In the blink of an eye, we went from paper bills and purses to Bitcoins and digital wallets.

The virtual realm of DeFi and cryptocurrency has gained momentum over the last decade. Millions of users access blockchain wallets each day, exchanging crypto tokens and other forms of digital assets. It’s estimated that over 100 million people are using cryptocurrencies around the world.

But, before you jump in on the action, you’re going to want to learn a bit about industry terms and the economics of cryptocurrency, including tokenomics.

What is tokenomics?

Tokenomics, in a nutshell, is the study of supply and demand between goods and services that have been tokenized. Having a basic understanding of tokenomics and decentralized finance (DeFi) is beneficial to leveraging blockchain and becoming a savvy crypto investor.

If you are ready to go from a no-coiner to a HODLer, this beginner’s guide to tokenomics is a great place to start.

What Is a Token?

Before you can answer what is tokenomics, you need to know what a token is.

Tokens, in general, are used to symbolize something else. For example, you may have a card that represents you are a member at a bookstore, which means you received discounts on products and other perks. The card is the token. Membership is the thing of value.

In the world of cryptocurrency, a crypto token represents an asset or utility. Tokens can be used to represent anything from money to abstract assets, such as votes or identities.

Crypto tokens are issued by companies, linking them to a particular platform or project. They occupy an existing blockchain network and are managed by smart contracts.

So tokens are a form of cryptocurrency that represents a thing’s value. How value is determined is part of tokenomics.

Tokens are not to be mistaken with crypto coins, which are solely used to make purchases. Essentially, crypto tokens can represent the value of several crypto coins.

What Is Blockchain?

Blockchain is the digital system that houses records of financial transactions. These records can be used and shared publicly in a decentralized access network.

Not only is blockchain where these records reside, but it is the technology behind virtual currency. Transactions are recorded with a fixed cryptographic signature, which enhances ledger security.

What Is Tokenomics?

So, now that you have a very basic understanding of what a token is, who issues them, and how they are managed, let’s dive in a little deeper into tokenomics.

Every token has its own unique “token economics”, or as it is better known, tokenomics. Firstly, tokens are subcategorized into fungible and non-fungible assets or utilities.

Fungible Assets

When you are referring to an asset or utility as having fungibility, it is to say that it has the ability to be exchanged. Fungibility denotes equal value between tradable assets.

An example of a fungible asset outside of crypto space is paper money. A dollar bill can be traded for four quarters. The specifications of the two assets must be identical.

Non-Fungible Assets

A non-fungible token (NFT) is an asset that is unique. There is nothing of equal value that it can be traded for. These assets are exclusive to rare items and collectibles.

NFTs are worth whatever amount someone is willing to pay for it. In 2017, a virtual game was developed called “CryptoKitties”, which first introduced the concept of NFTs by tokenizing in-game assets, such as digital swords and shields.

The Token Ecosystem

The value of a token is determined by several factors. Those factors are what make up the token ecosystem.

A token ecosystem works in a certain flow:

- Tokens can be used to transfer value between business partners within the ecosystem in utilities or securities

- The use of tokens can motivate people to use certain services managed by the blockchain

- Tokens empower a community, whereby the greater number of users, the greater the value of the assets, through early incentives

- Issued tokens serve to finance the supplier

Utility Tokens

Utility tokens, also known as app coins, are tokens created by a company as a digital coupon of sorts. These are given out as a company incentive during crowdfunding efforts when establishing an ICO (initial coin offering).

Security Tokens

A security token is the equivalent of a bond, equity, or derivative in a traditional investment setting. They are created as investments and are subject to federal regulations.

To understand the tokenomics behind a token and its respective ecosystem, you must also consider various elements that drive supply and demand. These are things like the people behind the project or platform (are they reputable?), distribution, PR and branding, & the business model.

Opportunity Awaits

While investing in the cryptocurrency market is considered high-risk, trends reflect that it’s here to stay. More companies have jumped on board, too, allowing customers to pay for products and services with digital cash.

Educating yourself about the economics of cryptocurrency and tokenomics is a responsible move. The more you know, the more shrewd of an investor you can become.

So, the next time you hear someone ask, “What is tokenomics?”, you can let them know its fundamentals for becoming profitable in the crypto space.

Simple enough?

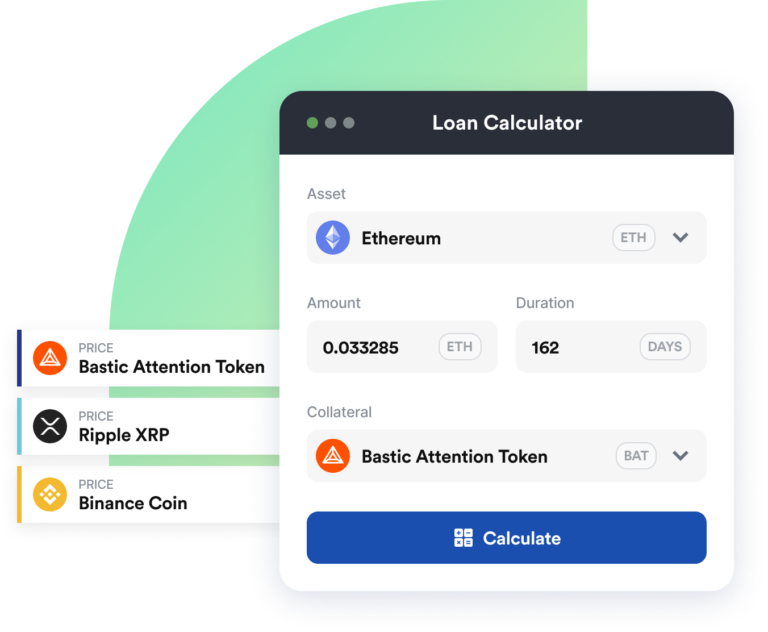

If you’re ready to take your knowledge to the next level and apply it, how about learning more about crypto lending and the ways you can earn interest on your digital assets?

Join the SmartCredit community and get rewarded today!