We presented at the Blockercon Conference in Bristol in June 2019 our favorite topic – Crypto Credit-Money – Why do we need it?

Presentation

Here are the Slideshare slides of this presentation.

Credit-money creation with SmartCredit.io

SmartCredit.io application shows in real life how to create a decentral crypto credit-money:

- Decentral credit-money is created in the same way, as it has been created in the last 5’000 years – via the lending process

- And it’s destroyed in the same way, as it has been done in the last 5’000 years – via payments of principal and interest in the lending process.

Everything is the same, as it was for thousands of years – but this time it’s empowered by Blockchain.

How does credit-money creation work today?

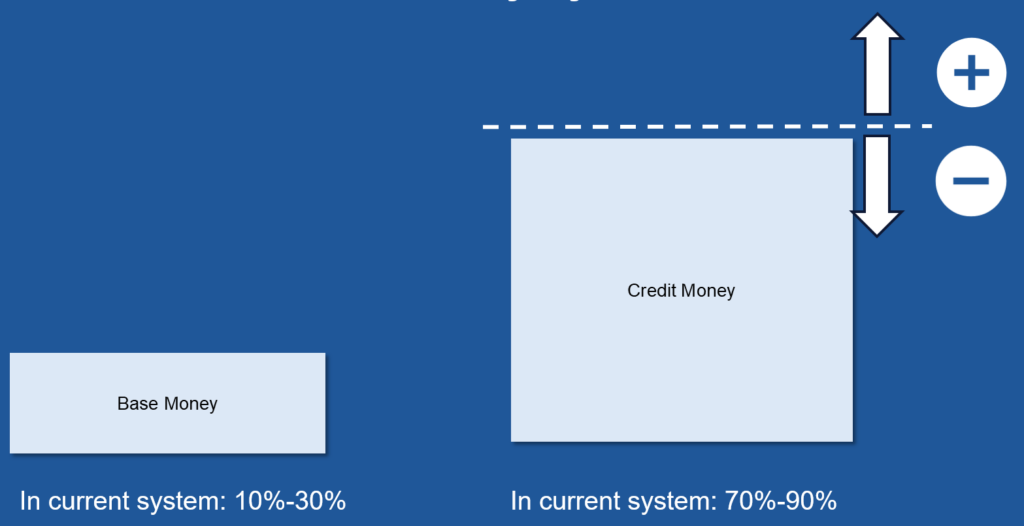

Every monetary system in the last 5’000 years had the base-money and credit-money. Base-money is durable and credit-money is continuously created and destroyed. We can consider the 1971 gold Bixon de-coupling as the start of our current monetary system – the central banks can create an unlimited amount of the base-money. And the commercial banks can create on top of this un-limited amount of the credit-money.

The following chart visualizes base-money and credit-money. The credit-money is elastic, the amount is growing and declining (but in reality continuously increasing). The amount of base-money is growing too, especially after the Quantitative Easing.

The key idea of the credit-money is to be pulsating – the amount of credit money grows with the growing economic activity and declines with the declining economic activity. In our current monetary system, the amount of credit-money is continuously growing. This is so by the design of the current monetary system. However, before our current monetary system the credit-money was pulsating, as visualized on the following chart:

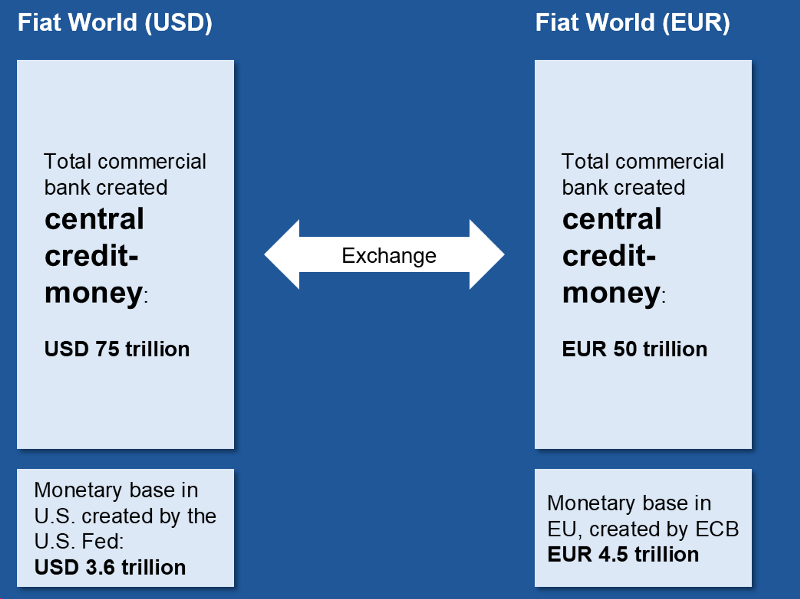

We call this monetary system a central credit-money system because the credit-money is standardized – it does not matter which commercial bank is creating the credit-money – it’s always the same type of money. It’s protected by the deposit insurance and the central banks (which will recapitalize the failing banks or merge them with the other banks):

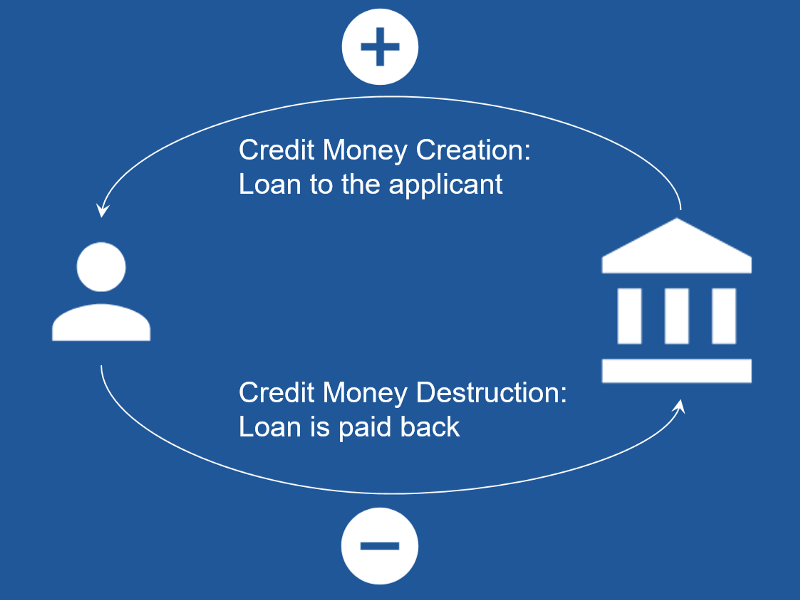

Commercial banks create the credit-money in the lending process and they destroy the credit-money in the lending process too. Credit-money is continuously created and destroyed. However, as banks create continuously more credit-money than they destroy, then the amount of the credit-money is continuously growing.

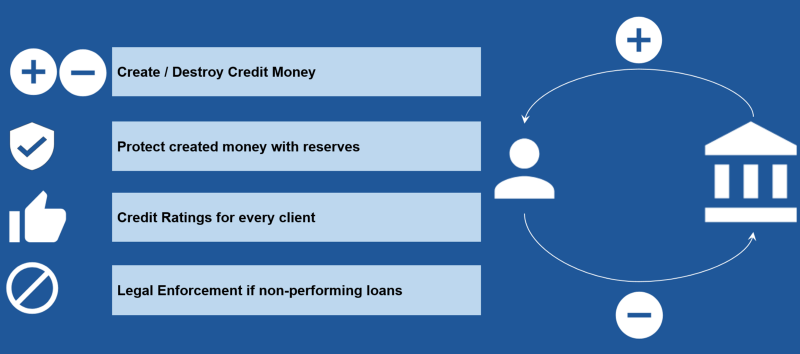

The following figure describes the key functions of the commercial banks in the credit money creation:

- Creation/Destruction of the credit-money

- Protecting credit-money with the reserves

- Credit scores for every client (the ones with good credit scores have better conditions and vice versa)

- Legal Enforcement for the non-performing loans

Today’s banks earn high profits from credit-money creation, it’s called seigniorage. It is estimated to be 3% of the loan principal. Now, let’s imagine this seigniorage will not belong to the selected view (commercial banks), but it will be distributed via decentral lending into the society. Just imagine what would be the effect of this for the wealth distribution in society. And let’s think that the way the monetary system works is one of the reasons for the inequality (see more in the article Why do we have inequality? ).

Decentral credit-money creation

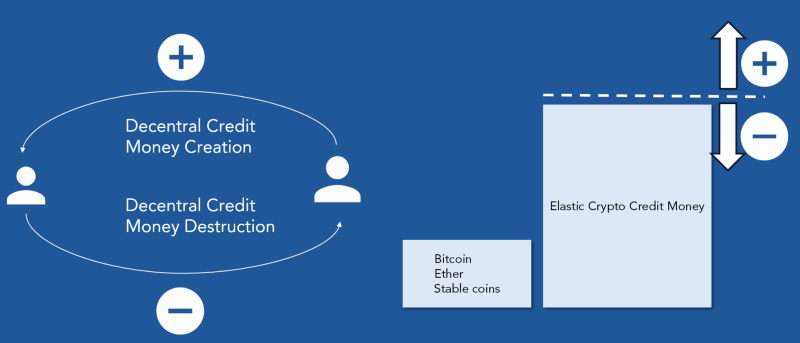

Credit-money has been created for thousands of years decentrally. And it can be created as well decentrally in the crypto economy:

- Decentral credit-money creation via taking the loan

- Decentral credit-money destruction via paying back the loan

- Bitcoin, Ethereum, and Stable-coins serve as base-money

- This will result in the elastic supply of the crypto credit-money

One needs to mirror the key capabilities of the commercial banks decentrally and one will be able to create decentral credit-money for the crypto economy. That’s what SmartCredit.io is doing.

SmartCredit.io Approach

SmartCredit.io is focusing on the following two key elements in the credit-money creation:

- The low collateral ratio for the borrowers – this means borrowers can borrow on SmartCredit.io 2x – 3x more on the same asset basis compared to the competitors. The crypto lending market is driven by the borrowers, the lenders will follow the borrowers (and not vice versa)

- Transferability of the loans for the lenders – lenders will receive the Credit-Coins (ccDAI, ccETH, etc) for their loans. These Credit-Coins are the credit-money – lenders can pay with them third parties or they can just wait and earn interest. on their Credit-Coins. The Credit-coins are interest-bearing as well – that’s the big difference to today’s central credit-money, which is not interest-bearing