SmartCredit.io’s vision is to create a self-reinforcing DeFi lending platform. The first version of our non-custodial crypto lending platform available in the Ethereum main-net. SmartCredit.io’s vision is to enable the alternate financial system on the Blockchain. This sounds easy, but how to achieve this?

Two key types of lending are:

- Custodial lending solutions like Nexo, Celsius, or Salt – are essentially wallets, where the platforms control your assets/your private keys. These keys allow them to access your assets/funds. They are using a wide range of collateral from several blockchains.

- Non-custodial lending solutions – these are the DeFi solutions. The user controls his assets on these platforms.

SmartCredit.io’s view is that custodial lending is too interconnected with the traditional banking approach, where the banks control clients’ assets and clients don’t have direct control of their assets. Custodial solutions defeat the purpose of the blockchain, where the users should not have any intermediaries. Therefore we focus below on the non-custodial / DeFi lending.

Let’s start with the key problems in crypto lending:

Key problems in the DeFi Lending

- Too high collateral requirements – Maker, Compound have ca 350% – 400% collateral to the loan ratio. This means the borrowers can borrow little relative to their collateral.

- Limited choice of collateral – Borrowers on Maker or Compound have limited choice of collateral (just 4 to 8 different ERC20). I.e., borrowers don’t have only a high collateral ratio, but they have little choice of collateral too.

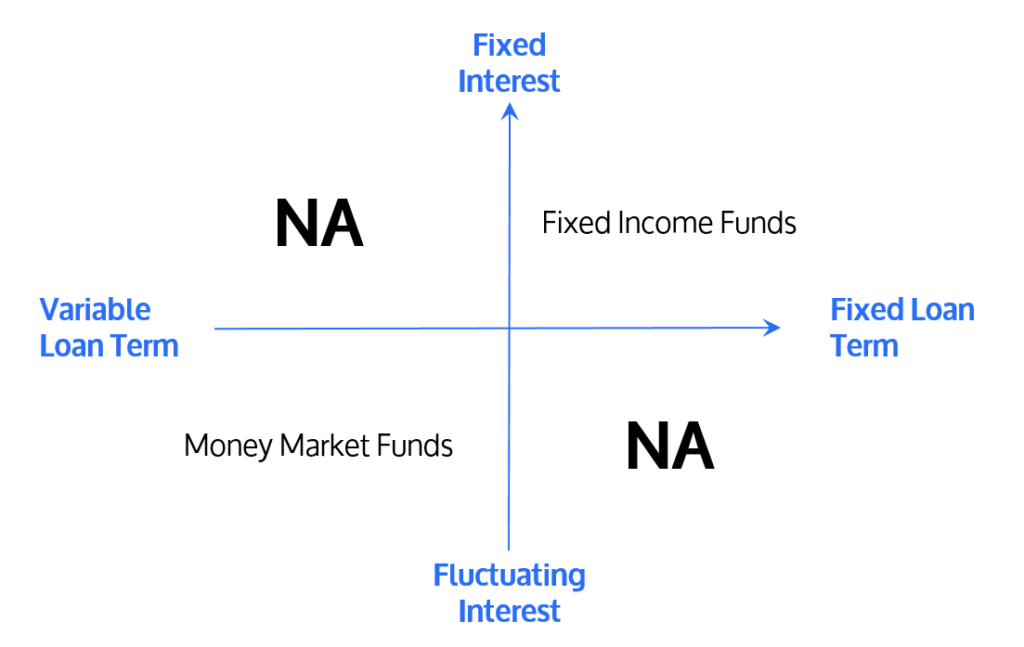

- Variable loan maturities (loan terms) – as most of the DeFi solutions are based on the money-market-fund concepts, then loans are not fixed maturities but variable maturities. Although this is easy to implement and convenient for the borrowers – this results in too high collateral requirements. Using fixed-term maturities would enable to reduce the collateral requirements.

- Fluctuating interest rates – most of the DeFi solutions are implementing the money-market-fund concepts. Money market funds have fluctuating interest rates. There are always herd movements in the markets. If the market thinks Ethereum is moving up, then users are borrowing DAI to buy Ethereum. This drives the interest rate of Ethereum down and DAI up. If the market thinks that Ethereum is moving down, then users are borrowing Ethereum to short it. This drives the interest rate of Ethereum up and of DAI down.

- Other platforms would like to earn revenues with value-adding services, such as offering credit via an API to their clients and earning additional revenues via this.

- Investors would like to earn passive income

Variable or Fixed Loans?

DeFi loans are very much based on the money-market-fund concept. The lenders deposit their assets into the pool and receive the shares of this pool. The borrowers can borrow from this pool against the collateral. This has some side effects:

The interest rates are fluctuating – they are not fixed. When the market thinks that ETH is moving up, traders will borrow DAI – this drives the DAI interest rates up. When the market thinks ETH is moving down, then the opposite will happen. As the market is a little bit in the herd movements, this translates into a fluctuating interest rate for borrowers and lenders.

The loan maturity for the borrower is variable (unlimited); the loan maturity for the lender is daily (as far as liquidity is available).

The DeFi money-market funds can be positioned as follows.

The opposite is the Fixed Interest and Fixed Term loans – that’s what the Fixed Income Funds do in traditional finance. The key here is that the ratio of Money Market Funds to the Fixed Income Funds is 1:10 in traditional finance.

There is a reason for this:

Fixed Term loans allow reducing the borrower’s collateral requirements. If one knows the loan term, then it’s easier to forecast the collateral requirements. If one doesn’t know the loan term, this results in very high collateral requirements, which are visible in Compound and Aave money-market protocols.

Lower collateral requirements are essential – they mean the borrowers can borrow much more on the same asset basis. This means higher leverage on the same risk to the borrowers – see more in the article “Why borrowers need low collateral ratio?”.

Fixed Interest Loans advantage is obvious – it’s about having pre-defined interest rate payments. It’s about avoiding high fluctuating interest rate payments; it’s about hedging against the herd movements on the market.

SmartCredit.io solution to the DeFi Lending

- Non-custodial lending – only borrowers/lenders control their assets; no one can access the borrowers/lender’s assets.

- Smaller collateral requirements for the borrowers than the industry standard

- Wide choice of collateral for the borrowers

- Fixed-term loans – this allows borrowers to reduce the collateral requirements.

- Fixed Interest loans – this protects borrowers and lenders against the herding movements on the markets.

- Lenders receive loan tokens (Credit-Coins). Lenders can use these loan tokens as a mean of payment (loans are tokenized and transferable)

- Holders of Credit-Coins will receive interest for the loan tokens – Credit-Coins are interest-bearing to the holder.

- Personal Fixed Income Funds enable a passive income for passive investors

- Non-custodial API for the other platforms – wallets, payment engines, marketplaces.

For the Borrowers – 2-Click Crypto Loans on the Marketplace

SmartCredit.io offers to borrow crypto and stablecoins against the crypto collateral. The following is important for the crypto borrower:

Usability – it’s about an easy loan process for the Borrower. That’s why we call it “2 Click Crypto Loans.”

Low collateral ratio – What is relevant for the crypto borrowers? One of the key elements besides usability is the collateral ratio. Most of the crypto lending platforms have high collateral ratio’s for the borrower. See more in our blog articles “Why is the collateral ratio so high in DeFi?” and “Why borrowers need a low collateral ratio?”

Fast order fulfillment – that’s about accepting the loan requests fast:

- The active lenders can accept the loan requests via the browsing of the order book or

- The loan requests will be accepted automatically by the Personal Fixed Income Funds, which enable a passive income for the passive investors

For the Lenders – Immediate Liquidity via Credit Tokenization and Credit Transferability

All loans are tokenized on our platform into one standardized ERC 20 contract. This tokenization makes loans transferable. The loans are protected with the collateral and loss provisions fund. This allows the lender to use the tokenized loans as payment means.

It works in the following way:

- When the loan is issued on the marketplace and Ether (or DAI) is transferred to the borrower, then the lender will receive the same amount of freshly minted credit coins (we call them Credit Coins – ccETH or ccDAI)

- The lender can keep all these credit coins till the end of the loan, by when the borrower’s interest and principal payments will replace the credit coins.

- Or the lender can pay with the credit coins to the next parties, which can pay the next parties, and so on. The final holders of the coins will receive interest and principal payments.

To whom should the lender transfer his credit coins? There are two ways:

- The lender can do advertisements to SmartCredit.io and add new members into the network or

- The lender can send his credit coins to the order book for the conversion. The personal fixed-income funds will buy them up from the conversion requests, and the lender will receive the Ethereum or DAI in return

For Passive Investors – Personal Fixed income Funds

The investor needs only to define the investment rules – to which credit ratings and to which loan terms he would like to allocate which part of his assets. He does not need to monitor ongoing loan requests, but everything will run fully automated.

If the lender/investor want’s to cancel the automated investment process, he can do this with one button click.

Personal Fixed Income Funds will provide continuous liquidity to the platform. Additionally, if some of the lenders have liquidity needs, then the respective lenders can always send their credit-coins into the Personal Fixed Income Funds and will receive ETH or DAI in return for their ccETH or ccDAI.

For Other Crypto Platforms – Credit As A Service API and Widgets

Many crypto platforms would like to offer credit to their users. However, lending is not their core competence, and it will require specific know-how. At the same time, these platforms would be interested in integrating crypto lending via the API.

Crypto lending key components

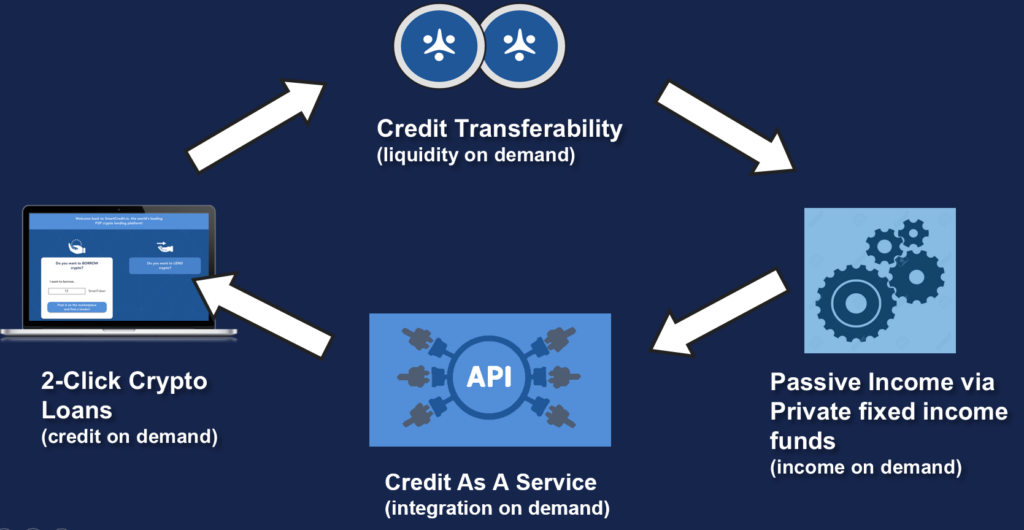

There are four key components of the SmartCredit.io ecosystem:

- 2-Click crypto loans for the borrowers

- Immediate liquidity for the lenders

- Passive crypto income for passive crypto investors

- Credit As A Service API for all other crypto platforms

The interplay of these components results in the self-reinforcements and positive feedback loop in the ecosystem.

Our DeFi lending difference to the competitors

There are several key differences from our competitors:

- Low collateral ratio – Having a low collateral ratio means that the borrowers can borrow more on their given asset basis – it offers much more leverage to the borrowers. The borrower’s demand drives the crypto lending market, i.e., the borrower’s needs have to be the key focus.

- Fixed Term loans – that’s one way to reduce collateral requirements.

- Fixed Interest loans – no more fluctuating interest rates for the borrowers and lenders.

- Personal Fixed Income Funds give exposure to the full fixed income instead of just offering the money market funds with fluctuating interest rates and variable loan terms.

- Crypto Credit Score via social media, Ethereum Blockchain history analysis, and psychometric analysis. The client can choose not to process with an automated Crypto Credit Score. However, he would be assigned to the “standard” Crypto Credit Score bucket.

- Loss Provision Fund – Our competitors have to prepare for the potential default with every loan. They protect against this with very high collateral requirements because they don’t know the loan maturities – i.e., these platforms have to overcollateralize their loans significantly. Having Loss Provisions Fund and allocating a small piece of every loan into the Loss Provisions Fund allows better to deal with the adverse market events and reduce the collateral requirements.

- Self Re-Inforcing Ecosystem provides usability to the borrowers, immediate liquidity to the lenders, and passive income to the investors on their crypto holding. And on every step, it’s only the client who controls the private keys. Only the client and no one else.