SmartCredit.io is a Decentralized Finance (DeFi) crypto lending platform focusing on fixed-interest loans and fixed-term loans. Thousands of users have registered already with SmartCredit.io.

But how does the borrower benefit from fixed-term and fixed-interest loans? There are multiple use cases. This article focuses on one of the use cases—Yield Farming with fixed-term loans. It shows how every borrower can become an investor and earn money on his assets.

The following topics are analyzed:

- What is Yield Farming?

- How do you monetize your assets?

- What are DeFi fixed-term loans?

- How do you borrow fixed term in SmartCredit.io?

- How do you benefit from Yield Farming with fixed-term loans?

What is Yield Farming?

Yield Farming is a way to earn income with your DeFi assets without selling them. There are two ways to do this:

- Using specialized tools such as yearn.finance to access yield farming

- Becoming a liquidity provider to one of the DEXs (Uniswap, Curve, Balancer, Sushi)

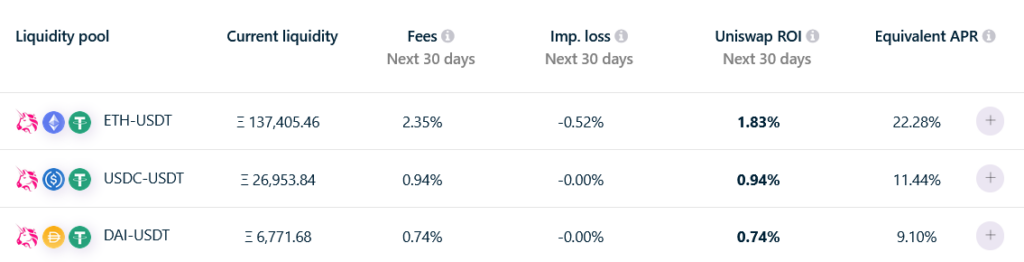

The DEXs take fees from users—for example, Uniswap takes 0.3%, and Loopring takes 0.25% per trade. These fees accumulate in the liquidity pool and increase the value of the liquidity provider shares. If one uses the pools with volatile assets, then there is the risk of impermanent loss. However, if one uses only stablecoin-based pools (such as Y pool in Curve), then the impermanent loss is mitigated.

Here are sample returns from the Uniswap pools from becoming a liquidity provider (Uniswap ROI shows the estimated return for the next 30 days; Equivalent APR shows the expected annual return):

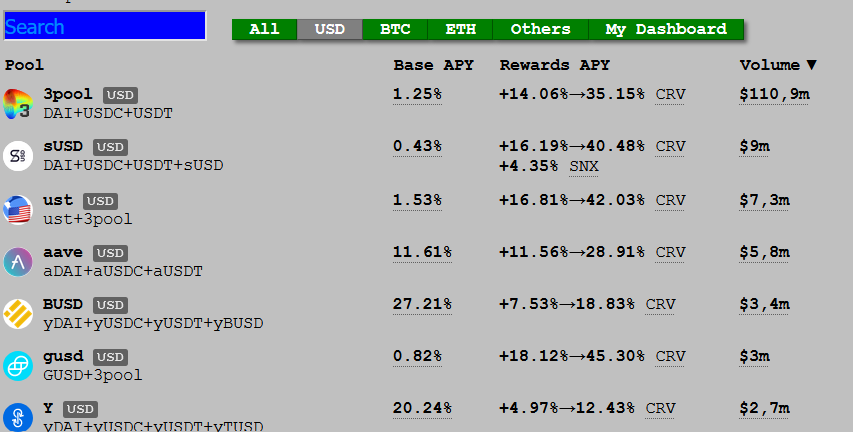

Here are the yields from the Curve stablecoin pools (the range depends on staking and on locking the Curve tokens):

Yield farmers can use many pools—Uniswap, Curve, Balancer, Sushi, etc. Some pools give reward tokens, and they add them to the yield, which is earned from the liquidity providing fees.

To summarize—yield farming allows the holders of stablecoins or other assets to earn the yield without selling but by locking the asset into the respective protocols.

How to monetize your assets?

If one has stablecoins already, then it’s easy to start with yield farming. But let’s assume the investor has several tokens (BAT, ZRX, LRC, MKR, etc.) in his wallet because the investor has a bullish view of these assets.

The investor could use these assets as collateral and borrow stablecoins against these assets. There are two possibilities for this:

- Borrowing via the Money-Market Funds

- Borrowing via the Fixed-Income Funds

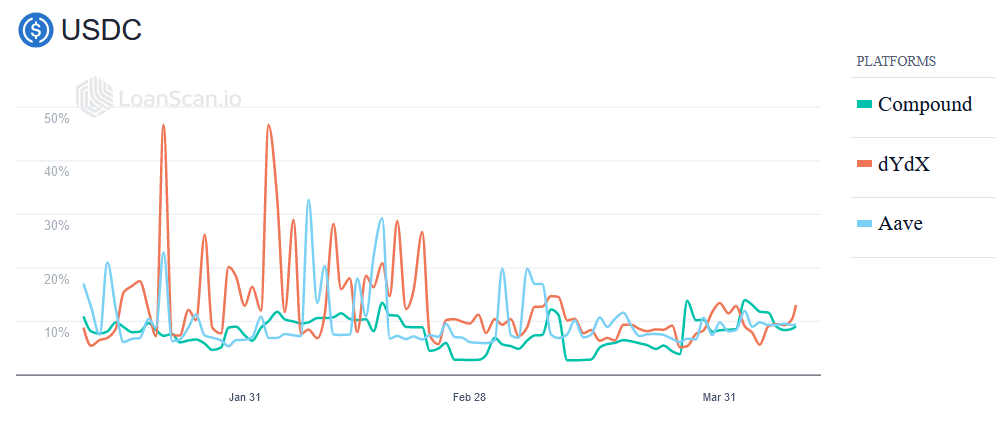

In the case of Money-Market Funds, the investor will receive stablecoins against his collateral. He will pay fluctuating interest rates because that’s how Money-Market Funds work—the interest rate is set via the “utilization formula” at every block. Here is the screenshot of the fluctuating interest rates at the time of writing:

dYdx interest rates fluctuate the most because they are part of margin lending/margin borrowing, which result in strong herding movements, which drive fluctuating interest rates. Aave and Compound interest rates fluctuate a lot, too, but less than dYdX.

The issue is that the investor does not know in advance how big his future obligations are…

In the case of Fixed-Income Funds, the borrower will get a fixed rate. The rate will depend on:

- The maturity of the loans—longer-term loans have higher interest rates

- The credit score—the better credit score means the better interest rate

But the key point here is that the borrower is not exposed to interest rate fluctuations and can develop profitable strategies.

What are DeFi fixed term Loans?

The key ideas of fixed-term loans are:

- The loan term is fixed, and

- The loan interest is fixed too

Both borrower and lender will know their future obligations/future revenue streams. Both know when they have to pay/will receive payments. Fixed-term loans give stability for lenders and borrowers.

The opposite of fixed-term loans is the Money-Market Fund with the variable term loans and fluctuating interest-rate loans. This means the borrower has flexibility on the loan term, but he doesn’t know how much interest he will pay. It’s like taking credit for 30 days but not knowing how much interest has to be paid—it can be a small amount, but it can be the opposite too.

SmartCredit.io offers fixed-term and fixed-interest-rate loans. The interest depends on:

- The loan duration—the longer-duration loans have higher interest rates and vice versa (they are based on the internal interest rate curve or the yield curve).

- On the borrower’s credit score, the borrower will be able to reduce his interest rate by completing the optional credit scoring procedure.

The SmartCredit.io crypto credit score enables monetization of the borrower’s data:

- The borrower can choose to stay fully anonymous, but he will end up paying more interest (and he will have a higher collateral ratio too).

- Or the borrower can choose to open up his data, and he will receive monetary benefit from this in the form of a lower interest rate.

How to borrow fixed term in SmartCredit.io?

It’s easy—the following steps are required:

- The borrower can use a loan calculator and calculate how much he can borrow, which collateral to use, and what loan term he would like to have.

- The borrower has to submit the loan request and add the collateral.

The following collaterals are supported for fixed-term loans

- Basic Attention Token – BAT

- Bancor – BNT

- Crypto.Com – CRO

- Enjin Coin – ENJ

- Houbi – HT

- ChainLink – LINK

- Loopring – LRC

- Maker DAO – MKR

- Nexo – NEXO

- Okex – OKB

- Augur – REP

- Uniswap – UNI

- 0x Token – ZRX

If the borrower is not paying at the end of his fixed-term loan, the platform will liquidate his collateral. The borrower can claim back the remaining funds from the liquidation.

The borrower’s fixed-term loan requests are matched with the lender’s Fixed-Income Fund or with active lenders who accept the loan requests manually. The matching is done on the costs of the platform. The platform charges a 0.5% fee from the loan volume to cover the gas costs.

How to benefit from Yield Farming with fixed-term loans?

The procedure for the borrower/investor is as follows:

- The investor borrows a fixed-term loan against his existing collateral assets.

- The investor receives stablecoins (USDC, DAI, or USDT).

- The investor invests the stablecoins into the yearn.finance or the Curve pools.

- The investor redeems the assets from the Yield Farming and pays back the fixed-term loan

- The difference between the Yield Farming yield and interest paid is the profit for the borrower.

This approach allows every borrower to become an investor.

Summary

This article described how to benefit from fixed-term loans for Yield Farming. Every borrower can:

- monetize his collateral assets

- borrow stablecoins

- invest them into Yield Farming, and

- earn yield this way

It’s a way for the borrower to earn funds.

This information is provided for educational purposes and is not financial advice.