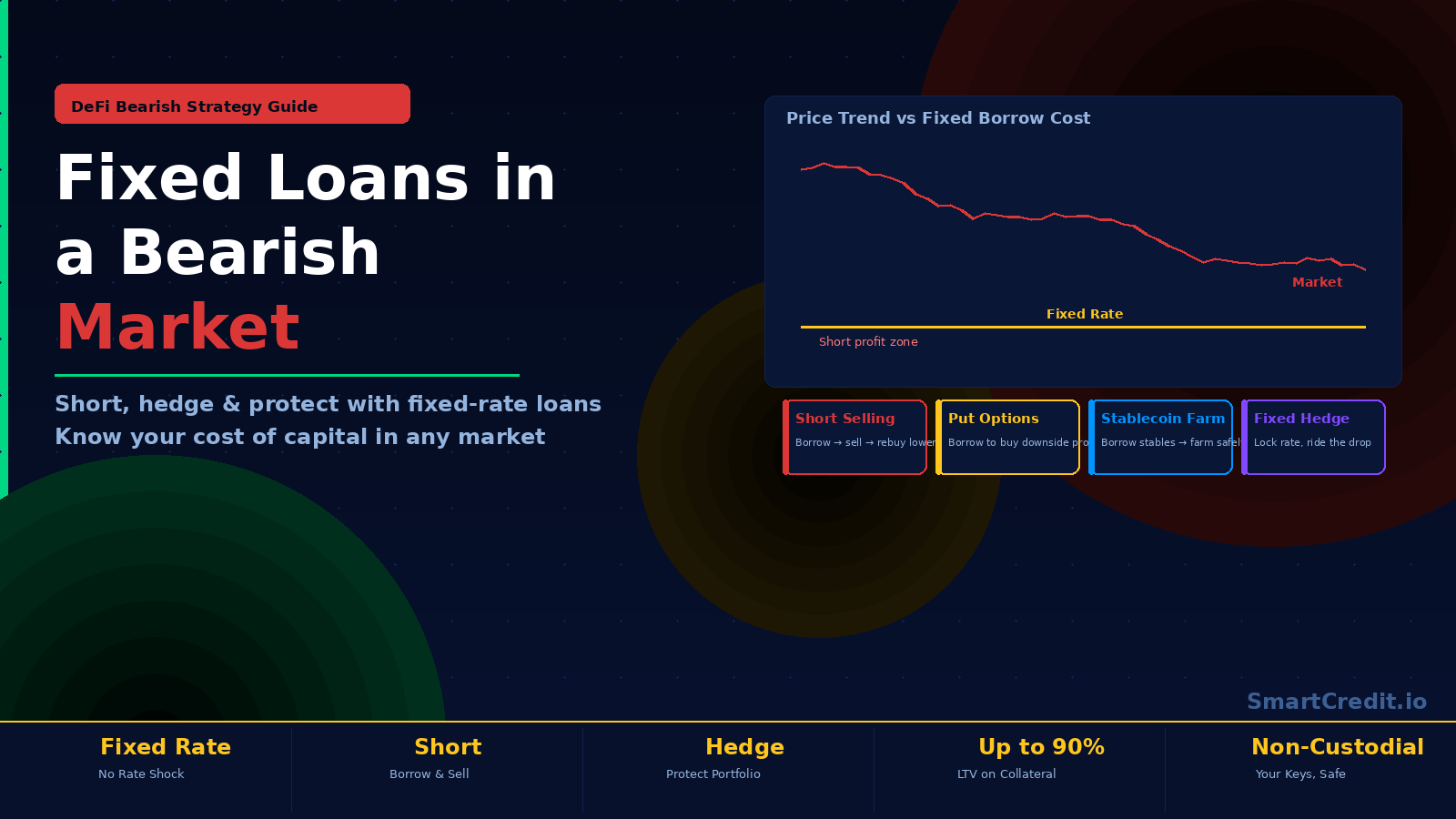

When crypto markets turn bearish, most traders freeze — or panic-sell. But experienced DeFi traders know that a bear market is also an opportunity: to short assets, to accumulate stablecoins, and to execute strategies that profit from falling prices. The problem? Variable-rate borrowing makes all of this unpredictable. Fixed-rate crypto loans change that entirely.

This guide explains exactly how to use fixed-term, fixed-interest-rate crypto loans to implement bearish market strategies — without the rate shock that kills trades on variable-rate platforms like Aave or Compound.

SmartCredit.io offers fixed-term, fixed-interest-rate crypto loans. Lock your borrowing cost before entering any bearish strategy. No rate surprises. No forced liquidations from rate spikes.

рџ’ё Open the Loan Calculator в†’

What Are Bearish Market Trading Strategies in DeFi?

Bearish strategies profit from falling asset prices. The classic approach: borrow an asset, sell it, wait for the price to drop, rebuy at a lower price, repay the loan, and pocket the difference. This is short selling — and it works just as well in DeFi as on centralised exchanges, with one critical advantage: you keep full custody of your assets throughout.

On centralised exchanges like Binance or Bitfinex, margin trading requires depositing assets into the exchange’s custody. If the maintenance margin drops below a fixed ratio, your position is forcibly liquidated — and the exchange controls the process. In DeFi, you retain control at every step.

A standard DeFi bearish strategy using crypto loans works as follows:

- Deposit collateral (e.g. BTC, ETH, or stablecoins) into a DeFi lending protocol.

- Borrow ETH or another target asset at a fixed interest rate for a fixed term.

- Sell the borrowed ETH on a DEX (e.g. Uniswap or Curve) for stablecoins at what you judge to be a market peak.

- Monitor the price using technical indicators (RSI, moving averages) for your exit signal.

- Rebuy ETH at a lower price when your exit signal triggers.

- Repay the fixed-rate loan — principal plus the known, locked interest.

- Collect the spread between your sell price and rebuy price, minus borrowing cost.

The chart below illustrates typical RSI-based entry points for a bearish ETH strategy — when RSI hits the upper limit on the 4-hour chart, overbought conditions signal a potential entry for a short position:

For a broader view of how bearish strategies fit within a full crypto portfolio framework, see our professional crypto portfolio management guide — specifically the sections on tactical asset allocation and downside risk management.

Why Variable-Rate Borrowing Destroys Bearish Strategies

Here is the critical problem with using variable-rate money market protocols (Aave, Compound, MakerDAO) for bearish strategies: the borrowing rate is unpredictable — and it spikes exactly when you need it most.

Variable rates are set algorithmically based on pool utilisation. When markets turn volatile — precisely the conditions that trigger bearish strategies — other traders flood into the same borrowing pools. Utilisation spikes. Rates spike. A strategy that was profitable at 3% APY borrowing cost becomes loss-making at 30% APY borrowing cost, with no warning and no recourse.

This isn’t theoretical. During the major crypto bear markets of 2022 and 2023, DeFi borrowing rates on variable-rate protocols regularly spiked above 20–40% APY during periods of peak stress — exactly when bearish traders were most active in those pools. Strategies that looked profitable at entry became loss-making within days due to rate movements alone.

Our 5-year DeFi interest rates comparison shows exactly how volatile variable rates have been across Aave, Compound, and MakerDAO — and why fixed rates are structurally superior for any strategy with a defined hold period.

With variable-rate DeFi loans: you enter a bearish trade at 3% APY borrowing cost. Markets turn volatile. Utilisation spikes. Your rate jumps to 35% APY. Your trade is now deeply unprofitable — and you can’t exit without realising a loss. Fixed rates eliminate this risk entirely.

What Are Fixed-Term, Fixed-Rate Crypto Loans?

SmartCredit.io is a fixed-term, fixed-interest-rate DeFi lending protocol built on Ethereum. Unlike money market protocols where rates fluctuate every block, SmartCredit.io locks both the term and the interest rate at loan origination — for the full duration of the loan.

The key characteristics of fixed-term crypto loans:

- Fixed loan term — you know exactly when the loan expires. No open-ended variable positions.

- Fixed interest rate — locked at origination, regardless of what markets or utilisation rates do during the term.

- Predictable total cost — you can calculate your exact borrowing cost before entering any strategy.

- Non-custodial — your collateral stays in audited smart contracts. SmartCredit.io never takes custody.

- SMARTCREDIT borrow rewards — as a borrower, you automatically earn weekly SMARTCREDIT token rewards, partially offsetting borrowing costs.

This fixed-cost structure is what makes SmartCredit.io loans specifically suited to bearish strategies with defined hold periods. You can calculate your breakeven price, your profit target, and your maximum acceptable loss — all before opening a position. Variable-rate borrowing makes this calculation impossible.

For a deeper dive into how fixed rates compare structurally to variable DeFi lending, see our fixed vs fluctuating interest rate guide.

How to Borrow Fixed-Rate Crypto Loans on SmartCredit.io

Getting a fixed-rate crypto loan on SmartCredit.io takes under 5 minutes:

- Connect your wallet — MetaMask or WalletConnect. New to MetaMask? See our MetaMask wallet setup guide.

- Open the Loan Calculator — enter your collateral type, loan amount, and desired term.

- Review your fixed rate — the exact interest you’ll pay for the full term is displayed before you commit.

- Submit the loan request and deposit your collateral.

- Receive your loan funds — matched with lenders from the Fixed Income Fund pool.

- Execute your bearish strategy — sell the borrowed asset on a DEX at your chosen entry point.

Accepted collateral includes ETH, WBTC, stablecoins (USDC, USDT, DAI), and major DeFi tokens. The platform supports up to 90% LTV — significantly higher than most DeFi lending protocols.

Use the SmartCredit.io loan calculator to see your exact borrowing rate and total interest cost for any term — before you commit to any trade. No KYC. Non-custodial. From any supported collateral.

рџ’° Open the Loan Calculator в†’

Full Bearish Strategy Walkthrough with Fixed-Rate Loans

Here’s a complete example of how a bearish ETH strategy works with a fixed-rate SmartCredit.io loan:

| Step | Action | Fixed-Rate Advantage |

|---|---|---|

| 1 | Deposit 2 WBTC as collateral | Collateral stays in non-custodial smart contracts |

| 2 | Borrow 10 ETH at 5% APY fixed for 90 days | Total interest cost known upfront: ~0.125 ETH |

| 3 | Sell 10 ETH on Uniswap at $3,000 = $30,000 | Entry executed when RSI signals overbought |

| 4 | Wait for ETH to drop to $2,000 | No rate shock during holding period |

| 5 | Rebuy 10 ETH at $2,000 = $20,000 | $10,000 gross profit |

| 6 | Repay loan: 10 ETH + 0.125 ETH interest | Net profit: ~$9,750 (minus gas) |

The critical difference from a variable-rate loan: at step 4, if market volatility caused borrowing rates to spike from 5% to 35% APY on a variable protocol, your holding cost would balloon from $125 to $875+ — potentially turning a profitable trade into a loss. With a fixed-rate SmartCredit.io loan, step 4’s holding cost is identical to what you calculated at step 2.

For additional DeFi income strategies that complement bearish positions — including how to earn yield on stablecoins while waiting for exit signals — see our guide to yield farming with fixed-rate DeFi loans.

Earn Fixed Yield While Others Are Bearish: The Lender Opportunity

Bear markets aren’t just an opportunity for borrowers. When bearish traders are actively borrowing to execute short strategies, lenders on SmartCredit.io earn fixed yields on those loans — with no exposure to price risk on the borrowed assets.

As a lender on SmartCredit.io’s Fixed Income Fund, you:

- Set your own investment rules — minimum rate, preferred collateral, loan term range

- Earn a fixed APY automatically matched to borrowers’ loan requests

- Receive weekly SMARTCREDIT token lender rewards on top of your fixed interest income

- Keep full non-custodial control — funds are secured in audited smart contracts

- Benefit from overcollateralised loans — borrowers post collateral exceeding loan value

Bear markets historically drive higher borrowing demand for short strategies — which means more loan requests hitting the Fixed Income Fund, and potentially higher utilisation and returns for lenders. To see the full range of yield strategies available on SmartCredit.io, including how leveraged staking fits alongside Fixed Income Fund lending, read our complete SmartCredit.io earning guide.

While bearish traders borrow to short, lenders earn fixed APY on every loan — with no price exposure. Set up your Fixed Income Fund on SmartCredit.io and earn whether markets go up or down.

рџ’№ Start Earning Fixed Yield в†’

Fixed-Rate Crypto Loans vs Variable-Rate: Side-by-Side

| Factor | Variable-Rate (Aave, Compound) | Fixed-Rate (SmartCredit.io) |

|---|---|---|

| Interest rate during hold | Unpredictable — can spike 10x | Locked at origination, never changes |

| Total borrowing cost | Unknown until position closed | Calculated exactly before entry |

| Strategy P&L modelling | Impossible to model accurately | Full P&L calculable at entry |

| Rate spike risk | High — worst during market stress | Zero — rate is fixed |

| Suitable for defined hold strategies | No | Yes |

| SMARTCREDIT borrow rewards | No | Yes — weekly token rewards |

Frequently Asked Questions

Can I use fixed-rate crypto loans for bearish strategies in DeFi?

Yes — and fixed-rate loans are specifically better suited to bearish strategies than variable-rate money market protocols. With a fixed rate, you know your exact borrowing cost from entry to exit, allowing you to model your full P&L before opening any position.

What is the minimum loan amount on SmartCredit.io?

SmartCredit.io supports loans from small to large positions. Use the loan calculator to see available terms and rates for your specific collateral and loan amount.

What happens if I cannot repay the loan at term end?

If a fixed-term loan is not repaid at the end of the loan term, the protocol liquidates the collateral and uses the proceeds to repay the lender. The borrower can claim any remaining collateral after liquidation. The fixed-term structure means there are no surprise liquidations during the loan term due to rate movements — only collateral ratio monitoring applies.

How does fixed-rate borrowing compare to using a CEX for shorting?

The key difference is custody. On a CEX, your margin assets are held by the exchange — as seen with the collapse of FTX, Celsius, and other custodial platforms. On SmartCredit.io, your collateral remains in non-custodial, audited smart contracts at all times. You maintain full self-custody throughout the entire strategy lifecycle.

Is this strategy suitable for beginners?

Bearish DeFi strategies involve real financial risk including potential loss of collateral. We recommend starting with the loan calculator to understand costs, reading the leveraged strategies guide to understand the mechanics, and starting with smaller positions to build familiarity before scaling up.

Summary: Why Fixed-Rate Loans Are the Right Tool for Bear Markets

Bear markets reward preparation. The traders who profit in downturns are those who entered with a clear plan, a known cost structure, and no exposure to rate shocks mid-strategy. Fixed-rate, fixed-term crypto loans from SmartCredit.io provide exactly that framework:

- вњ… Know your exact borrowing cost before entering any trade

- вњ… No rate spikes that can destroy your P&L mid-position

- ✅ Non-custodial — your collateral in audited smart contracts, not an exchange

- вњ… SMARTCREDIT borrow rewards reduce your effective borrowing cost

- вњ… Lenders earn fixed yield regardless of market direction

Open the SmartCredit.io loan calculator, enter your collateral and desired loan amount, and see your exact fixed rate for any term. 50,000+ users. $10M+ TVL. 5 years of DeFi track record.

рџљЂ Get a Fixed-Rate Crypto Loan в†’ рџ’№ Start Lending for Fixed Yield в†’

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Crypto trading and DeFi strategies involve significant risk including potential loss of collateral. Always do your own research before executing any strategy.

рџ“Ј Stay connected: Twitter/X | Gitbook Docs | Telegram Community