Last updated: February 2026

Wealth Management is a multi-billion dollar industry — and as the market cap for crypto assets grows, it becomes increasingly valuable to apply the same rigorous concepts of professional wealth management to cryptocurrency investments. Whether you hold Bitcoin, Ethereum, or a broad basket of altcoins, the principles of crypto portfolio management can help you build a more resilient, better-returning portfolio without gambling on individual coins.

This guide covers the complete crypto portfolio management framework used by professional wealth managers, adapted for crypto:

- Modern Portfolio Theory and the Efficient Frontier

- Strategic and Tactical Asset Allocation

- Client Risk Profiling (Risk Tolerance + Risk Ability)

- Crypto sub-class portfolio construction

- How to automate it all on SmartCredit.io

SmartCredit.io automates everything described in this guide — portfolio construction, sub-class allocation, and rebalancing — all based on your personal risk profile.

What Is Modern Portfolio Theory — and Why It Applies to Crypto

Modern Portfolio Theory (MPT), developed by Harry Markowitz in 1952, is the mathematical foundation of professional portfolio management. Its central insight is deceptively simple: it is not enough to look at each asset in isolation. What matters is how assets behave in relation to each other — their correlation.

The two core principles of MPT are:

- Higher risk should produce higher returns — investors who accept greater volatility are rewarded with greater potential upside

- Diversification reduces portfolio volatility — by combining assets that do not move in lockstep, the swings of one are offset by the stability of another, resulting in better risk-adjusted returns

Different asset types carry different statistical characteristics:

- Expected historical return — equities have historically outperformed bonds over long periods; Bitcoin has outperformed both, with significantly higher volatility

- Expected risk (volatility) — crypto assets carry far higher short-term volatility than equities or bonds, but this volatility creates the diversification opportunity

- Correlations to other assets — crypto assets have shown relatively low correlation to traditional equities over multi-year periods, which is precisely what makes them valuable in a diversified portfolio. When one asset class falls, the other may not follow

The Efficient Frontier and Sharpe Ratio

Markowitz’s Efficient Frontier is the set of portfolios that offer the maximum expected return for each level of risk. Any portfolio below the frontier is suboptimal — you are accepting too much risk for the return you’re getting. The goal of professional cryptocurrency portfolio strategy is to push your holdings toward this frontier.

The Sharpe Ratio quantifies this — it measures return per unit of risk. A higher Sharpe Ratio means your portfolio is more efficient. When crypto is added to a traditional portfolio, it often improves the overall Sharpe Ratio because of its low correlation to stocks and bonds, even accounting for its high standalone volatility.

The practical takeaway: combine crypto sub-classes thoughtfully, and you can achieve better returns for the same risk than any single asset could provide alone. If you want to apply Markowitz optimization interactively across CoinGecko categories, our AI Crypto Portfolio Optimizer lets you generate a mathematically optimized allocation in seconds.

Why Crypto Behaves Differently from Traditional Assets

Before applying traditional portfolio theory to crypto, it is important to understand where the analogy holds — and where it breaks down.

Where it holds: The mathematics of diversification, correlation, and risk-adjusted return apply to any set of assets with measurable return distributions. Crypto sub-classes (Bitcoin, Smart Contract platforms, DeFi tokens, stablecoins) have meaningfully different return and volatility profiles, which means that combining them intelligently produces genuine diversification benefits within a crypto-only portfolio.

Where it diverges: Crypto asset class correlations are not stable. During broad market sell-offs — particularly in 2018 and 2022 — correlations across all crypto sub-classes spiked toward 1.0, meaning almost everything fell simultaneously. This is the key risk of crypto diversification that traditional models underestimate. It means that sub-class diversification provides meaningful benefit in normal markets but offers limited protection during systemic crypto bear markets.

The professional response to this is not to avoid crypto diversification — it is to be honest about it in your risk profiling, and to maintain appropriate position sizing relative to your total wealth.

Strategic and Tactical Asset Allocation for Crypto Portfolio Management

Traditional portfolio management operates at two levels of allocation decision-making. Both apply directly to how you should diversify your crypto portfolio.

Traditional asset classes in professional portfolio management are:

- Equities (stocks)

- Bonds (fixed income)

- Real Estate

- Alternative Investments (hedge funds, private equity, commodities)

Each class has a characteristic return profile — equities deliver the highest long-term returns, followed by real estate and bonds. Alternative investments aim to match equity returns while correlating negatively with the rest of the portfolio. Return and risk are correlated: the higher the expected return, the higher the expected drawdown risk.

Strategic Asset Allocation defines the long-term target weights between major asset classes. Research by Brinson, Singer, and Beebower (1991) demonstrated that strategic asset allocation explains approximately 92% of the variation in portfolio returns over time — meaning that getting the big-picture allocation right matters far more than picking the right individual assets. Applied to crypto portfolio management, this means that the decision of how much to allocate to Bitcoin vs Smart Contract platforms vs DeFi tokens drives most of your long-term outcome.

Tactical Asset Allocation involves shorter-term adjustments within those strategic ranges — for example, increasing Smart Contract Blockchain exposure when on-chain activity is surging, or rotating toward stablecoins (Fiat Proxies) during high-uncertainty periods. Tactical decisions are adjustments around the strategic anchor, not replacements for it.

For equities, tactical decisions might include choosing between Developed vs Emerging market stocks based on the economic cycle. For crypto, the equivalent decisions include:

- Rotating between Bitcoin vs altcoin sub-classes based on market cycle stage

- Increasing stablecoin allocation during macro uncertainty

- Adding Resource Sharing or Prediction Market exposure when those sectors show strong on-chain growth signals

The key insight: the investor does not need to “coin pick” any more than a stock investor needs to “stock pick.” The majority of your crypto portfolio performance will be determined by your strategic crypto asset allocation across sub-classes — not by which specific tokens you hold within each sub-class.

For a deeper look at how crypto compares to traditional assets as an asset class, see our comprehensive 2025 comparison guide.

How to Define Your Crypto Risk Profile

Every professional wealth management engagement begins with an Investment Policy Statement (IPS). The IPS documents the client’s situation and constraints before any portfolio decisions are made. The key elements are:

- Financial objectives — what is the timeline of investments (1 year? 10 years?)

- Risk profile — what level of loss can the client tolerate and accept

- Need for liquidity — what monthly or yearly cash needs does the client have

- Investment restrictions — ethical screens (e.g. avoiding certain sectors)

- Asset-Liability Management — the overall financial picture, including debts and obligations

For most crypto investors, the dominant variable in the IPS is the Risk Profile — the single most important input to crypto portfolio management. It is determined by two independent dimensions:

SmartCredit’s onboarding questionnaire captures all the risk dimensions described below and automatically maps you to your portfolio tier — no spreadsheets, no guesswork.

Dimension 1: Risk Tolerance (Psychological)

Risk Tolerance captures the psychological and behavioral dimension of risk — how the investor reacts to losses, not just how much they can mathematically afford. It is determined by:

- Investment experience in years and breadth of asset classes

- Interest in actively following market developments

- Loss sensitivity — how the investor would react to a 30% portfolio decline

- Risk awareness — whether they prefer higher potential return for higher risk, or lower return for lower risk

Loss Sensitivity is typically measured by asking the investor how they would respond to a hypothetical 30% portfolio loss:

- Reduce all or most of positions (very low tolerance)

- Reduce some investment positions (low tolerance)

- Maintain current positions (moderate tolerance)

- Increase some positions (high tolerance)

- Increase all or most of existing positions (very high tolerance)

Risk Awareness is measured by preference between scenarios such as: “Would you prefer 30% return potential with 20% risk, or 5% return with 0% risk?” Loss sensitivity and Risk Awareness together form the psychometric picture of the investor — some clients sleep better with conservative portfolios regardless of their mathematical ability to absorb losses.

Dimension 2: Risk Ability (Rational)

Risk Ability is the objective, rational counterpart to Risk Tolerance. It asks not how the investor feels about risk, but how much risk their financial situation actually allows. It is determined by:

- Time Horizon — the longer the investment horizon, the higher the risk a portfolio can absorb, because there is more time to recover from drawdowns

- Free Assets Ratio — the ratio of uncommitted financial assets (total assets minus bound assets like pension funds, mortgages, etc.) to total assets. A higher ratio means more capacity for risk

- Annual Loss Compensation Rate — the ratio of (Annual Income minus Annual Expenses) to Free Assets. Investors with high annual surplus relative to their invested assets can recover from losses more easily and therefore afford higher risk

The final Client Risk Profile is the lower of Risk Tolerance and Risk Ability. Both dimensions are scored and mapped to one of five tiers: Low, Moderate, Medium, Enhanced, High. The lower score is taken because an investor who can mathematically afford high risk but psychologically cannot handle drawdowns will still panic-sell during bear markets — and panic-selling is the single most wealth-destructive behavior in crypto investing.

Best Crypto Asset Allocation 2026: Building by Sub-Class

Once the Risk Profile is established, crypto portfolio management becomes a systematic process. Client Risk Profiles are mapped to five standard portfolio tiers, each with predefined crypto sub-class allocation weights.

The key innovation in professional crypto portfolio management is that exposure is taken at the sub-class level, not the individual token level. You do not need to decide between Ethereum and Solana — you decide how much exposure you want to “Smart Contract Blockchains” as a category, and the platform manages the token-level execution. This dramatically reduces the cognitive burden and eliminates the noise of individual token speculation.

The main cryptocurrency sub-classes for portfolio diversification are:

- Bitcoin — the lowest volatility, lowest return crypto sub-class; the “blue chip” anchor of any crypto portfolio

- General Blockchains — layer-1 networks with broad utility but no smart contract focus

- Smart Contract Blockchains — Ethereum and competitors; higher return potential and volatility than Bitcoin

- Payments — crypto designed for transaction use cases (Ripple, Litecoin, etc.)

- Anonymous Payments — privacy-focused crypto; higher risk/reward than standard payments

- Resource Sharing (storage, compute, network) — tokens powering decentralized infrastructure; high growth potential, high risk

- Prediction Markets — decentralized forecasting platforms; high beta exposure

- Gaming — the highest-risk, highest-return sub-class; extreme volatility

- Fiat Proxies (stablecoins) — zero return, zero risk; used to anchor conservative portfolios and provide liquidity

One can calculate the historical return and volatility characteristics of each sub-class on a normalized scale:

| Sub-Class | Return (scale 1–5) | Volatility (scale 1–5) |

|---|---|---|

| Bitcoin | 1 | 1 |

| General Blockchains | 2 | 2 |

| Smart Contract Blockchains | 2 | 3 |

| Payments | 2 | 3 |

| Anonymous Payments | 3 | 4 |

| Resource Sharing (storage, calculation, network) | 4 | 5 |

| Prediction Markets | 4 | 5 |

| Gaming | 5 | 5 |

| Fiat Proxies (stablecoins) | 0 | 0 |

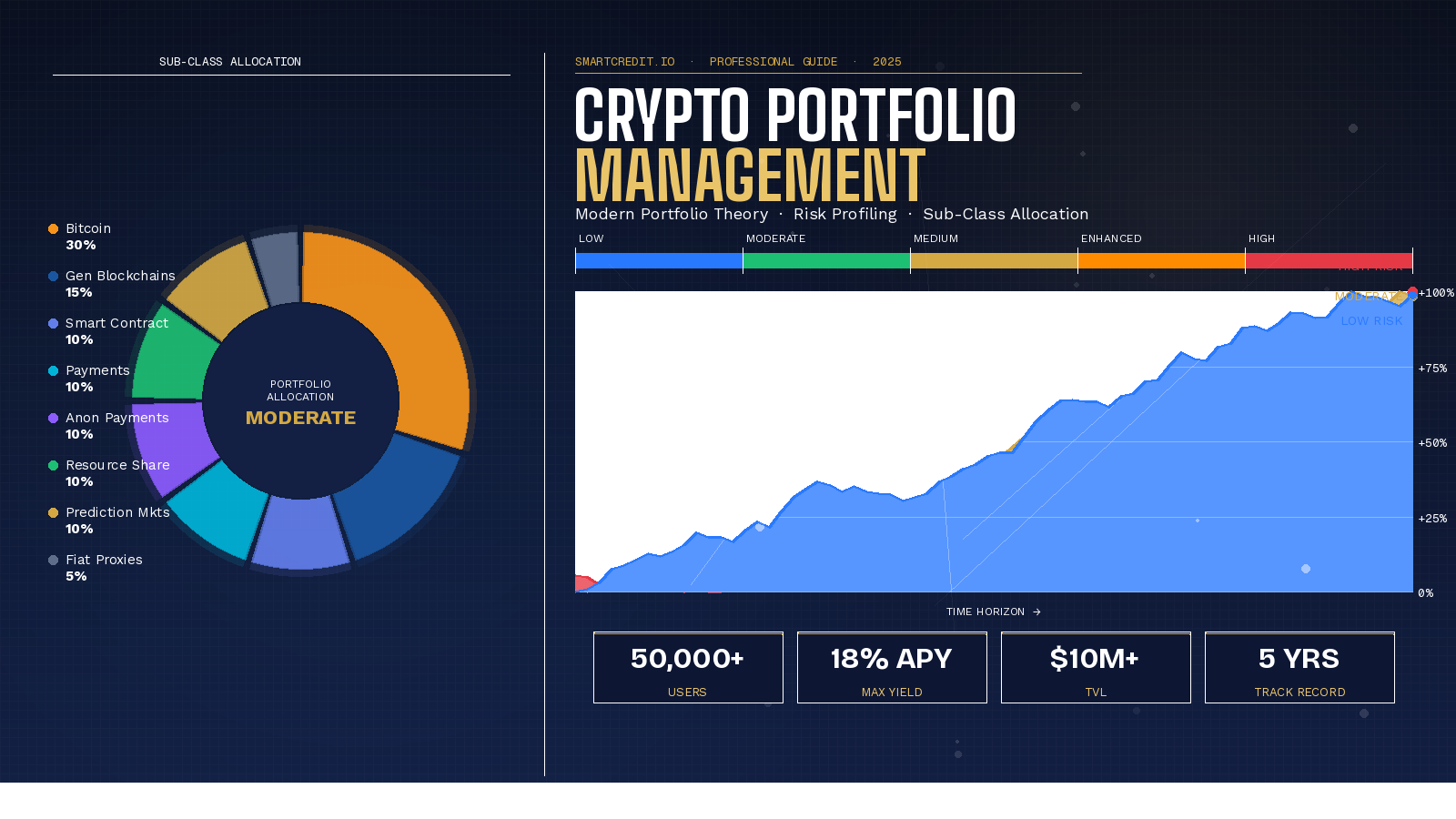

These return/volatility profiles are then used as inputs into standard portfolio optimization. The resulting crypto portfolio allocations by risk profile look like this:

| Sub-Class | Low | Moderate | Medium | Enhanced | High |

|---|---|---|---|---|---|

| Bitcoin | 40% | 30% | 20% | 15% | 5% |

| General Blockchains | 20% | 15% | 5% | 5% | 5% |

| Smart Contract Blockchains | 10% | 10% | 15% | 15% | 15% |

| Payments | 10% | 10% | 10% | 10% | 10% |

| Anonymous Payments | 5% | 10% | 10% | 15% | 20% |

| Resource Sharing (storage, calc., network) | 5% | 10% | 15% | 15% | 20% |

| Prediction Markets | 0% | 10% | 15% | 15% | 20% |

| Gaming | 0% | 0% | 5% | 5% | 5% |

| Fiat Proxies | 10% | 5% | 5% | 5% | 0% |

| Total | 100% | 100% | 100% | 100% | 100% |

Notice the structural logic: conservative (Low) portfolios are anchored heavily in Bitcoin and General Blockchains, with a 10% stablecoin buffer. Aggressive (High) portfolios shift weight toward Resource Sharing, Prediction Markets, and Anonymous Payments — accepting extreme volatility in pursuit of maximum return potential. Gaming only appears at Medium and above, reflecting its extreme risk/reward profile.

Want to apply Markowitz optimization to these categories automatically? Our AI Crypto Portfolio Optimizer runs mean-variance optimization across CoinGecko categories in seconds — including yield-bearing allocations for income-focused portfolios.

The allocation tables above are implemented live on SmartCredit.io. Once you complete your risk profile questionnaire, the platform constructs your sub-class portfolio automatically — and rebalances it whenever allocations drift outside predefined ranges.

Earn Passive Income While Your Crypto Portfolio Grows

Effective crypto portfolio management is not just about allocation — it is about making your holdings work harder between rebalancing cycles. SmartCredit.io allows you to deploy your sub-class allocations into fixed-rate, fixed-term lending positions that generate up to 18% APY, while maintaining full price exposure to your chosen assets.

This is a fundamentally different model from leaving crypto idle in a wallet or on an exchange. The predictability of fixed rates is especially important here: unlike variable-rate DeFi platforms like Aave or Compound, SmartCredit locks your yield at origination. Your portfolio generates income at a known rate, regardless of market conditions. You can learn more about why fixed rates matter in our DeFi interest rates comparison guide — backed by five years of daily data.

For investors who need liquidity without selling portfolio holdings, using crypto as collateral for a fixed-rate loan is significantly more tax-efficient than selling. And understanding the tax treatment of crypto loans vs selling is an important part of a complete portfolio management strategy.

Deploy your portfolio into fixed-rate lending on SmartCredit.io and earn predictable income while maintaining full price exposure. No variable rate surprises. No KYC. Non-custodial.

How SmartCredit.io Automates Crypto Portfolio Management

The framework described throughout this guide represents the state of the art in professional crypto portfolio management — but historically, implementing it required either significant personal expertise or access to expensive wealth management services. SmartCredit.io changes that.

SmartCredit.io is a decentralized finance lending and portfolio platform that implements this exact framework for any investor. Here is how it maps to what you have just read:

- Complete your Risk Profile questionnaire — SmartCredit determines your tier (Low, Moderate, Medium, Enhanced, or High) based on the Risk Tolerance and Risk Ability dimensions described above

- Transfer your crypto assets — all major assets supported including BTC, ETH, wBTC, wETH, and partner tokens; full self-custody maintained throughout

- Automatic portfolio construction — sub-class allocations are set according to your risk tier, matching the allocation tables in this article

- Earn up to 18% APY — your assets are deployed into fixed-rate, fixed-term lending positions within your target sub-class allocations, generating passive income on your crypto holdings while you maintain full price exposure

- Automatic rebalancing — if any sub-class drifts beyond defined thresholds, the system rebalances automatically, without any action required from you

- Regular performance reports — no daily management required; you receive structured updates on portfolio performance

Client would pay a simple monthly or yearly fee to the platform, and would be free from the burden of daily asset management — free to focus on what matters most.

| Factor | DIY Crypto Management | SmartCredit.io |

|---|---|---|

| Risk profiling | Manual / guesswork | Automated questionnaire |

| Portfolio construction | Hours of research | Instant, rule-based |

| Sub-class rebalancing | Manual monitoring required | Automatic when ratios drift |

| Yield on holdings | 0% (idle assets) | Up to 18% APY |

| Performance reporting | None / manual spreadsheets | Regular automated reports |

| Time required | Daily attention | Set-and-forget |

Trust signals: 50,000+ users earning passive income on SmartCredit.io • $10M+ Total Value Locked • 5 years of DeFi track record • Fixed-rate, fixed-term loans — predictable returns for lenders • Pioneer in peer-to-peer DeFi, not pool-based

Frequently Asked Questions

What is crypto portfolio management?

Crypto portfolio management is the process of selecting, allocating, and rebalancing a collection of cryptocurrency assets to achieve the best possible return for a given level of risk — using the same principles as traditional wealth management, adapted for the unique volatility and sub-class structure of digital assets. It involves defining a risk profile, setting strategic sub-class weights, and systematically rebalancing when allocations drift.

How should I allocate my crypto portfolio by risk level?

Conservative (Low risk) investors should allocate approximately 40% to Bitcoin and 20% to General Blockchains, with a 10% stablecoin buffer. Moderate investors can reduce Bitcoin to 30% and increase exposure to Smart Contract Blockchains. High-risk portfolios shift weight toward Resource Sharing, Prediction Markets, and Anonymous Payments, which offer higher return potential but significantly higher volatility. See the full allocation tables above.

Can I automate crypto portfolio management?

Yes. Platforms like SmartCredit.io allow you to define your risk profile once, then automate portfolio construction and rebalancing entirely. The system constructs your sub-class allocation automatically and rebalances whenever ratios drift outside predefined thresholds — delivering regular performance reports with no daily management required from you.

What is a crypto risk profile and how is it calculated?

A crypto risk profile classifies an investor into one of five categories — Low, Moderate, Medium, Enhanced, or High — based on two dimensions: Risk Tolerance (investment experience, loss sensitivity, risk awareness) and Risk Ability (time horizon, free assets ratio, annual loss compensation rate). The final profile is the lower of the two scores, because psychological tolerance and financial capacity both constrain how much risk an investor should actually take.

What are the main sub-classes of cryptocurrency for portfolio diversification?

The main crypto sub-classes for portfolio diversification are: Bitcoin, General Blockchains, Smart Contract Blockchains, Payments, Anonymous Payments, Resource Sharing (storage/compute/network), Prediction Markets, Gaming, and Fiat Proxies (stablecoins). Each has a different return/volatility profile, enabling genuine diversification within a crypto-only portfolio — similar to how equities, bonds, and real estate diversify a traditional portfolio.

What is the difference between strategic and tactical crypto asset allocation?

Strategic allocation sets your long-term target weights across crypto sub-classes based on your risk profile — for example, 30% Bitcoin, 15% General Blockchains, 10% Smart Contract Blockchains. Research shows this explains roughly 92% of long-term portfolio performance. Tactical allocation involves shorter-term adjustments within those ranges — rotating toward stablecoins during uncertainty, or increasing Smart Contract exposure during on-chain growth surges — without abandoning the strategic anchor.

Can I earn passive income from my crypto portfolio?

Yes — and at rates significantly higher than traditional stock dividends. While stock dividends typically yield 2–3% annually, lending crypto on platforms like SmartCredit.io generates up to 18% APY in fixed-rate, fixed-term lending positions. This passive income is generated while maintaining full exposure to price appreciation, and it creates a powerful psychological incentive to hold through market volatility rather than panic-selling during drawdowns.

General Note

This information is provided for educational purposes only. Please always consult a qualified investment advisor before making real investment decisions. Cryptocurrency investments carry substantial risk including potential loss of principal.

Everything described in this guide — risk profiling, sub-class allocation, automatic rebalancing, and up to 18% APY on your holdings — is available today on SmartCredit.io. 50,000+ users. 5 years of track record. Non-custodial and self-sovereign.

SmartCredit.io’s free AI Portfolio Optimizer applies Markowitz mean-variance optimization across CoinGecko categories. Type a prompt, get an optimized allocation with Sharpe Ratio, Sortino Ratio, and Efficient Frontier — in seconds.

References

- Brinson, Gary P., Brian D. Singer, and Gilbert L. Beebower. 1991. “Determinants of Portfolio Performance II: An Update.” Financial Analysts Journal, vol. 47, no. 3 (May/June): 40–48.

- Markowitz, Harry. 1952. “Portfolio Selection.” The Journal of Finance, vol. 7, no. 1: 77–91.

- Crypto vs Stocks 2025: Complete Investment Comparison & Portfolio Strategy Guide — SmartCredit.io

- Best Crypto Lending Platforms 2025: Earn Up to 18% APY with DeFi — SmartCredit.io

- AI Crypto Portfolio Optimizer: Build a Markowitz-Optimized Portfolio Using CoinGecko Categories — SmartCredit.io

- DeFi Interest Rates Comparison: Why Fixed Rates Win for Real-Economy Borrowers — SmartCredit.io

- How traditional banking business revenues will be impacted with crypto and smart contracts