SmartCredit.io is a Decentralized Finance (DeFi) crypto lending platform focusing on fixed-interest loans, fixed-term loans, and DeFi Fixed Income Funds. Thousands of users have registered already with SmartCredit.io.

The new Release 1.1 of SmartCredit.io will add support for DeFi Fixed-Income Funds (FIFs):

- DeFi lenders can define their own personal investment rules, and the SmartCredit.io platform will automatically invest based on these rules.

- These Fixed-Income Funds are personal to lenders; they are not pooled or shared with other users.

- Every DeFi lender will have the capability offered by traditional fixed-income funds in traditional finance.

SmartCredit.io offers in addition to the DeFi Fixed-Income Funds:

- Fixed-term and fixed-interest loans to borrowers—borrowers are no longer exposed to fluctuating interest rates.

- Fixed interest rates to lenders—lenders will earn a stable interest rate.

- Low collateral ratio for borrowers—because the loan terms are known, the collateral ratios are lower than in money-market funds

This article will look at:

- What are the DeFi Fixed-Income Funds?

- Why are DeFi Fixed-Income Funds important for the lender?

- How can the borrower benefit from SmartCredit.io?

DeFi Fixed Income Funds

Fixed-Income Funds in traditional finance have different investment strategies based on the:

- Maturity of the bonds

- Risk ratings of the bonds

By combining different maturities (1 month, 3 months, 6 months, 1 year, 2 years, and so on) and different risk ratings (BB, B, A, AA, AAA), one can optimize the return of the Fixed-Income Funds and earn a better return on risk ratio (please note, it’s not about the return, but it’s about the return on a given risk level).

Traditional Fixed-Income Funds have quite high fees:

- The Total Expense Ratio (TER) for investors is 1.5%–2% of the investment amount—this fee will be deducted every year from investors’ share value.

- The custody costs of Fixed-Income Funds, which are 0%–0.4%, depending on the bank where you keep your assets.

- This results in the 1.5%–2.4% fees per year.

The Personal Fixed-Income Funds of SmartCredit.io offer the following:

- The investor has to pay only the gas fees to create his Fixed-Income Fund smart contract.

- The investor has to pay for depositing into his Fixed-Income Fund

- There are no more fees for the investor—the SmartCredit.io platform will make all the investments based on the rules the investor defined.

- The Investor does not share his assets with other investors.

- The Investor will own his assets – the assets are not in the custody of the intermediaries, as in the case of traditional finance, but it’s the investor who owns his assets.

What does this mean?

- The DeFi Money-Market Funds have disintermediated the traditional Money-Market Funds

- Fixed-Income Funds are in traditional finance 10x of the Money-Market Funds

- SmartCredit.io DeFi Fixed-Income Funds will disintermediate the traditional Fixed-Income Fund business.

Why are DeFi Fixed Income Funds important?

Let’s think about the big picture:

- The global stock market size in March 2021 was USD95 trillion

- The global bond market size in August 2020 was USD128 trillion

- The global money-market-funds size by the end of 2019 was USD 6 trillion

Let’s now think about DeFi:

- DeFi users can invest in diverse tokens (that’s the equivalent of the global stock market)

- DeFi users can borrow/lend in money-market funds

But until today, DeFi users haven’t had the opportunity to invest in DeFi Fixed-Income Funds. SmartCredit.io is filling this gap.

How does a DeFi Money-Market-Fund work?

DeFi Money-Market Funds mirror traditional money-market funds:

- There are no lockup periods for borrowers or lenders.

- The funds are in one big shared pool.

- The interest rates are highly fluctuating.

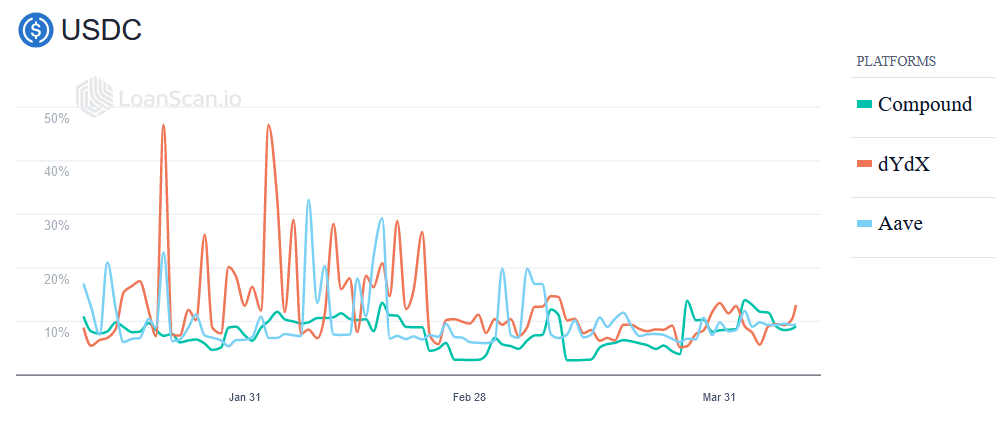

Here is a snapshot of the USDC interest at the moment of writing this article. Market moods drive interest-rate fluctuations:

- If the market thinks that ETH is going up, investors borrow USDC to buy ETH—the USDC rate moves up, and the ETH rate moves down.

- If the market thinks that ETH is going up, investors will borrow ETH for shorting—the USDC rate will go down, and the ETH rate will go up.

This results in the herd movement of interest rates—that’s why one can see continuous fluctuations.

One would think that traders would prefer fixed interest rates instead of continuously fluctuating rates.

How do DeFi Fixed Income Funds work?

Investors define their investment rules (i.e., into which maturity they want to invest with how many assets), and they deposit the funds into their FIFs. That’s all they need to do.

The FIFs will invest in the borrower’s fixed-term and fixed-interest-rate loan requests. The borrower’s loans are collateralized with ERC20 tokens. If the collateral value declines too much or the borrower is not paying, the loans will be liquidated. The FIF investor can add additional funds into his FIF or withdraw the unallocated funds.

This means that:

- Every investor will have his own pool (FIF), which invests in the borrowers’ requests.

- Every investor will earn a stable return on his funds in the FIF.

- FIFs are the source of funds for the borrowers, which earn a stable rate.

How can the borrower benefit from SmartCredit.io?

There are three key use cases for the borrower:

Borrow fixed term and invest proceeds into Yield Farming

SmartCredit.io supports 13 ERC20 tokens as collateral assets. Borrowers can borrow stablecoins against these collateral assets. As the loan term is known, then the collateral ratios are lower than in Money-Market Funds.

The borrower will pay a fixed rate for his fixed-term loan. He can invest his borrowed stablecoins into Yield Farming—for example, into InstaDapp or Yearn. The interest rate from the yield farming will be higher than the interest he has to pay.

See more in the article Yield Farming with fixed-term-loans.

Borrow fixed term and use bullish strategies

At the moment, borrowers are using money-market funds to implement bullish strategies:

- They borrow against their collateral from the money-market funds.

- They invest stablecoins into an asset where they have a bullish view.

The issue here is that the interest rate fluctuates, and the interest rate follows the market mood. If the market mood is that “ETH is going up,” then traders borrow stablecoin and are going long in ETH. However, as all traders do this simultaneously, they will all pay high interest costs too.

SmartCredit.io offers an alternative strategy:

- Borrow stablecoins on fixed term against the collateral, pay a fixed interest rate.

- Invest the stablecoins into bullish strategies.

- The borrower/investor will know his costs—he is not exposed to interest rate fluctuations; he can calculate profitable trading strategies when all the parameters are known.

See more in the article: Potential of fixed-term-loans in bullish market trading

Borrow fixed term and use bearish strategies

This strategy is the opposite of the bullish strategy—it’s the strategy for bearish markets. The borrower/investor would borrow ETH against his collateral. He would short ETH and repurchase it later. The difference will be his profit.

When a borrower uses money-market funds, his interest costs are not known; they are fluctuating and probably high because of the herd movements on the market.

SmartCredit.io offers an alternative strategy:

- Borrow ETH on fixed term against the collateral, pay fixed interest rates

- Invest the ETH into bearish strategies

- The borrower/investor will know his costs—he is not exposed to interest rate fluctuations; he can calculate profitable trading strategies when all the parameters are known.

See more in the article: Potential of fixed-term-loans in bullish market trading

Summary

SmartCredit.io introduces with Release 1.1 the DeFi FIFs—this fills the gap in the DeFi landscape and adds Fixed-Income Funds beside the Money-Market Funds.

Lenders will earn stable interest from their FIFs. They are not exposed to continuous interest-rate fluctuations.

Borrowers submit their loan requests, which they collateralized with their collateral tokens. The FIFs invest in these requests. Borrowers can implement several effective strategies—for yield farming, for the bullish or bearish strategies—and all without being exposed to fluctuating interest rates.