In the groundbreaking world of finance, using crypto as collateral has become an effective strategy for obtaining loans. By securing a loan with your digital assets, you can access funds without having to liquidate your crypto holdings.

Why Use Crypto as Collateral?

Choosing to use crypto as collateral presents a unique opportunity for crypto investors to unlock the value embedded in their digital portfolio. The loans obtained this way can help meet immediate fiscal needs while allowing your digital assets to continue to potentially appreciate in value.

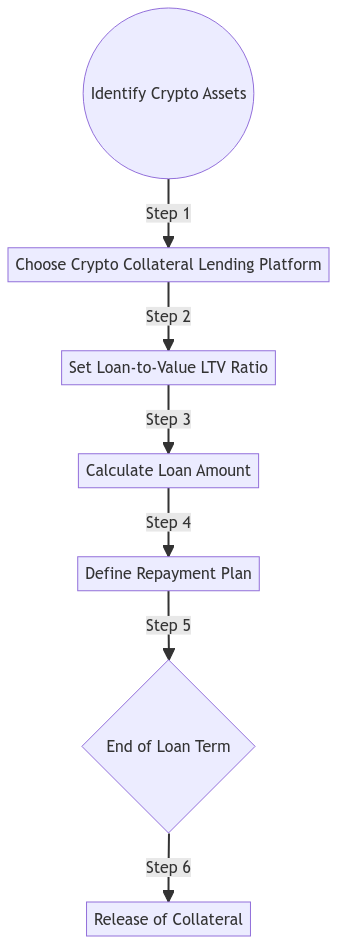

Selecting Your Crypto Collateral Lending Platform

In the rapidly growing space of digital finance, numerous platforms offer services for using crypto as collateral. Each comes with distinct features, rates, and collateral requirements. When choosing a platform, it’s crucial to consider its security, loan-to-value (LTV) ratio, interest rates, and the variety of supported cryptocurrencies.

Loan-to-Value (LTV) Ratio When Using Crypto as Collateral

A vital aspect when using crypto as collateral is understanding the LTV ratio. This value reflects the loan amount you can secure against your crypto collateral. For instance, with an LTV ratio of 50%, $10,000 worth of Bitcoin could secure a $5,000 loan.

Repayment Terms for Loans Using Crypto as Collateral

Loans that use crypto as collateral generally offer flexible repayment options. This can range from monthly payments to a single payment at the loan term’s end. It’s crucial to remember that failure to meet the repayment terms could result in your crypto collateral being liquidated to cover the loan balance.

Using Crypto as Collateral vs. Traditional Collateral

When compared to traditional loans, loans that use crypto as collateral can be processed more quickly and with fewer bureaucratic obstacles. Traditional loans often require credit checks, but when using crypto as collateral, the value of your crypto assets is the primary consideration.

Best Practices When Using Crypto as Collateral

- Thorough Research: Understand the loan’s terms, interest rates, and repayment plans.

- Value Monitoring: Regularly monitor the value of your crypto assets due to their inherent volatility.

- Repayment Plan: Develop a clear plan to repay the loan and prevent the liquidation of your collateral.

Wrapping Up

Using crypto as collateral offers a novel means to leverage your digital assets while keeping potential appreciation within reach. As with any financial decision, they require careful consideration. When used wisely, crypto-collateralized loans can serve as a powerful tool in your financial strategy.

Through this guide, our aim is to provide our readers with a deep understanding of using crypto as collateral, empowering them to make informed financial decisions. Stay tuned for more in-depth insights into the evolving landscape of cryptocurrency and blockchain technology.