The world of finance is rapidly evolving, and the advent of cryptocurrencies has greatly influenced this evolution. While traditional stocks continue to remain a staple investment instrument, cryptocurrencies are heralding an era of digital financial revolution.

Exploring Stocks: A Dive into the Conventional Investment Realm

Stocks, often referred to as shares or equity, are units of ownership in a corporation. When you buy stocks, you are buying a piece of the company, which often comes with voting rights and the potential for dividends, dependent on the company’s success.

Dynamics of Stock Markets

Stock markets are places where buyers and sellers meet to trade stocks. These exchanges are governed by the law of supply and demand. When demand for a specific stock outstrips its supply, its price increases. Conversely, the stock price decreases if more investors want to sell a stock than buy it. Major stock exchanges include the New York Stock Exchange (NYSE), NASDAQ, and the London Stock Exchange (LSE).

Unraveling Cryptocurrencies: Leading the Digital Financial Revolution

In contrast to stocks, cryptocurrencies do not confer ownership rights in a corporation or entitlement to dividends. Instead, they are digital or virtual currencies that employ cryptography for security.

The Mechanics of Cryptocurrencies

Cryptocurrencies utilize a decentralized system to enable secure digital transactions and to control the creation of new units. Bitcoin, the progenitor of all cryptocurrencies, was launched in 2009, setting the stage for the development of a plethora of other cryptocurrencies like Ethereum, Ripple, Litecoin, and many more.

Stocks and Cryptocurrencies: An In-depth Comparative Examination

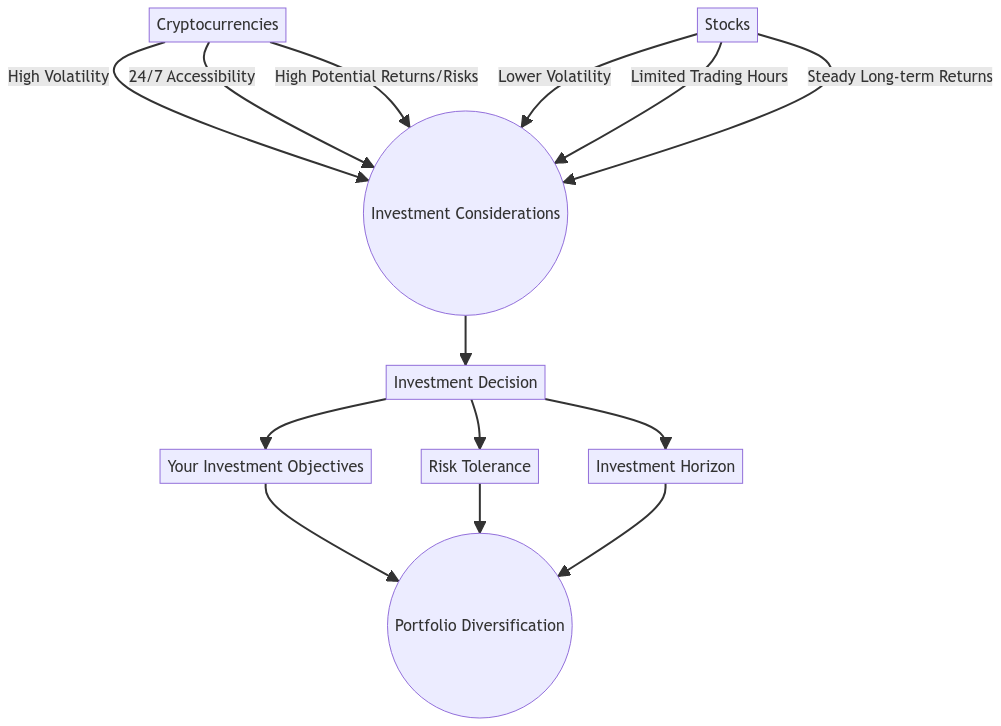

In this section, we delve deeper into the juxtaposition of stocks and cryptocurrencies, with an emphasis on volatility, accessibility, and potential for returns.

Navigating Through Volatility

Cryptocurrencies are infamous for their high volatility. Their values can fluctuate wildly within short time frames, presenting both significant opportunities and risks for investors.

On the contrary, stocks are usually less volatile. Although stock prices do fluctuate, their shifts are generally less abrupt and extreme.

Accessibility and Liquidity: Round-the-clock Trading vs Standardized Trading Hours

Cryptocurrencies are traded on a 24/7 basis, providing unparalleled accessibility to investors across time zones. In comparison, stock markets operate during specific hours on weekdays, barring public holidays and special circumstances.

Both stocks and cryptocurrencies are liquid assets, which can be converted into cash expediently. However, the liquidity of some cryptocurrencies may be lower than others, depending on their popularity and market acceptance.

Weighing Potential Returns Against Risks

Historically, stocks have proven to provide steady, positive returns over the long term. In contrast, due to their volatility and relative novelty, cryptocurrencies possess the potential for high returns but also carry substantial risks.

Deciphering the Investment Decision: Stocks or Cryptocurrencies?

The decision to invest in stocks or cryptocurrencies should be anchored in your investment objectives, risk tolerance, and investment horizon. Diversification of your portfolio is vital for risk mitigation and achieving a balanced return on investment.

Concluding Perspective: Harnessing the Power of Diversification

While cryptocurrencies may present opportunities for substantial returns, their accompanying risks and volatility cannot be undermined. Stocks, although not devoid of risks, generally offer stability and are substantiated by the tangible value of a company. By diversifying your portfolio with a mix of both, you can attain an optimal balance of risk and return.

Further Reading

To gain a deeper understanding of the nuances of stocks and cryptocurrencies, consider exploring the following resources:

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

- Antonopoulos, A. M. (2014). Mastering Bitcoin: Unlocking Digital Cryptocurrencies. O’Reilly Media.

- Malkiel, B. G., & Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383-417.

Caveat

This article provides information for educational purposes and is not a substitute for professional investment advice. Please undertake thorough research and/or consult a financial advisor prior to making any investment decisions.