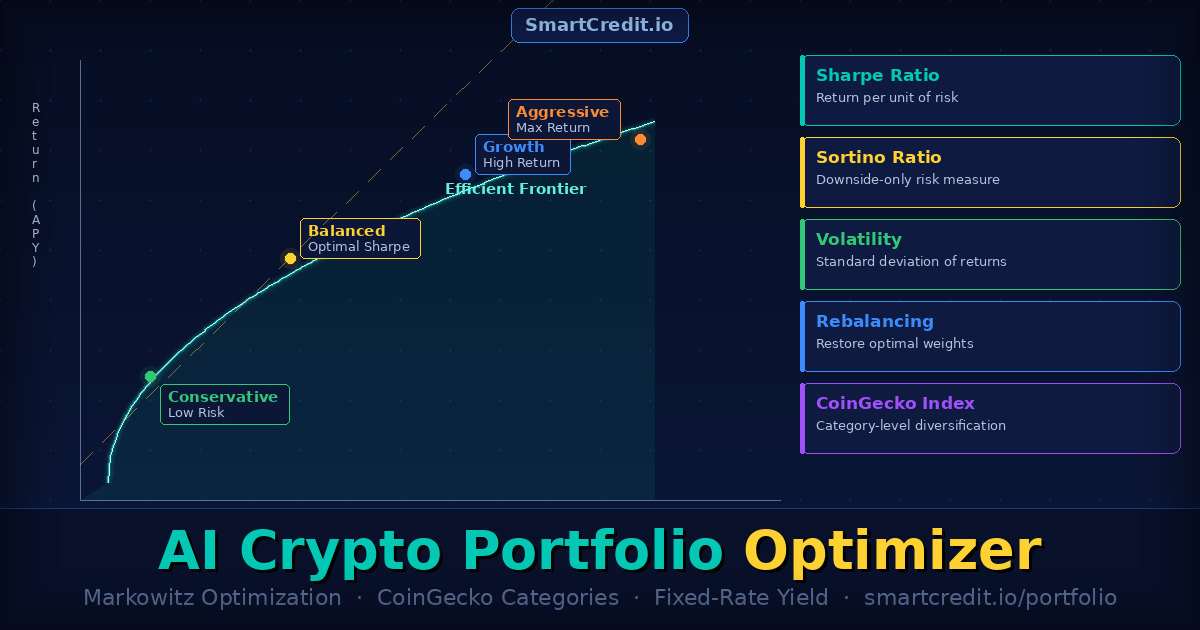

AI Crypto Portfolio Optimizer: Build a Markowitz-Optimized Portfolio Using CoinGecko Categories

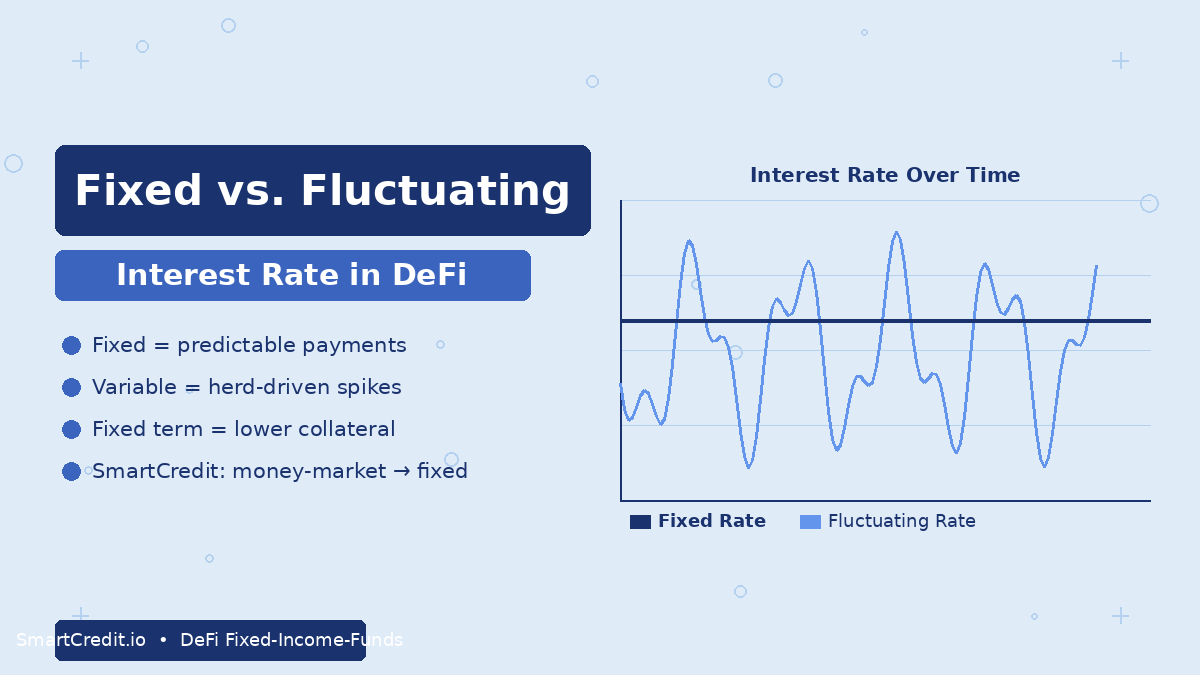

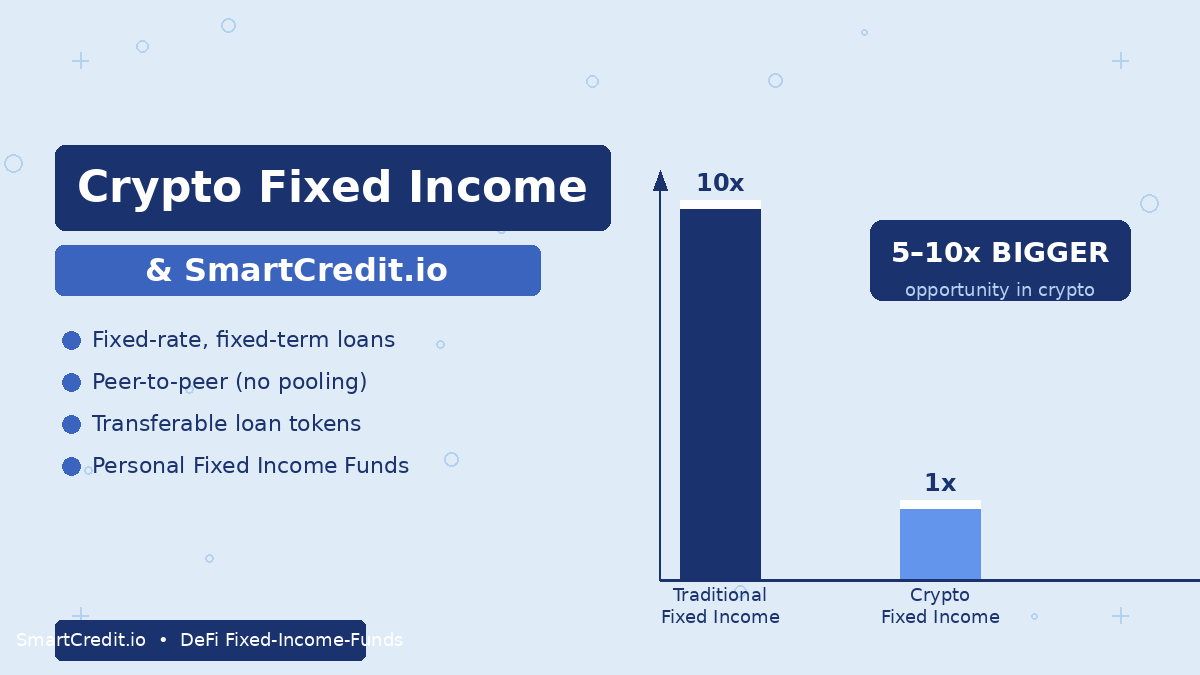

Use SmartCredit.io’s AI portfolio chatbot to build a Markowitz-optimized crypto portfolio across CoinGecko categories. Includes fixed-rate yield optimization, Sharpe Ratio, Sortino Ratio, Volatility explained, and why rebalancing matters.