The world of cryptocurrencies and digital assets often seems riddled with technical jargon and complex concepts. Among these, the idea of a “Collateral Ratio” stands out for its crucial role in the ecosystem. Comprehending the Collateral Ratio and its significance is paramount for anyone who wishes to navigate through the cryptosphere. This article aims to delve deep into the concept and the underlying reasons why maintaining a 100% ratio is so crucial.

Defining Collateral Ratio

The Collateral Ratio is a measure used to determine the percentage of a borrower’s total value of collateral relative to the amount they wish to borrow. It’s calculated using the following formula:

This ratio is essential as it signifies the financial soundness of a position in any lending or borrowing scenario, especially in the realm of decentralized finance (DeFi).

The Intricacies of the Collateral Ratio

In the context of DeFi, a user will typically over-collateralize their loans to maintain a secure position. For instance, if you wish to borrow 1000 USD worth of a particular token, you might need to deposit collateral worth 1500 USD, resulting in a Collateral Ratio of 150%.

However, it’s essential to remember that the value of collateral and loans are calculated in the native tokens, and these values can fluctuate based on market conditions. Therefore, users must constantly monitor their collateral ratio to ensure they are not at risk of liquidation.

Why Does a 100% Collateral Ratio Matter?

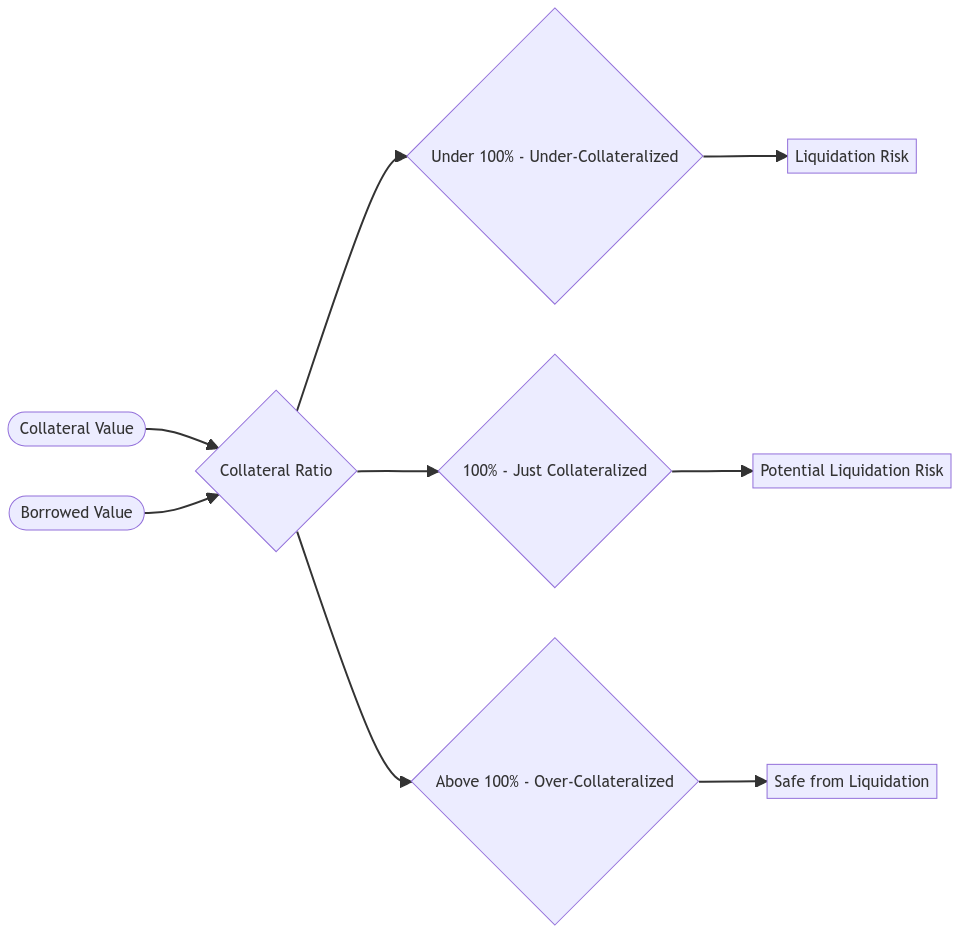

A 100% Collateral Ratio is an essential benchmark in DeFi. It is the point at which the value of your collateral is equal to the value of your outstanding loan. If the Collateral Ratio falls below 100%, it signifies that the collateral’s value is less than the value of the loan. This state is called ‘under-collateralization’ and can lead to liquidation of assets.

Conversely, if the Collateral Ratio is above 100%, it means that the collateral’s value exceeds the outstanding loan value. This is referred to as ‘over-collateralization’.

Keeping a Collateral Ratio at 100% or above is critical to avoid liquidation, which is the process where the borrowed assets are automatically sold to pay off the outstanding loan. This is an essential risk management protocol incorporated by most DeFi platforms to ensure that lenders do not lose their assets due to borrowers defaulting on repayments.

Diagrammatic Representation of the Collateral Ratio

The following mermaid diagram illustrates the relationship between the value of collateral, borrowed value, and the collateral ratio.

Consequences of Not Maintaining a 100% Ratio

In cases where the Collateral Ratio falls below 100%, the system may trigger a liquidation event. This event means that a portion, or all, of the borrower’s collateral, is sold off automatically to repay the loan. This process protects the lenders but can lead to significant losses for the borrower.

For this reason, it is always advised to maintain a Collateral Ratio significantly above 100% to protect against market volatility and prevent the risk of liquidation.

Ways to Maintain a Healthy Collateral Ratio

In order to maintain a healthy Collateral Ratio, there are several actions a borrower can take:

- Monitor the Market Regularly: Keep a close eye on the value of your collateral and borrowed assets. As these values can fluctuate, regular monitoring can help you react swiftly to any adverse changes.

- Rebalance Your Portfolio: If the value of your collateral decreases, consider adding more collateral or repaying a portion of your loan.

- Opt for Stable Collateral: Use stable assets as collateral to avoid massive fluctuations in value.

In conclusion, understanding and managing your Collateral Ratio is fundamental when participating in DeFi activities. By maintaining a ratio of 100% or more, you can mitigate risks and ensure the stability of your financial position.