We wrote lately an analysis in our medium post asking that ”Is the Blockchain-based alternate financial system ready to be used?” Here is the summary of this article.

Where are we now?

Coronavirus has triggered an economic shock, which has triggered the global markets crash. As pointed out in the previous article, this will not be a “V style” shock with a fast decline and fast recovery, but it will be rather “L style” economic crash with a fast decline and slow recovery.

The coronavirus economic crash is different from previous economic crashes. The previous ones have been resolved with the additional base-money creation from the central banks (resulting in the hidden inflation) and with the fiscal stimulus programs (resulting in un-bearable government deficit).

The current economic crisis will need a much bigger monetary response and fiscal response. However, the response size will not matter and by doing more than less, the governments will trigger the second phase of the current crisis – the fall of the zombie companies – these are the companies, which can exist only in the very low-interest-rate environment. Many zombie companies will default and will create holes in the bank balance sheets, especially in Europe. The response to banks failing will be even more additional base-money creation.

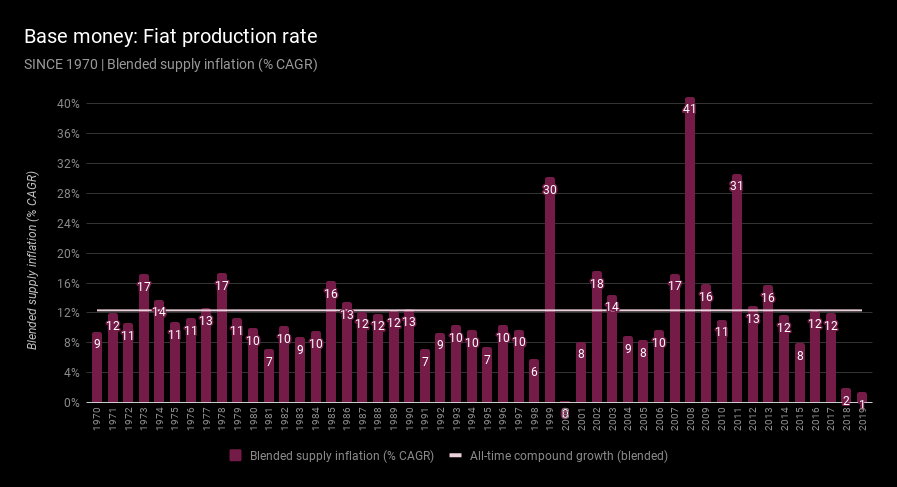

This response to the “doing more than less” will result in massive base-money creation, which will debase all bigger currencies. This will translate the initial deflationary shock into an inflationary shock. These shocks can bring down the existing credit system and payments system. Here is the chart describing the average growth of worldwide base-money in the last 40 years:

Let’s think that the Federal Reserve has officially announced unlimited base-money printing after first announcing 59% additional base-money creation (money printing) within the next month (2.026 Trillion USD …) Let’s think that ca other 40 central banks are doing massive base-money creation as well. This will lead to the debasement of the traditional fiat currencies and the massive inflation after the initial deflationary shock.

Are we ready?

What will happen, when people will lose trust in the fiat currencies? What will happen when the trust in the banks erodes? Then it’s time for an alternate financial system.

Our thesis is:

- The alternate financial system can be blockchain-based

- The alternate blockchain-based financial system is ready to be used

Our current financial system has the following elements (see the details in our medium post):

- Base-Money

- Credit-Money and Debt

- Means to keep the base-money, credit-money, and financial assets

- Means to make payments and to transfer financial assets

- Exchange of different money’s and financial assets

- Financial products

- Means of wealth management

All these components are already available in the Blockchain-based alternate financial system (see the details in our medium post):

- Base-Money – Bitcoin, Ethereum, Stablecoins

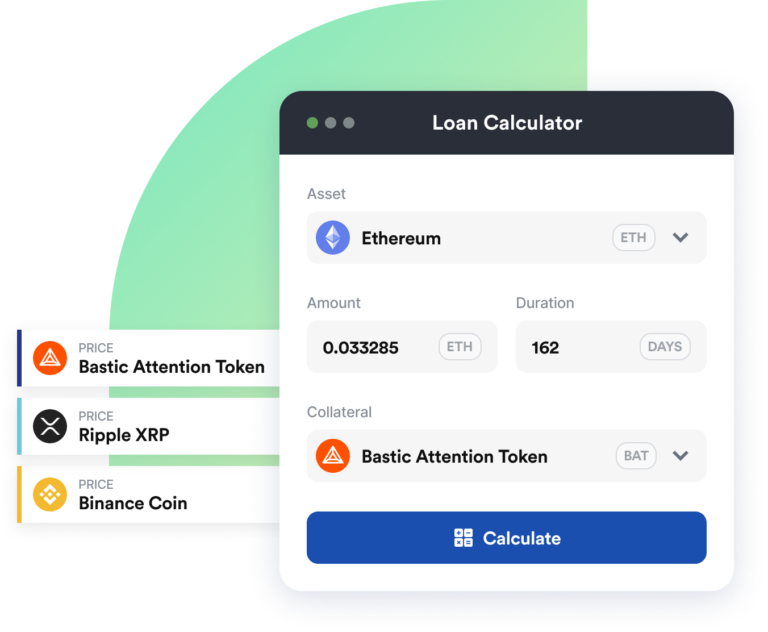

- Credit-Money and Debt – Crypto lending and transferable debt (credit-money), as implemented by the SmartCredit.io

- Means to keep the base-money, credit-money, and financial assets– the wallets

- Means to make payments and to transfer financial assets– via asset transfers in the blockchain

- Exchange of different money’s and financial assets – via crypto exchanges

- Financial products – currently less available because of regulatory skepticism

- Means of wealth management– currently less available because of regulatory skepticism

What is the solution?

This is very easy – its gradual migration from the traditional banking system to the distributed blockchain-based financial system:

- Instead of keeping 100% of the assets in the banking system, let’s start with keeping 90%, then 80%, and so on assets in the banking system and the rests in the blockchain-based financial system

- Instead of keeping USD or EUR, the users can keep first their equivalent stablecoins. However, these stablecoins are getting debased as much the main currencies are getting debased (1:1 mapping …)

- Instead of using stablecoins, users would use the main cryptocurrencies, which have no risk of the debasement, but rather a high potential of the appreciation.

It’s not only that the alternate blockchain-based financial system is ready, but we can start with the stepwise migration to the alternate financial system.