Blockchain technology in banking will bring changes to client value networks. This article focuses on the following:

- How does Blockchain affect financial services? New alternative financial services providers will emerge, and services that are currently billable will become free or virtually free (including payments, custodial accounts, etc.)

- What is the benefit of bank customers? The relatively high costs for clients to switch banks will reduce significantly. Clients will be able to engage in “service hopping” when searching for the services that best suit their needs

This article looks at the key processes of private banking and considers how they will be impacted by Blockchain. We can categorize the key banking processes as follows:

- Highly relevant client-facing processes; these are value-adding processes for the client and revenue-generating processes for the bank

- Supporting processes, which outnumber client-facing processes by one or two orders of magnitude

- Compliance and regulatory processes, which do not directly add value for the client or the bank, but represent a requirement

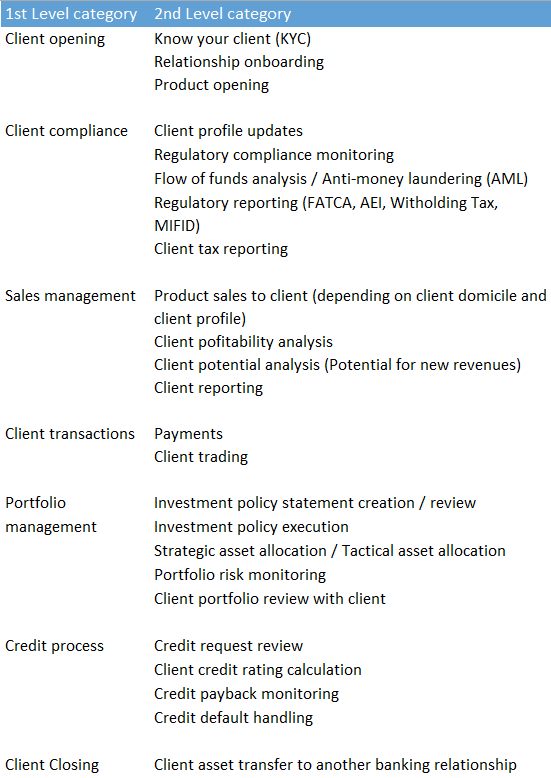

Key Banking Processes

We will look first at Key Banking processes and then how Blockchain will impact banking.

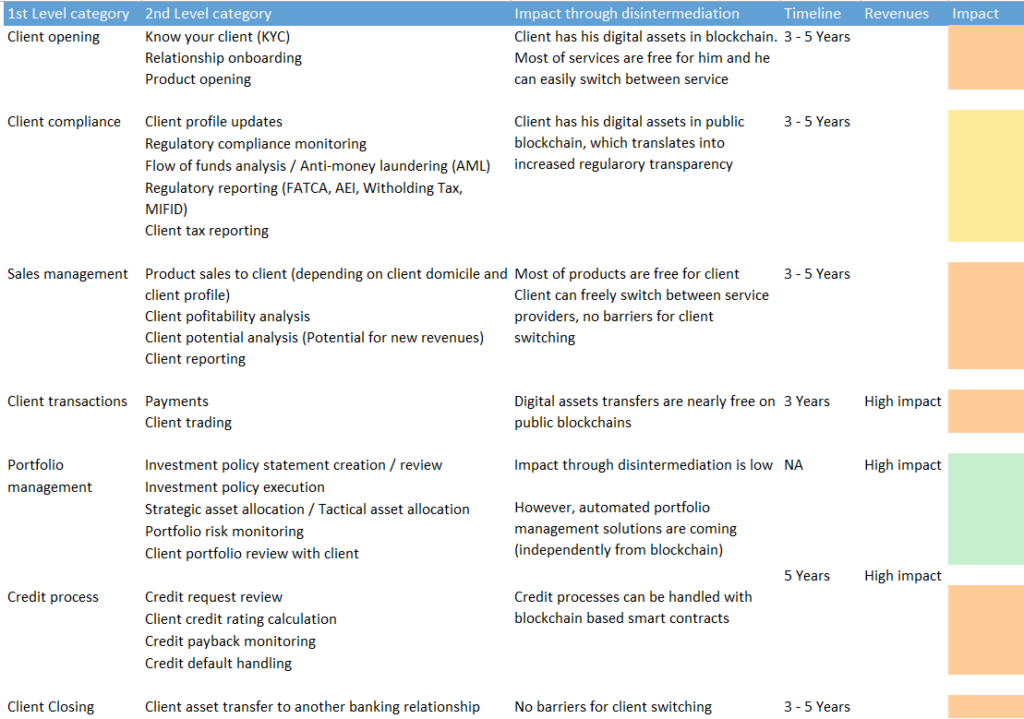

In the following table, key banking processes are divided into the “1st Level Category” and the “2nd Level Category”:

Banking Process List

Client opening processes

These processes are related to opening new client relationships. It encompasses KYC (Know Your Client) and establishing who is the beneficial owner or the real owner of the assets.

Client opening also covers product opening processes. Different products require different setup parameters from the client. For example, when ordering a credit card, you can specify whether it is “silver”, “gold” or “platinum” and whether there a need for a partner credit card (with corresponding fees).

Some products might not be allowed in some jurisdictions (determined by the client’s domicile) or, for example, US persons may be excluded from the offer (regardless of jurisdiction).

Client compliance processes

There is a high level of client activity monitoring that takes place in modern banking; most of this is determined by regulations, but not exclusively. For instance, if a bank has given a mortgage to a client who then decides to transfer assets out of the bank, the client would quickly receive a phone call from their relationship manager.

But this also relates to flow-of-funds analysis (if clients make larger payments, they might need to add additional justification for these payments) or AML-related (Anti-Money Laundering) issues. Regulatory client reporting, such as FATCA, AEI, withholding tax, MIFID, etc., also fall under the same category.

Client tax reporting is likewise covered by this category. Clients are provided tax documents that are required each year. If a client decides not to submit these documents to the relevant tax authorities, the tax authorities will still obtain digital access to these documents via the AEI (Automated Exchange of Information).

Client profile updates are also relevant here. This concerns keeping client profiles up to date (regarding domicile, nationality, etc.), as this information determines which products can be offered to which clients. Indeed, it can also determine that certain clients cannot be contacted actively at all, for example, if they are offshore clients in certain domiciles.

Sales management processes

This involves a lot of client profitability analysis (which is always running in the background) or client potential analysis (which is about identifying additional suitable products for specific clients). These processes are intended to identify which customers are “good” and which products may be sold to these customers.

Banks earn their revenue by selling financial products to clients; banks are not altruistic organizations that seek to serve the common good in society. They want to sell, sell, sell. And there are also fee structures that are not always transparent (one could speculate that this is deliberate).

Of course, there are product suitability processes in place. Lehman Brothers structured notes (a global financial services provider that declared bankruptcy after the Lehman Brothers default) are not suitable for grandmothers, for example. Advisory risk processes would also not allow a 100-percent portfolio allocation in structured notes (which would be subordinated claims, if the issuer went bust).

Client reporting processes are likewise included here. They provide clients with helpful summaries about transactions or the investment performance of their assets.

Client transaction processes

These mainly relate to payments and client trading.

Portfolio management processes — here we have a full stack of processes starting from creating the Investment Policy Statement (IPS) and ending with the client portfolio review with the client.

Every client has an IPS which is determined by their ability to take investment risk, their willingness to take investment risk and the constraints issued by the client (for example, no investments in the tobacco sector). All investments should always be made following the IPS.

Each bank defines the strategic asset allocation (the range of assets that should be invested into specific asset classes) and the tactical asset allocation (which is a more short-term form of asset allocation). These are usually performed by research departments.

This process category is advice-intensive. And this advice is and will continue to be, the core competence of banking.

Credit processes

This category refers to lending and the associated monitoring of risks. This is the process category in which banks generate most of their revenue.

The key process here is the client credit risk calculation. This risk determines the loan interest rate. It is dictated by client income, other obligations, the amount to lend, family circumstances, and other factors.

Another key process is credit payback monitoring: Is the client still able to repay the loan and are any adjustments required? If the client is unable to pay back the loan, the client default handling process is initiated.

Client closing processes

The costs for clients to switch banks are relatively high in the traditional banking system. If a client changes their banking relationship, it is necessary to transfer their assets to another bank. This is a costly process that also takes a lot of time.

The impact of Blockchain on banking

In the previous article, we looked at how private banks generate revenue. We looked as well how Blockchain will impact banking revenues:

- Client transaction processes would be based on various distributed ledgers and would essentially become free for clients.

- Credit processes would be conducted using smart contracts, which would result in low-cost execution for clients and the loss of a revenue source for banks. However, advice-intensive lending products would remain unaffected.

- Portfolio management processes are relatively advice-intensive and they would also remain unchanged.

But let us consider client opening, client compliance, and client closing — since the client would be in control of their assets and their switching costs for blockchain-based assets would be minimal, clients will be much less tied to banks than they are currently. This will bring major changes to this process category.

Client assets would not be listed on the banks’ books like they are today. Client assets would be controlled by the respective private keys and secured on the corresponding crypto-asset blockchains. If a client needs portfolio management from a bank, in the future they could set up 1:2 multi-signature access (signature one for the client and signature two for the bank) for the asset manager.

Sales management processes will likewise transform due to the following:

- Barriers for clients would be very low (and banks would no longer be able to lock in their clients for the long term). This would result in clients being able to select the best products for them.

- Many products that are currently rather costly will become either free or subject to very low fees, and it would make no sense to sell these products to clients.

- The client profitability analysis and client potential analysis will no longer be as important as they were before since banks would no longer be able to tie in their clients for a long time.

Timeline of Blockchain Impact on Banking

The key question here is how exactly will the timeline of blockchain disintermediation unfold.

Technology adoption is expressed with the S-curve. It contains the following adoption phases:

- Innovators — 2.5%

- Early adopters — 13.5%

- Early majority — 34%

- Late majority — 34%

- Laggards — 16%

We would probably not be inaccurate to assume that less than one percent of the working population in OECD countries currently own any cryptocurrencies — this comes under the “Innovators’ Phase”. Real business value will develop from the middle of the “Early Adopters’ Phase” — from an adoption rate of ten percent.

It is difficult to forecast when an adoption rate of ten percent will be achieved, but we could estimate a time frame of three to five years. This adoption will not only involve “owning tokens” but also “value-adding business services”, including banking, meaning there is a real impact on banking processes and banking revenues.

Blockchain and Banking – What will happen next?

This analysis can be summarized in the following table:

Blockchain disintermediation will affect key banking processes, such as client transactions, portfolio management, and credit processes. They are all among the key processes in which banks generate revenue today.

On the one hand, there will be huge opportunities for crypto/fintech companies to focus on these areas. On the other hand, traditional banks will have to seriously rethink their future processes and revenue streams.

Additional information

The S-Curve of technological adoption

How traditional banking business revenues will be impacted by crypto and smart contracts

Top Crypto Lending Platforms for Fixed Income (Guide)

Why Borrowers need Low Collateral Ratio?

Blockchain-based financial system – Are we ready?

Telegram: https://t.me/SmartCredit_Community

Twitter: https://twitter.com/smartcredit_io