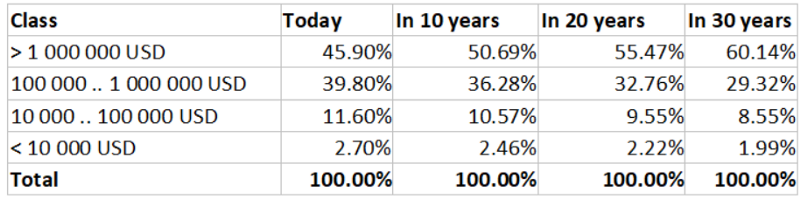

Let’s illustrate the effect of the fiat money system with the following simulation which considers the current wealth pyramid, world annual inflation 3.2%, and profit from money creation (seigniorage) 2% annual. The inflation applies here for everyone. However, the profits from the seigniorage are available only to the rich class.

The effect of the fiat money creation system on the wealth pyramid is clear. The Rich become richer and the poor become poorer.

What is the solution?

What can we do? Cryptocurrencies created non-central-bank controlled base-money. It is a big step forward. But it is not enough. We need more. We need to distribute profits from money creation (seigniorage) evenly in the world and not only to the selected few.

Therefore, we created SmartCredit.io. To make the world a better place, to have more even wealth distribution in the world, to give chance to the non-included people in our world and to reduce inequality in our world! In SmartCredit.io everyone has the same proximity to the money creation. There is no preferred class, which will accumulate the benefits of money creation, year by year, generation by generation.

Join the revolution.