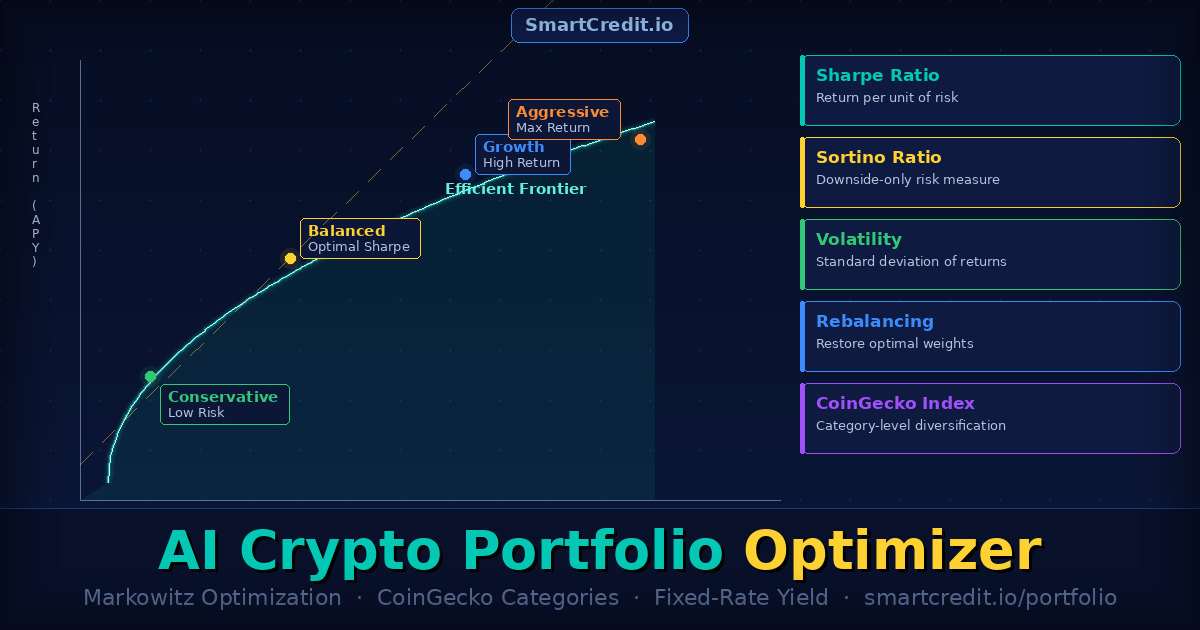

What if you could type a single sentence and instantly receive a mathematically optimal crypto portfolio — one built using the same Nobel Prize-winning theory that institutional fund managers spend millions implementing? The SmartCredit.io crypto portfolio optimizer does exactly that, applying Markowitz Portfolio Optimization directly to CoinGecko’s crypto category universe through a simple AI chat interface.

This tool is not a generic crypto screener or a simple allocation calculator. It is a conversational AI chatbot that applies the mathematical framework that gave birth to modern portfolio theory — directly to CoinGecko’s crypto category universe. You describe the portfolio you want in plain language. The optimizer builds it for you, maximised for risk-adjusted return.

And uniquely among crypto portfolio tools, it can also optimise for fixed-rate yield-bearing portfolios — not just price return, but income-generating positions built on DeFi lending. This article explains how it works, what the key metrics mean, and how to start using it today.

Type a prompt like “Create a long only portfolio with 5 crypto categories” and receive an instantly computed, Markowitz-optimized portfolio across CoinGecko categories. No signup required to explore.

Open the Portfolio Optimizer в†’

What Is Markowitz Portfolio Optimization?

In 1952, economist Harry Markowitz published a paper that fundamentally changed how rational investors think about portfolios. His insight, which later earned him the Nobel Prize in Economics, was this: the risk of a portfolio is not the average of its components’ risks — it depends critically on how those components move relative to each other.

Two assets that each carry 30% annual volatility do not necessarily produce a 30%-volatile portfolio when combined. If the two assets are negatively correlated — when one rises the other tends to fall — the combination can be significantly less volatile than either asset alone. Markowitz formalised this intuition into a precise mathematical framework: mean-variance optimisation.

The algorithm takes as inputs the expected returns, volatilities, and correlations of every asset in the investable universe. It then calculates the set of portfolios that offer the highest possible expected return for each level of risk — a curve known as the Efficient Frontier. Every portfolio on the Efficient Frontier is optimal: no portfolio below it offers better risk-adjusted returns. Every portfolio off it leaves return on the table for the risk taken.

For decades, this framework was available only to institutional investors with quantitative research teams, expensive data subscriptions, and portfolio management software costing tens of thousands of dollars per year. SmartCredit.io has made it available to any crypto investor, through a natural language interface, in seconds.

How the Crypto Portfolio Optimizer Works

The SmartCredit.io Portfolio Optimizer is a conversational AI that accepts natural language prompts and returns fully computed, Markowitz-optimized portfolio allocations. Here is the workflow:

Step 1: Describe Your Portfolio in Plain Language

You type a prompt describing what kind of portfolio you want. The AI interprets your intent and maps it to the appropriate universe of investable categories. Example prompts include:

- “Create a long only portfolio with 5 crypto categories” — produces a return/risk optimized allocation across five CoinGecko crypto categories selected for their diversification properties

- “Create a long only portfolio with 5 interest bearing categories” — produces a yield-optimized portfolio of categories where the underlying assets generate fixed-rate interest income

- “Build a conservative portfolio with low volatility” — tilts the optimization toward the lower-risk end of the Efficient Frontier

- “Maximize the Sharpe Ratio across DeFi categories” — finds the single point on the Efficient Frontier with the best risk-adjusted return

Step 2: The Optimizer Runs Markowitz Calculations

Under the hood, the optimizer retrieves historical return and correlation data for the requested category universe. It then solves the mean-variance optimization problem to find the Efficient Frontier and selects the portfolio that best matches your stated objective — whether that is maximum Sharpe Ratio, minimum volatility, target return, or another constraint you specify.

Step 3: You Receive Specific Allocation Weights

The output is a precise set of portfolio weights: for example, 35% Bitcoin, 25% Smart Contract Platforms, 20% DeFi, 15% Payments, 5% Stablecoins. Each allocation is accompanied by the portfolio’s expected return, volatility, Sharpe Ratio, Sortino Ratio, and other key metrics.

Step 4: You Implement Manually

This is a crucial point: CoinGecko categories are not directly investable instruments. Unlike an ETF that tracks an index, there is no product you can buy that gives you exposure to “the CoinGecko DeFi category” as a whole. The optimizer tells you the optimal allocation across categories — but to implement it, you need to select representative tokens within each category and purchase them yourself, or weight them proportionally.

Think of it like an equity fund manager who uses the S&P sector weightings as a framework but selects individual stocks within each sector. The categories provide the strategic allocation structure; individual token selection is the tactical implementation. This is actually an advantage: you maintain full control over which specific assets you hold within each category.

Try the chatbot now: “Create a long only portfolio with 5 crypto categories” — and see the Markowitz-optimized allocation, Efficient Frontier, Sharpe Ratio, and full risk metrics instantly.

Try the Portfolio Optimizer в†’

CoinGecko Categories as Investable Indexes: The Framework Explained

CoinGecko maintains a taxonomy of cryptocurrency categories that group coins by their primary use case, technology, or sector. These categories function as informal “indexes” of each crypto sub-sector and include groups such as Bitcoin, Smart Contract Platforms, DeFi, Layer 2, Payments, NFTs, Gaming, Stablecoins, Liquid Staking, and many more.

The SmartCredit.io optimizer uses these categories as its investable universe for several reasons:

- Sector-level diversification: Allocating at the category level ensures exposure to different parts of the crypto economy — infrastructure, applications, finance, gaming — rather than overconcentrating in correlated assets

- Reduced single-token risk: Category-level thinking reduces the temptation to make concentrated bets on individual coins, which is responsible for the majority of retail investor losses in crypto

- Cleaner correlation structure: Coins within the same category tend to move together. Categories themselves have more distinct correlation patterns, making them better building blocks for diversification

- Alignment with professional portfolio management: This mirrors how institutional equity investors allocate to sectors (Technology, Healthcare, Financials) rather than individual stocks — the approach that research shows explains 92% of long-term portfolio returns

This approach is directly connected to the professional crypto portfolio management framework we cover in depth in our dedicated guide — including the full sub-class allocation tables by risk profile.

Fixed-Rate Yield Portfolio Optimization: A Unique Capability

Standard portfolio optimizers focus exclusively on price return. SmartCredit.io’s optimizer goes further: it can optimize portfolios specifically for yield-generating, interest-bearing positions — with fixed rates.

When you prompt “Create a long only portfolio with 5 interest bearing categories,” the optimizer selects categories where the underlying protocols generate fixed-rate income — DeFi lending platforms, liquid staking, yield aggregators, and similar — and then applies Markowitz optimization to find the allocation that maximises risk-adjusted yield rather than just price appreciation.

This matters enormously for investors who want their portfolio to generate income, not just capital gains. The practical implication: instead of holding crypto passively and hoping for price appreciation, you can hold an optimized allocation across yield-bearing categories and earn fixed-rate income throughout the holding period — regardless of price movement.

SmartCredit.io itself is a core component of this yield-bearing universe. As a peer-to-peer fixed-rate lending platform, SmartCredit allows borrowers to access crypto-backed loans at fixed interest rates while lenders earn predictable fixed-rate returns. This is precisely the kind of yield-bearing position that the interest rate portfolio optimizer is designed to include and optimize.

You can learn more about how fixed rates fundamentally outperform variable-rate alternatives in our article on DeFi interest rate comparisons — backed by five years of live data.

Use the prompt “Create a long only portfolio with 5 interest bearing categories” to build a Markowitz-optimized yield portfolio. Then implement it on SmartCredit.io to earn fixed-rate returns on your holdings.

Build a Yield Portfolio в†’

Key Metrics Explained: Sharpe Ratio, Sortino Ratio, and Volatility

The portfolio optimizer returns several risk and performance metrics alongside the allocation weights. Understanding these metrics is essential for interpreting the output and selecting the right portfolio for your objectives. Here is a plain-language explanation of each.

Sharpe Ratio: Return Per Unit of Total Risk

The Sharpe Ratio is the most widely used risk-adjusted performance metric in professional finance. It was developed by Nobel laureate William Sharpe and answers a single question: how much excess return am I earning for each unit of total risk I am taking?

Mathematically, the Sharpe Ratio is calculated as:

Sharpe Ratio = (Portfolio Return в€’ Risk-Free Rate) Г· Portfolio Volatility

Where “Risk-Free Rate” is typically the return on a zero-risk asset (such as short-term US Treasury bills), and “Portfolio Volatility” is the standard deviation of portfolio returns.

In practice for crypto portfolios:

- A Sharpe Ratio below 1.0 means you are not being adequately compensated for the volatility you are accepting

- A Sharpe Ratio between 1.0 and 2.0 is considered good — you are earning meaningful excess return per unit of risk

- A Sharpe Ratio above 2.0 is excellent, though rare in crypto markets at the portfolio level except during strong bull cycles

The Markowitz optimization in the SmartCredit.io optimizer can explicitly target the maximum Sharpe Ratio portfolio — the single point on the Efficient Frontier where risk-adjusted return is highest. This is the portfolio most commonly recommended by professional wealth managers as the “tangency portfolio” — the point where the Capital Market Line is tangent to the Efficient Frontier.

Sortino Ratio: Return Per Unit of Downside Risk

The Sortino Ratio refines the Sharpe Ratio by making a crucial distinction: not all volatility is bad. Upside volatility — your portfolio rising sharply — is not a problem. What investors actually want to avoid is downside volatility: large losses.

Sortino Ratio = (Portfolio Return в€’ Risk-Free Rate) Г· Downside Deviation

Where “Downside Deviation” measures only the volatility of negative returns — it ignores positive surprises entirely.

The Sortino Ratio is particularly relevant for crypto portfolios because crypto returns are highly asymmetric — the distribution has a “fat tail” on both the upside (parabolic bull runs) and the downside (sudden crashes). A portfolio that has a moderate Sharpe Ratio but a high Sortino Ratio is one where most of the volatility is positive — exactly what you want.

When comparing two portfolios with similar Sharpe Ratios, always prefer the one with the higher Sortino Ratio. It means the volatility you are experiencing is skewed toward gains rather than losses.

Volatility: The Foundation of All Risk Metrics

Volatility — measured as the annualised standard deviation of returns — quantifies how much a portfolio’s returns fluctuate around their average. A portfolio with 60% annual volatility can be expected, in a typical year, to swing roughly 60 percentage points above or below its mean return.

For context:

- The S&P 500 has historically exhibited annualised volatility of approximately 15–20%

- Bitcoin has historically shown annualised volatility of 60–100%

- A well-diversified crypto portfolio across multiple categories typically exhibits lower volatility than Bitcoin alone — because category correlations reduce total portfolio variance

- A yield-bearing, fixed-income-heavy crypto portfolio can achieve even lower volatility, approaching 20–40% depending on the composition

Markowitz optimization works precisely by exploiting the relationship between individual asset volatilities and their correlations. Two assets each with 80% volatility can produce a portfolio with 50% volatility if they are sufficiently uncorrelated — this is the mathematical foundation of diversification. The SmartCredit.io optimizer calculates this precisely, not by approximation.

For a deeper understanding of how risk profiles translate to portfolio construction, see our comprehensive guide to crypto portfolio management, which walks through risk tolerance scoring, risk ability assessment, and the five standard allocation tiers.

Why You Should Rebalance Your Crypto Portfolio Frequently

The Markowitz-optimized portfolio weights produced by the SmartCredit.io optimizer are not a one-time configuration. They are a living target that requires regular rebalancing to maintain. Here is why this matters more in crypto than in any other asset class — and why neglecting rebalancing is one of the most common and costly mistakes crypto investors make.

Drift: How Optimized Portfolios Become Unoptimized

Imagine a portfolio initially allocated 40% Bitcoin, 30% Smart Contract Platforms, 20% DeFi, 10% Payments. After three months of a bull run, Bitcoin has outperformed: it now represents 55% of the portfolio’s value because its price has risen faster than the other categories. The portfolio that was optimized for a specific risk/return profile now holds a dramatically different one — with higher concentration, higher correlation to Bitcoin, and almost certainly a worse Sharpe Ratio.

This is called portfolio drift, and it happens constantly in crypto markets because of the extreme return dispersion between categories. A category that surges 300% in a quarter will dominate the portfolio even if it started at a 10% weight. The result is a portfolio that is no longer on the Efficient Frontier — it is producing worse risk-adjusted returns than the original optimized allocation.

Rebalancing Enforces a Sell-High, Buy-Low Discipline

Rebalancing back to target weights mechanically forces you to sell the categories that have risen (trim the winners) and buy the categories that have lagged (add to the laggards). This is the exact opposite of what human psychology pushes investors to do — we naturally want to hold the winners and avoid the underperformers. This behavioural bias is the primary reason most retail investors underperform simple rebalanced index strategies.

A systematic rebalancing discipline removes this bias entirely. You are not making a judgement call — you are restoring the mathematically optimal weights that the Markowitz algorithm identified. The discipline is the strategy.

Correlation Structure Changes Over Time

One of the most important — and most overlooked — reasons to rebalance regularly is that the correlation structure between crypto categories changes. During bull markets, correlations across categories tend to rise as all sectors participate in the upside. During crashes, correlations spike dramatically, often approaching 1.0, as panic selling hits all sectors simultaneously.

This means the optimization that was performed with historical correlations from six months ago may be based on a correlation structure that no longer reflects current market dynamics. Rerunning the optimization regularly with updated data, and rebalancing to the new optimal weights, ensures your portfolio accounts for the current correlation environment rather than a stale historical one.

How Often Should You Rebalance?

For crypto portfolios, the consensus among quantitative researchers is that rebalancing monthly or quarterly captures most of the benefit while minimising transaction costs. The optimal frequency depends on:

- Transaction costs: On-chain gas fees and exchange trading fees eat into rebalancing gains; lower-cost chains and venues allow more frequent rebalancing

- Portfolio size: Larger portfolios can justify more frequent rebalancing because the gains from maintaining optimal weights outweigh the transaction costs

- Market volatility regime: During high-volatility periods (major bull or bear moves), drift happens faster and rebalancing should be more frequent

- Threshold-based triggers: Many professional managers use drift-threshold rules rather than calendar rules — e.g., rebalance whenever any category drifts more than 5 percentage points from its target weight

The SmartCredit.io portfolio optimizer makes it practical to rebalance frequently: running a new optimization with updated data takes seconds. You can regenerate your optimal weights monthly, compare them to your current holdings, and identify the minimal set of trades required to restore optimal allocation.

Run the portfolio optimizer monthly, compare the new optimal weights to your current holdings, and make the minimal trades to restore efficiency. It takes under 60 seconds to generate updated weights.

Regenerate Your Optimal Portfolio в†’

Example Prompts and What They Produce

To help you get started immediately, here are specific prompts you can enter into the SmartCredit.io portfolio optimizer, with a description of what each produces:

“Create a long only portfolio with 5 crypto categories”

The optimizer selects five CoinGecko crypto categories and applies Markowitz optimization to find the allocation that maximises risk-adjusted return. The output includes the portfolio weights, the Efficient Frontier curve, the Sharpe Ratio, Sortino Ratio, expected return, and annualised volatility. This is a good starting point for anyone new to the tool.

“Create a long only portfolio with 5 interest bearing categories”

This variant focuses specifically on yield-generating categories — protocols and platforms where holding the category produces ongoing income through staking, lending, or liquidity provision. The optimization is tuned for risk-adjusted yield rather than pure price return. Ideal for investors who want their portfolio to generate income regardless of market direction.

“Maximize the Sharpe Ratio with DeFi categories”

Constrains the universe to DeFi-related categories and finds the single portfolio on the Efficient Frontier with the highest Sharpe Ratio — the “tangency portfolio” that professional managers target for maximum risk-adjusted efficiency.

“Build a low volatility portfolio with 7 categories”

Targets the minimum-variance end of the Efficient Frontier — the portfolio with the lowest achievable volatility given the selected categories. Appropriate for conservative investors who prioritise capital preservation over maximum return.

“Create a portfolio targeting 50% annual return”

Constructs the portfolio on the Efficient Frontier that targets a specific expected return level, finding the mix of categories that achieves that return with the minimum possible volatility. Useful for investors with explicit return targets who want to understand the risk required to achieve them.

From Optimized Portfolio to Fixed-Rate Income: The SmartCredit.io Connection

The portfolio optimizer is the analytical layer. SmartCredit.io is the execution layer — and the two are designed to work together.

Once you have generated an optimized portfolio — particularly an interest-bearing yield portfolio — the natural implementation venue is SmartCredit.io’s fixed-rate lending platform. Here is how the connection works in practice:

- Generate your optimized allocation using the portfolio optimizer — e.g., 40% liquid staking protocols, 30% DeFi lending, 20% yield aggregators, 10% stablecoins

- Acquire representative tokens from each category in your target proportions — this is the manual implementation step, since CoinGecko categories are not directly investable

- Deploy on SmartCredit.io — use your crypto holdings as collateral to borrow stablecoins at fixed rates, or lend your holdings to earn fixed-rate returns of up to 18% APY

- Your portfolio now generates income at a predictable, locked rate — not at the mercy of Aave or Compound variable rates that can spike unpredictably

- Rebalance monthly by running a fresh optimization, comparing to current weights, and making the minimal necessary adjustments

This is a complete investment system: systematic optimization for portfolio construction, fixed-rate income generation for yield, and disciplined rebalancing to maintain efficiency. It is the same framework used by professional wealth managers, made accessible through a conversational AI interface.

For investors who want to access liquidity from their portfolio without selling — for example, to fund rebalancing trades or real-world expenses — using crypto as collateral for a fixed-rate loan is significantly more tax-efficient than selling holdings. Borrowing is not a taxable event; selling is. Learn more about the tax treatment of crypto loans in our dedicated guide.

Generate your Markowitz-optimized allocation with the chatbot, then deploy on SmartCredit.io to earn fixed-rate returns on your holdings — up to 18% APY with rates locked from day one. No KYC. Non-custodial. Up to 90% LTV for borrowers.

Start on SmartCredit.io в†’

Why This Approach Beats “Token Picking”

The dominant retail crypto investor strategy is token picking: researching individual projects, forming a view, and concentrating capital in a handful of chosen coins. This approach has several well-documented problems:

- Concentration risk: A 5-token portfolio where one token drops 90% destroys the entire portfolio even if the others perform well. A category-level portfolio distributes this risk across the full category

- Information disadvantage: Retail investors do not have access to the same on-chain data, team intelligence, or market flow information as professional traders. Competing on individual token selection is fighting on unfavourable ground

- Behavioural traps: Concentrated positions create emotional attachment to specific tokens, leading to overholding of losers and early selling of winners — both well-documented sources of underperformance

- No systematic exit framework: Token pickers typically have no rebalancing discipline, meaning they accumulate winners until they crash rather than systematically locking in gains

The Markowitz category-level approach sidesteps all of these issues. You are not trying to pick which token will outperform — you are building a diversified portfolio that is mathematically optimized to generate the best risk-adjusted return available from the current market structure. The only active decisions required are (1) which categories to include and (2) how often to rebalance. Both of these are decisions the AI optimizer helps you make systematically.

This is also why professional fund managers have consistently outperformed retail investors over long periods — not because they are better stock pickers, but because they have systematic portfolio construction processes with defined rebalancing rules. The SmartCredit.io optimizer brings exactly this institutional-grade discipline to the individual investor.

Frequently Asked Questions

What is Markowitz Portfolio Optimization?

Markowitz Portfolio Optimization, also called mean-variance optimization, is a mathematical framework for constructing portfolios that achieve the maximum possible expected return for a given level of risk. It was developed by Nobel Prize winner Harry Markowitz in 1952. The framework uses historical return, volatility, and correlation data to identify the Efficient Frontier — the set of portfolios where no improvement in return is possible without accepting additional risk.

What are CoinGecko categories and why are they used?

CoinGecko categories are groupings of cryptocurrencies by their primary use case or sector — such as Smart Contract Platforms, DeFi, Layer 2, NFTs, Liquid Staking, Payments, and many others. They function as informal sector indexes for the crypto market. The SmartCredit.io optimizer uses them because they provide clean sector-level diversification, reducing concentration risk while maintaining meaningful exposure to different parts of the crypto economy.

Are CoinGecko categories directly investable?

No. Unlike an ETF, there is no product that directly tracks a CoinGecko category. To implement the optimizer’s allocation weights, you need to select representative tokens within each category and purchase them manually in the recommended proportions. The optimizer tells you the optimal category weights; you choose which specific tokens to hold within each category.

What is the difference between Sharpe Ratio and Sortino Ratio?

Both measure risk-adjusted return, but they differ in how they define risk. The Sharpe Ratio divides excess return by total volatility — both upside and downside price swings count as “risk.” The Sortino Ratio divides excess return only by downside volatility — only negative swings count as risk, ignoring positive surprises. For crypto portfolios, the Sortino Ratio is often more informative because it doesn’t penalize portfolios for rising sharply.

How often should I rebalance a Markowitz-optimized crypto portfolio?

Monthly or quarterly rebalancing captures most of the benefit for most investors. The key triggers are: (1) calendar-based — rebalance every 30 or 90 days regardless of drift, or (2) threshold-based — rebalance whenever any category drifts more than 5 percentage points from its target weight. During high-volatility market regimes, more frequent rebalancing is advisable. The SmartCredit.io optimizer makes it practical to regenerate optimal weights in seconds, so calendar-based monthly rebalancing is easy to implement.

What is the “interest bearing portfolio” optimization?

When you ask the optimizer to create an “interest bearing” portfolio, it constrains the universe to CoinGecko categories where the underlying protocols generate ongoing yield — DeFi lending, liquid staking, yield aggregators, and similar. It then applies Markowitz optimization to find the allocation that maximises risk-adjusted yield (income return) rather than pure price appreciation. This is ideal for investors who want their portfolio to generate income regardless of market direction.

How do I implement the portfolio on SmartCredit.io?

After generating your optimized allocation weights, you can deploy your holdings on SmartCredit.io in several ways: lend your crypto assets to earn fixed-rate returns of up to 18% APY, or use your holdings as collateral to borrow stablecoins at fixed rates for liquidity without selling. SmartCredit.io’s peer-to-peer model locks your rate at origination — unlike Aave or Compound where rates can spike unpredictably. No KYC, non-custodial, up to 90% LTV.

The SmartCredit.io AI Portfolio Optimizer is free to use. Generate your Markowitz-optimized allocation in seconds, understand your Sharpe Ratio and Sortino Ratio, and implement your strategy with fixed-rate income on SmartCredit.io.

Open the Portfolio Optimizer в†’ Borrow or Lend on SmartCredit.io в†’

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry substantial risk including potential loss of principal. Past performance of any category, portfolio, or optimization model does not guarantee future results. Always conduct your own research and consult a qualified financial advisor before making investment decisions.