This DeFi interest rates comparison covers five years of daily borrowing rate data across SmartCredit, Aave V2, Aave V3, Compound V2, and MakerDAO — and the verdict is unambiguous: fixed rates win for anyone who actually needs to plan. If you’ve ever borrowed against your crypto, you’ve faced the fundamental question banks have wrestled with for centuries: lock in a fixed rate, or gamble on a variable one?

In traditional finance, the answer has long separated two worlds: fixed rates for homebuyers, small business owners, and working families — variable rates for institutional traders and investment banks. DeFi has recreated this same divide, and our DeFi interest rates comparison data leaves no room for ambiguity about who benefits from which.

SmartCredit.io has published five years of live, daily interest rate data across the major DeFi lending platforms for ETH, DAI, USDC, and USDT. You can explore the full DeFi interest rates comparison tool here. What this data reveals is striking: variable rates are not just volatile — they are unpredictably, structurally volatile in ways that harm everyday borrowers while benefiting nobody except arbitrage traders.

This article explains why, and why SmartCredit’s fixed-rate model was built for the rest of us.

SmartCredit.io’s DeFi Interest Rates Comparison Tool shows daily historical rates across SmartCredit, Aave V2, Aave V3, Compound V2, and MakerDAO for ETH, DAI, USDC, and USDT. The data speaks for itself.

Compare DeFi Interest Rates Now в†’

DeFi Interest Rates Comparison: What the 5-Year Data Shows

Before discussing theory, look at the evidence. SmartCredit’s DeFi interest rates comparison tool covers daily borrowing rates since the early days of DeFi across all major protocols. The picture that emerges is consistent across every asset pair:

- Aave and Compound variable rates spike dramatically during periods of market stress — sometimes reaching 50–100% APR during the 2021 and 2022 market peaks and crashes.

- MakerDAO’s stability fee has been revised dozens of times, often in response to governance votes that respond to macro conditions rather than individual borrower needs.

- SmartCredit’s fixed rates remain stable and predictable — locked at the time of borrowing, immune to market sentiment, governance votes, or liquidity crunches.

The volatility isn’t a bug in variable-rate DeFi protocols — it’s a feature. Algorithmic interest rates are designed to incentivise or discourage borrowing based on pool utilisation. When everyone wants to borrow at once — during a bull run when crypto collateral is soaring — rates surge to rebalance the pool. When everyone is repaying — during a bear market — rates crash toward zero. This creates a deeply counterintuitive trap: rates are highest when you least want them to be, and lowest when you don’t need a loan.

Here is an example of DAI interest rates for the last 6 months (source: smartcredit.io/compareInterestRates):

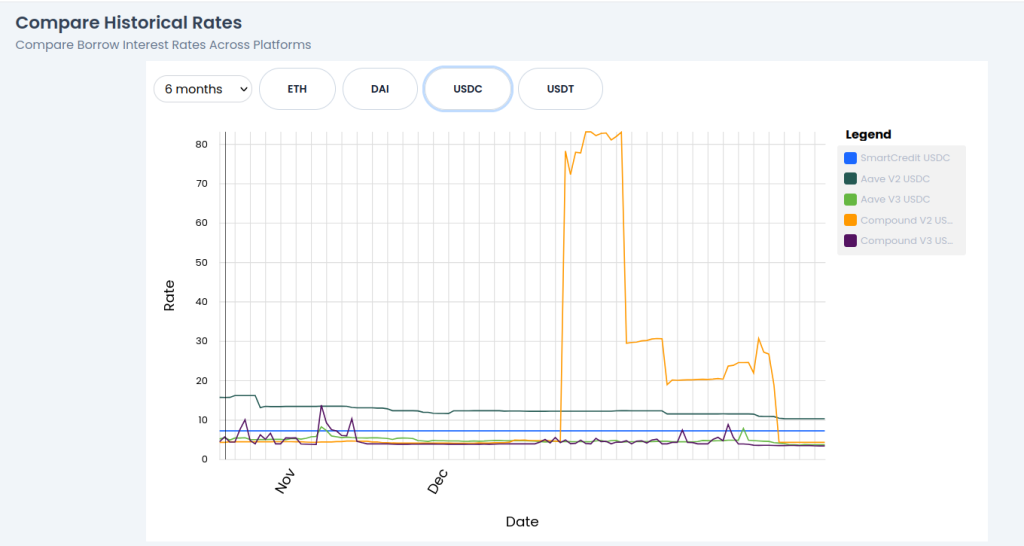

Here is an example of USDC interest rates for the last 12 months:

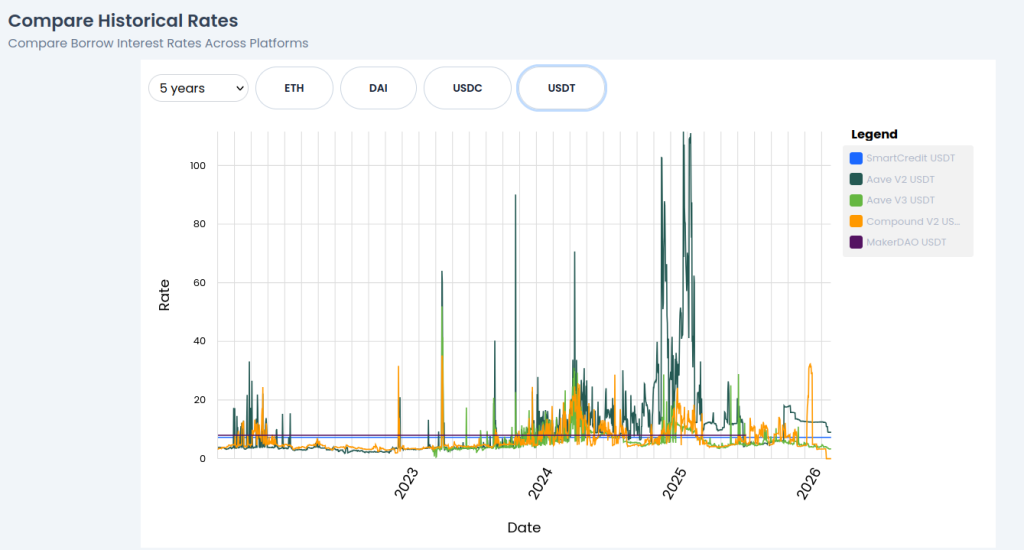

Here is an example of USDT interest rates over the last 5 years:

Variable Rates Were Designed for Investment Bankers — Not You

To understand why variable rates exist, you need to understand who they were designed to serve.

In traditional finance, adjustable-rate mortgages (ARMs) and floating-rate loans became popular in the 1970s and 1980s primarily because they served lenders and financial institutions, not borrowers. When interest rates rise, the lender’s cost of capital rises too — and with a variable-rate loan, the borrower absorbs that cost. The institution is protected; the borrower bears all the risk.

Professional investors — hedge funds, proprietary traders, and institutional desks — can absorb this volatility. They have sophisticated treasury operations, hedging tools (interest rate swaps, options, futures), and the analytical capacity to monitor positions in real time. When rates spike, they can react within minutes.

A small business owner using a variable-rate credit line cannot. A property developer using a floating-rate construction loan cannot. A DeFi borrower who took a loan to fund a real-world purchase cannot. For anyone with a budget, a plan, or a life outside of financial markets, variable rates are a liability.

DeFi replicated this same structural problem. Aave, Compound, and similar protocols offer algorithmically adjusted rates that can — and do — move by 10–30 percentage points within days. Their primary users for variable-rate borrowing are arbitrageurs and yield farmers who hold positions for hours or days, not weeks or months. For these users, a rate that jumps from 3% to 40% APR is annoying but manageable. For a trader who took a six-month loan to fund a position, it’s a catastrophe.

How Fixed Rates Enable the Real Economy

Every functioning economy is built on the ability to plan. When businesses take loans, they calculate whether the projected return from the loan proceeds will exceed the cost of borrowing. This calculation is only meaningful if the cost of borrowing is known in advance.

The Entrepreneur Who Needs Working Capital

An entrepreneur holds ETH as their primary asset but needs $50,000 in stablecoins to purchase inventory for their business. They expect 20% gross margins on the inventory over three months. If they borrow at a fixed 8% APR, the cost of the loan is approximately $1,000 for three months — and the loan makes clear financial sense.

If they borrow at a variable rate that starts at 4% but spikes to 45% when the market turns bullish (exactly when ETH collateral is rising in value), the loan’s three-month cost becomes unpredictable and potentially ruinous. The business decision becomes impossible to evaluate. Many would simply not borrow at all — and the opportunity is lost.

The Homebuyer or Property Investor

Real estate markets worldwide are built on fixed-rate mortgages. The 30-year fixed mortgage in the United States was specifically designed after the Great Depression to give ordinary families the ability to plan their financial lives. A family buying a home at 6% fixed can budget for the next decade. A family at a variable rate is at the mercy of central bank decisions they cannot influence.

Crypto-backed loans for property purchases or down payments require the same predictability. A borrower who posts ETH as collateral to free up stablecoin liquidity for a property purchase needs to know their monthly cost. Fixed rates make this possible. Variable rates make it a speculation.

The DeFi Yield Farmer With a Defined Strategy

Even within DeFi, most sustainable yield strategies depend on knowing the cost of capital. A borrower who takes a loan at 6% APR fixed and deploys into an 18% APY staking strategy has a clear, locked spread of 12% annualised. The strategy works regardless of what happens to market-wide borrowing rates.

The same borrower at a variable rate may find their cost of capital rises to 22% precisely when market demand for the underlying staking position drives up borrowing rates — eliminating the spread and potentially making the position unprofitable. This is not unusual. It’s systemic in variable-rate DeFi. SmartCredit’s Fixed Rate Leveraged Lido Staking product addresses exactly this problem by locking both the borrowing cost and the staking yield, making the return calculable from day one.

Unlike Aave or Compound, your rate is locked from the moment you borrow. No surprises. No rate spikes. No governance votes changing your costs overnight.

Start Borrowing at a Fixed Rate в†’

Why Traders Specifically Benefit from Fixed Rates

Trading is a business of managing uncertainty. The best traders systematically reduce the number of unknowns in any position, focusing their risk budget on the directional bet they’ve researched and believe in — not on operational variables outside their control.

When a trader takes a crypto-backed loan at a variable rate, they’re introducing a second source of risk that has nothing to do with their thesis. Their position now depends on:

- Whether their trade thesis is correct (the risk they chose to take)

- What happens to DeFi interest rates across the market (a risk they did not choose)

Professional risk management calls this “basis risk” — and reducing it is always preferable. With a fixed-rate loan, the trader knows exactly what their financing cost will be for the duration of the loan. The only variable they need to manage is the one they actually have a view on.

Position Sizing Becomes Accurate

A trader sizing a position needs to calculate their maximum risk. With fixed-rate borrowing, the interest cost is a known constant — it can be built into the position model precisely. With variable-rate borrowing, any position-sizing model includes an assumption about future DeFi interest rates that could be wrong by 30 percentage points.

Exit Timing Is Cleaner

Variable rates can create a perverse situation where a trader needs to exit a position not because their trade is wrong, but because funding costs have become unsustainable. This forced liquidation is a structural wealth transfer from retail borrowers to DeFi liquidity providers — it happens at exactly the wrong time, when markets are stressed and exits are costly.

With a fixed-rate, fixed-term loan, the trader knows their exit timeline. They can hold through short-term volatility without worrying that their cost of capital will spike while they wait. This aligns perfectly with the kind of disciplined, research-driven approach that separates successful traders from gamblers. You can learn more about building robust crypto portfolio strategies in our Crypto Portfolio Management guide.

Leverage Strategies Become Sustainable

Many traders use crypto loans to implement leveraged strategies — borrowing stablecoins against ETH to buy more ETH, for example. The sustainability of any leverage strategy depends on the spread between yield and borrowing cost. As AI trading agents become more sophisticated in DeFi risk management, the importance of predictable financing costs will only grow — automated systems need stable DeFi interest rates as inputs to function reliably.

Fix your borrowing cost and focus on what you actually have a view on. SmartCredit.io offers fixed-rate crypto-backed loans with terms from 30 to 365 days — no rate surprises mid-trade.

Borrow at a Fixed Rate on SmartCredit.io в†’

The Psychological Cost of Variable Rates

There’s a dimension of variable-rate borrowing that rarely appears in financial analysis but profoundly affects real-world behaviour: the psychological cost of uncertainty.

Research in behavioural economics consistently shows that uncertainty — even uncertainty that averages out to the same expected value as a known outcome — causes stress, reduces decision quality, and leads to suboptimal choices. A borrower who knows their rate is 8% fixed can make confident decisions: they can plan, invest, and commit. A borrower facing variable DeFi interest rates that could be anywhere from 2% to 40% over the life of their loan is in a state of chronic financial anxiety.

This isn’t a trivial concern. The 2008 financial crisis was partly caused by homeowners with adjustable-rate mortgages who could afford their initial teaser rates but were completely unprepared — psychologically and financially — for the reset. The same dynamic plays out in DeFi every time market conditions shift sharply and variable rates surge.

Fixed rates eliminate this entirely. You know what you owe. You can plan around it. You can sleep at night.

Platform-by-Platform DeFi Interest Rates Comparison

The SmartCredit.io interest rates comparison tool provides five years of daily data across all major platforms. Here is what the data shows for each protocol:

Aave V2 and V3 Interest Rates

Aave’s variable borrowing rates for USDC and USDT have ranged from near-zero to over 80% APR within the same calendar year. The algorithmic rate model responds to pool utilisation in real time — meaning that when the protocol is in high demand (typically during bull markets or periods of stress), costs surge for all existing borrowers simultaneously. There is no protection for borrowers who took loans at low rates and find themselves paying multiples of their original cost.

Aave V3 introduced efficiency mode and isolation mode, improving capital efficiency but not fundamentally changing the variable-rate exposure for borrowers. When market-wide demand for stablecoin loans spikes, Aave V3 rates spike too — typically in lockstep with V2 — as both pools draw from the same market of capital seekers. For borrowers planning over weeks or months, this structural unpredictability makes Aave unsuitable as a primary borrowing venue.

Compound V2 Interest Rates

Compound’s rate model is similar in structure to Aave’s and exhibits comparable volatility. Historically, Compound’s DAI borrowing rates have been among the most volatile of any major stablecoin on any major protocol — a direct result of DAI’s tighter supply dynamics and Compound’s specific utilisation curve parameters.

Compound also introduced the COMP token incentive model in 2020, which briefly made borrowing economically negative (borrowers were net recipients of value due to COMP rewards) — then reversed sharply when incentive programmes changed, creating violent rate discontinuities. This episode illustrates a broader risk with variable-rate DeFi: governance and tokenomics decisions can flip borrowing economics overnight, with no advance notice to existing borrowers.

MakerDAO (Sky) Stability Fee

MakerDAO’s stability fee is set by governance vote — meaning borrowers are exposed to decisions made by a token-weighted voting body responding to macroeconomic conditions, DAI peg stability, and collateral risk factors. Over five years, the ETH-A stability fee has ranged from 0% to over 8%, with multiple significant changes in short periods.

While MakerDAO rates are less volatile than Aave or Compound on a day-to-day basis, they carry a different kind of risk: governance risk. A borrower with a 12-month planning horizon may find their rate revised upward multiple times during that period by a DAO vote they had no influence over. The 2023 period saw multiple consecutive stability fee increases as MakerDAO responded to rising real-world interest rates — directly passing macroeconomic risk onto borrowers.

SmartCredit.io Fixed Rates

SmartCredit.io’s peer-to-peer model locks rates at the point of loan origination. A borrower who agrees to a 7% APR loan for 90 days will pay exactly 7% APR for exactly 90 days — regardless of what Aave rates do, regardless of market conditions, regardless of governance votes. The rate in the DeFi interest rates comparison data is the rate you pay. It is the only platform in the comparison where this is true.

This is not a subtle distinction. It is the foundational difference between a financial product designed for borrowers and one designed for liquidity providers. If you want to build an optimized portfolio funded by fixed-rate borrowing, our AI Crypto Portfolio Optimizer can help you build a Markowitz-optimized allocation across CoinGecko categories — then deploy it on SmartCredit.io at a locked rate.

Fixed Rates and Collateral Management: A Critical Synergy

One underappreciated benefit of fixed-rate borrowing is how it simplifies collateral management. In DeFi, borrowers must maintain sufficient collateral to prevent liquidation. This is already a significant source of stress and complexity — particularly for ETH and BTC collateral that can lose 30–50% of value in short periods.

Variable-rate loans compound this problem. When DeFi interest rates spike, the effective cost of a loan increases — but this doesn’t directly change the collateral ratio. What it does is change the borrower’s financial calculus in real time, potentially forcing early repayment or position adjustment precisely when markets are most volatile. Understanding how collateral ratios work is essential for any DeFi borrower — and fixed rates make maintaining healthy ratios far more manageable.

With a fixed-rate, fixed-term loan, the borrower’s only collateral-related concern is the underlying asset price. There are no interest rate shocks to absorb. The cost of the loan is known; the only variable is the asset. This is the cleanest possible risk structure for a borrower.

SmartCredit.io also offers some of the highest LTV ratios in DeFi — up to 90% — making it possible to extract maximum value from collateral without the compounding unpredictability of variable rates layered on top. You can read more about using crypto as collateral effectively in our dedicated guide.

Who Should Use Variable Rates?

In the interest of balance: variable-rate DeFi lending does serve legitimate use cases. Flash loans — atomic transactions that borrow and repay within a single block — are inherently variable-rate but are also zero-duration by definition, so rate volatility is irrelevant. Very short-term liquidity needs (hours to days) where the borrower is monitoring DeFi interest rates continuously are also potentially well-served by variable-rate protocols.

Professional arbitrageurs who hold positions for minutes or hours, and who have automated systems managing their exposure, can rationally choose variable rates in exchange for the instant liquidity that pool-based protocols provide.

But for the vast majority of borrowers — those with planning horizons measured in weeks, months, or years — variable rates are a poor choice. They introduce uncontrollable risk in exchange for a liquidity premium that is rarely worth the price. Five years of DeFi interest rates comparison data confirms this. The theory of finance confirms this. And the real-world consequences — borrowers squeezed out of positions during market stress, trading strategies derailed by rate spikes, business plans undermined by unpredictable financing costs — confirm it in human terms.

How to Borrow at Fixed Rates on SmartCredit.io

SmartCredit.io’s fixed-rate, fixed-term lending model works through a peer-to-peer matching system: lenders specify the minimum rate they’ll accept, borrowers specify the maximum they’ll pay, and the platform matches compatible parties. Once matched, the rate is locked for the term of the loan — no exceptions, no surprises.

Getting started takes less than five minutes:

- Connect your Web3 wallet (MetaMask or any compatible wallet) at smartcredit.io.

- Choose your collateral — ETH, BTC, stablecoins, and other supported assets are accepted at up to 90% LTV.

- Select your loan amount and term — from short-term liquidity to longer-horizon borrowing.

- Review your fixed rate — the rate you see is the rate you pay, locked for the full term.

- Receive your stablecoins — instantly, directly to your wallet.

No credit checks. No KYC. No variable rate shocks. Your cost of capital is fixed from the moment you borrow to the moment you repay.

For borrowers interested in generating yield while borrowing — or in leveraged staking strategies — SmartCredit’s Fixed Rate Leveraged Lido Staking offers a particularly compelling use case: earn 2–5x ETH staking returns with a fixed borrowing cost locked in from the start.

No credit checks. No KYC. Up to 90% LTV. Your rate is locked at the moment you borrow and stays fixed for the entire term — unlike Aave or Compound where DeFi interest rates can surge overnight.

Get a Fixed-Rate Loan on SmartCredit.io в†’

Conclusion: Know Your Rate Before You Borrow

The choice between fixed and variable rates in DeFi is not merely a product preference — it reflects a fundamental philosophy about who the financial system is designed to serve.

Variable rates serve liquidity pools and their providers. They optimise for protocol efficiency and incentivise short-term traders. They work beautifully for DeFi insiders who treat borrowing as a professional operation with real-time monitoring and hedging tools.

Fixed rates serve borrowers. They provide the predictability that enables planning, the stability that reduces psychological stress, the transparency that makes position-sizing accurate, and the fairness that allows anyone — not just institutional-grade operators — to access capital without gambling on what DeFi interest rates will do next.

Five years of DeFi interest rates comparison data from SmartCredit.io tell a clear story: variable rates in DeFi are volatile in ways that systematically disadvantage real-economy borrowers at the worst possible moments. The alternative has always existed. It’s called a fixed rate — and it’s what SmartCredit.io was built to provide.

Stop guessing what your rate will be next month. SmartCredit.io locks your rate at the start and holds it for the full term — whether you borrow for 30 days or 365 days. Non-custodial. No KYC. Up to 90% LTV.

Start Borrowing at SmartCredit.io в†’

Frequently Asked Questions

What is the difference between fixed and variable rates in DeFi?

Fixed rates are set at the time of borrowing and remain constant for the loan term. Variable rates — used by Aave, Compound, and MakerDAO — change continuously based on pool utilisation, market conditions, or governance decisions. A DeFi interest rates comparison across these platforms clearly shows how much variable rates can diverge from any predictable level, especially during periods of market stress.

Why are variable rates in DeFi so volatile?

Variable-rate DeFi protocols use algorithmic models where rates rise when borrowing demand is high relative to available liquidity, and fall when demand is low. During bull markets and periods of market stress — exactly when many borrowers need stability most — DeFi interest rates surge dramatically. This is a feature of the protocol design, not a bug.

Can I compare historical interest rates across DeFi platforms?

Yes. SmartCredit.io provides a free DeFi interest rates comparison tool with five years of daily data for SmartCredit, Aave V2, Aave V3, Compound V2, and MakerDAO across ETH, DAI, USDC, and USDT. Explore the full comparison here.

What assets can I use as collateral on SmartCredit.io?

SmartCredit.io supports ETH, BTC, USDC, USDT, DAI, and other major assets as collateral, with LTV ratios up to 90% — among the highest in DeFi. Learn more in our guide to using crypto as collateral.

Are fixed-rate crypto loans suitable for traders?

Yes — particularly for traders with defined strategies and holding periods measured in weeks or months. Fixed rates eliminate DeFi interest rate uncertainty from position models, allow accurate cost-of-capital calculations, and prevent forced exits caused by rate spikes. Variable rates introduce additional unpredictable risk that professional risk management aims to eliminate.

How does SmartCredit.io’s fixed-rate model work?

SmartCredit.io uses a peer-to-peer model where lenders and borrowers agree on rates directly. Once a loan is matched, the rate is locked for the full term — regardless of what happens to DeFi interest rates market-wide. This is fundamentally different from pool-based protocols where your rate is recalculated continuously. The result is transparent, predictable, and genuinely borrower-friendly lending.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Crypto borrowing involves risk including potential liquidation of collateral. Always conduct your own research and consider your financial situation before borrowing.