рџЋ‰ ANNOUNCEMENT: SmartCredit is increasing rewards for the 2025-2026 period! Stake your SMARTCREDIT tokens to earn 10%+ APY, or borrow/lend to receive 9.5% bonus rewards. Join 50,000+ users already earning passive income.

рџ’Ћ Start Earning 10%+ APY Today

Stake, lend, or borrow to maximize your SMARTCREDIT token earnings

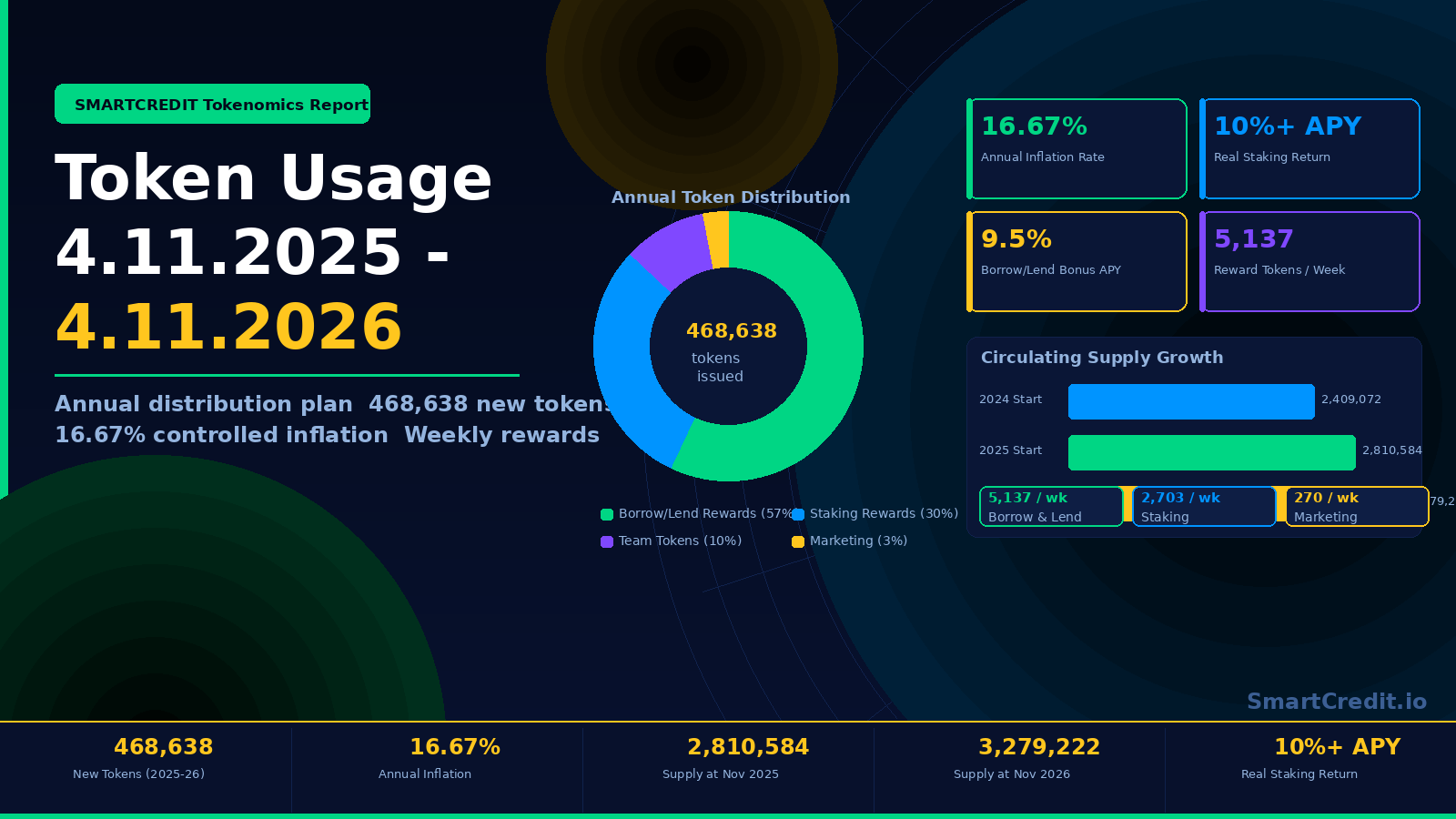

The plan for 4.11.2025–4.11.2026

We’re excited to announce our SMARTCREDIT token distribution plan for the upcoming year. This updated tokenomics model increases rewards for active platform participants while maintaining sustainable inflation rates.

Planned Statistics:

- Circulating tokens at 4.11.2025–2,810,584

- Circulating tokens on 4.11.2026–3,279,222

- New tokens distributed–468,638 tokens (16.67% controlled inflation)

Planned Usage:

- Bonus Rewards for the Borrowers and Lenders on Ethereum — 5,137 tokens per week, 267,139 tokens per year, 9.5% inflation

- Staking rewards for the Holders — 2,703 tokens per week, 140,529 tokens per year, 5.00% inflation

- Marketing tokens — 14,053 tokens annually, 0.50% inflation

- Team tokens — 46,872 tokens, 10% of the annualized inflation, to be allocated at 4.11.2026

- Inflation per year — 16.67%

What This Means For You: Real Earning Potential

Let’s translate these numbers into actual earnings you can expect based on your participation level:

💰 Staking Rewards – Earn While You Hold

When you stake SMARTCREDIT tokens, you earn passive income automatically. Here’s what you can expect:

| Your Stake | Weekly Earnings | Annual Earnings | Real APY* |

|---|---|---|---|

| 10,000 tokens | 19 tokens | 1,000 tokens | 10%+ |

| 50,000 tokens | 96 tokens | 5,000 tokens | 10%+ |

| 100,000 tokens | 192 tokens | 10,000 tokens | 10%+ |

| 500,000 tokens | 961 tokens | 50,000 tokens | 10%+ |

*Real APY assumes 50% of circulating supply is staked. Actual returns may be higher if fewer tokens are staked.

🎁 Bonus Rewards – Get Paid to Use the Platform

Every time you borrow or lend on SmartCredit, you earn bonus SMARTCREDIT tokens on top of your regular interest:

- Borrowers: Borrow $10,000 в†’ Earn 9.5% in bonus tokens = $950 worth of tokens annually

- Lenders: Lend $10,000 в†’ Earn interest (5-12% APY) + 9.5% bonus tokens = Total returns of 15-20%+ APY

Real Example: If you lend $50,000 on SmartCredit:

- Base interest earned: $3,000-$6,000 (6-12% APY)

- Bonus token rewards: $4,750 (9.5%)

- Total annual earnings: $7,750-$10,750 (15.5-21.5% APY)

рџ’Ў Pro Tip: Stack your earnings! Stake your tokens for 10%+ APY, then use them as collateral to borrow and earn another 9.5% in bonus rewards. Some users achieve 20%+ total returns by combining strategies.

Compare: SmartCredit vs The Competition

See how SmartCredit stacks up against traditional finance and other DeFi platforms:

| Platform | Staking APY | Lending APY | Bonus Rewards | Total Returns |

|---|---|---|---|---|

| SmartCredit.io | 10%+ | 5-12% | +9.5% | 15-21%+ рџЏ† |

| Aave | 0% | 2-4% | 0% | 2-4% |

| Compound | 0% | 1-3% | 0% | 1-3% |

| Traditional Bank | 0% | 0.5% | 0% | 0.5% |

| Stock Market (S&P 500) | N/A | N/A | 0% | ~10% avg |

SmartCredit delivers 10-40x better returns than traditional savings accounts and consistently outperforms other DeFi platforms through our unique bonus reward system.

рџљЂ Join 50,000+ Users Earning Passive Income

Start staking, lending, or borrowing today to maximize your returns

3 Ways to Earn with SMARTCREDIT Tokens

Method 1: Stake Your Tokens (Easiest – Passive Income)

Best For: Long-term holders who want passive income without active management

How It Works:

- Purchase SMARTCREDIT tokens on supported exchanges

- Transfer tokens to SmartCredit.io staking platform

- Stake your tokens with one click

- Earn 10%+ APY automatically – rewards distributed weekly

Earnings Potential: 10%+ APY with zero effort

Risk Level: Low (you maintain ownership of tokens)

Method 2: Lend Your Crypto (Medium Difficulty – Higher Returns)

Best For: Crypto holders who want to earn interest on their assets

How It Works:

- Deposit cryptocurrency (ETH, BTC, stablecoins) into SmartCredit lending pool

- Earn base interest rate (5-12% APY depending on asset)

- Receive 9.5% bonus in SMARTCREDIT tokens on top of interest

- Withdraw anytime – no lock-up periods

Earnings Potential: 15-21%+ total APY (interest + bonus tokens)

Risk Level: Low-Medium (smart contract risk, platform-specific)

Method 3: Borrow with Rewards (Advanced – Leverage Opportunities)

Best For: Active traders and investors who want leverage or need liquidity without selling assets

How It Works:

- Deposit crypto as collateral on SmartCredit

- Borrow stablecoins or other crypto (up to 90% LTV)

- Use borrowed funds for trading, investing, or any purpose

- Earn 9.5% bonus rewards in SMARTCREDIT tokens while borrowing

- These bonus rewards often offset a significant portion of your interest costs

Earnings Potential: 9.5% bonus rewards reduce effective borrowing costs significantly

Risk Level: Medium (liquidation risk if collateral value drops)

💡 Advanced Strategy: Many users combine all three methods: Stake tokens for 10%+ APY, use staked tokens as collateral to borrow (earning 9.5% bonus), then lend the borrowed funds (earning interest + another 9.5% bonus). This “triple-stacking” strategy can generate 25-35%+ total returns.

Token usage 4.11.2024–4.11.2025

Summary:

- Circulating tokens on 4.11.2024–2,409,072

- Circulating tokens on 4.11.2025–2,810,584

- Tokens distributed–401,512 tokens (16.67% actual inflation)

Statistics:

- Bonus Rewards for the Borrowers and Lenders on Ethereum — 4,401 tokens per week, 228,862 tokens per year, 9.50% inflation

- Staking rewards for the Holders — 2,316 tokens per week, 120,454 tokens per year, 5.00% inflation

- Marketing tokens — 12,045 tokens annually, 0.50% inflation

- Team tokens — 40,151 tokens, 10% of the annualized inflation, to be allocated at 4.11.2025

- Inflation per year — 16.67%

Initially, planned inflation was 16.67% per year. As we used fewer marketing tokens, this resulted in 16.67% annual inflation.

Changes to the previous epoch:

Here are the key improvements to the last period:

- Maintained High Staking Rewards: We kept staking rewards consistent at 5% base inflation. With 50% of circulating supply staked, the real return for stakers remains above 10% APY – one of the highest in DeFi.

- Increased Platform Usage Incentives: We increased the borrower/lender bonus rewards from 228,862 to 267,139 tokens annually (16.7% increase) to further facilitate platform usage and growth. This means more rewards for active users!

- Sustained Marketing Investment: We maintained a consistent marketing budget (14,053 tokens, 0.50% inflation) aligned with our aggressive growth strategy for 2025-2026.

- Controlled Inflation: Despite increasing rewards, we maintained the same 16.67% annual inflation rate through efficient token management.

The planned inflation for the new period is 16.67%. We work on keeping the real inflation lower than the planned one by optimizing marketing spend and ensuring tokens are used efficiently.

💬 User Success Story: “I started staking 50,000 SMARTCREDIT tokens in early 2024. After one year, I’ve earned over 5,000 tokens (worth $5,000+) in passive rewards. Plus, I use my staked tokens as collateral to borrow and earn even more bonuses. Best investment decision I’ve made!” – Sarah K., SmartCredit Power User

Frequently Asked Questions

How do I earn staking rewards?

Simply purchase SMARTCREDIT tokens and stake them on the SmartCredit platform. Rewards are automatically calculated and distributed weekly based on your stake percentage of the total staked supply. No active management required – it’s completely passive income.

What’s the minimum amount required to stake?

There’s no minimum requirement! You can stake any amount of SMARTCREDIT tokens. However, due to gas fees, staking at least 1,000 tokens is recommended to ensure fees don’t eat into your rewards significantly.

When are staking rewards distributed?

Staking rewards are calculated continuously and distributed weekly. You can claim your rewards anytime or let them compound automatically by re-staking.

How do bonus rewards work for borrowing and lending?

When you borrow or lend on SmartCredit, you automatically earn SMARTCREDIT tokens as bonus rewards equal to 9.5% of your position value annually. These tokens are distributed weekly and can be immediately staked for additional returns.

Is my stake locked or can I withdraw anytime?

Your staked tokens are NOT locked. You can unstake and withdraw your tokens anytime with no penalty. However, you’ll stop earning rewards once unstaked. There may be a short waiting period (typically 24-48 hours) for security purposes.

What’s the total return if I stake and lend simultaneously?

If you stake tokens for 10%+ APY and also lend assets for 15-21% APY (including bonuses), you’re earning from multiple sources simultaneously. Advanced users who employ leverage strategies report total returns of 25-35%+.

Is the 16.67% inflation rate concerning?

Not at all! This controlled inflation serves a purpose: rewarding active users and growing the ecosystem. Historical data shows we often achieve lower real inflation than planned due to efficient token management. Plus, if you’re staking or using the platform, you’re earning well above the inflation rate, meaning your holdings increase in value relative to non-participants.

Where can I buy SMARTCREDIT tokens?

SMARTCREDIT tokens are available on major DEXs (decentralized exchanges) like Uniswap and on centralized exchanges. Visit SmartCredit.io for the latest list of supported exchanges and trading pairs.

Ready to Start Earning?

Join thousands of users earning passive income with SMARTCREDIT tokens. Stake, lend, or borrow to maximize your returns.

No lock-up periods • Withdraw anytime • 50,000+ active users

Why SmartCredit Token Rewards Are Superior

рџЋЇ Transparent & Predictable

We publish our token distribution plans annually, so you always know exactly how many tokens will be distributed and where they’re going. No surprises, no hidden inflation.

рџ’Ћ Sustainable Tokenomics

Our 16.67% annual inflation is balanced by platform growth and token utility. As the platform grows, token demand increases, often outpacing inflation and driving price appreciation.

рџЏ† Industry-Leading Rewards

10%+ staking APY and 9.5% bonus rewards place SmartCredit among the highest-yielding DeFi platforms while maintaining security and sustainability.

рџ”’ Proven Track Record

We’ve been distributing rewards consistently since 2020, with 99.9% uptime and zero security breaches. Our smart contracts are audited and our team is doxxed.

рџЊ± Growing Ecosystem

With $10M+ TVL and 50,000+ active users, SmartCredit is one of the fastest-growing DeFi platforms. More users = more liquidity = better rates for everyone.

Maximize Your Earnings: Pro Tips

- Compound Your Rewards: Automatically re-stake your weekly rewards to benefit from compound interest. This can increase your annual returns by 5-10%.

- Use Multiple Strategies: Don’t just stake OR lend – do both! Stake your SMARTCREDIT tokens, then deposit other crypto to lend and earn both interest and bonus tokens.

- Take Advantage of Bonus Rewards: Every dollar you borrow or lend earns you 9.5% in SMARTCREDIT tokens. These add up quickly!

- Monitor APY Rates: Lending rates vary by asset and demand. Check current rates regularly and shift to higher-yielding assets when advantageous.

- Long-Term Thinking: Token rewards increase in value as the platform grows. Early participants who staked in 2020 have seen their tokens appreciate 10-50x while earning 10%+ annually.

What’s Next for SMARTCREDIT?

The 2025-2026 period brings exciting developments:

- рџљЂ Launch on Additional Blockchains: Expanding beyond Ethereum to Polygon, Arbitrum, and more for lower fees

- рџ¤– AI-Powered Liquidation Protection: Advanced algorithms to protect borrowers from liquidation during market volatility

- рџ“± Mobile App: Manage your staking and lending on-the-go with our upcoming iOS and Android apps

- рџЊЌ Global Expansion: Supporting more fiat on-ramps and languages to reach users worldwide

- рџ’ј Institutional Products: Enterprise-grade solutions for institutional investors

By participating now, you position yourself to benefit from all these upcoming features while earning consistent rewards throughout the year.

Additional Information

- SmartCredit.io – Start Earning Today

- Lend Your Crypto – Earn 15-21% APY

- Borrow with Rewards – Get 9.5% Bonus

- Learn – Complete Guides & Tutorials

Follow us on Social Media

- Twitter: https://twitter.com/smartcredit_io

- Gitbook: https://learn.smartcredit.io

- Telegram: https://t.me/SmartCredit_Community