Bitcoin is a digital currency that enables instant payments to anyone and anywhere in the world. But how much should the Bitcoin price be?

There are many differences between the Bitcoin and the other currencies:

- Other currencies are issued by Central Banks and have the role of legal tender. Bitcoins are issued de-centrally; there is no Central Bank, and they are not legal tender.

- Other currencies have some physical representations (bills). Bitcoin exists only digitally.

- Other currencies have central authorities. Bitcoin has no central authority; validation of transactions is done from Bitcoin Network.

- The Monetary Base of other Currencies is continuously increased, which translates into inflation in the long term. But in Bitcoin Network will contain only 21 Million Bitcoins (the smallest transferable unit being 0.00000001 Bitcoins), which translates into deflation in the long term.

Bitcoin is based on a combination of several existing technologies:

- Peer to Peer Systems (like BitTorrent)

- Private / Public key Cryptography

- Application of this combination for creating a currency

First Private / Public key cryptography algorithms were published in 1977. The first famous Peer-to-Peer system was Napster, published in 1999. However, it took till 2008 when Satoshi Nakamoto (pseudonym) connected peer to peer systems with state of the art cryptography to create the first cryptocurrency — Bitcoin.

Bitcoin has properties of currency — it’s unit of account; it’s portable, durable, divisible and fungible. However, Bitcoins are much more just as a simple currency. Satoshi’s ideas went much further — Bitcoin Network is a means to describe economic contracts and transactions between the participants of the Network. Additionally, the distributed storage of transactions (Blockchain in Bitcoin terminology) can be considered as a public general ledger, but not only simple payment transactions but many more complex economic contracts can be stored and easily distributed/published to any node of the network.

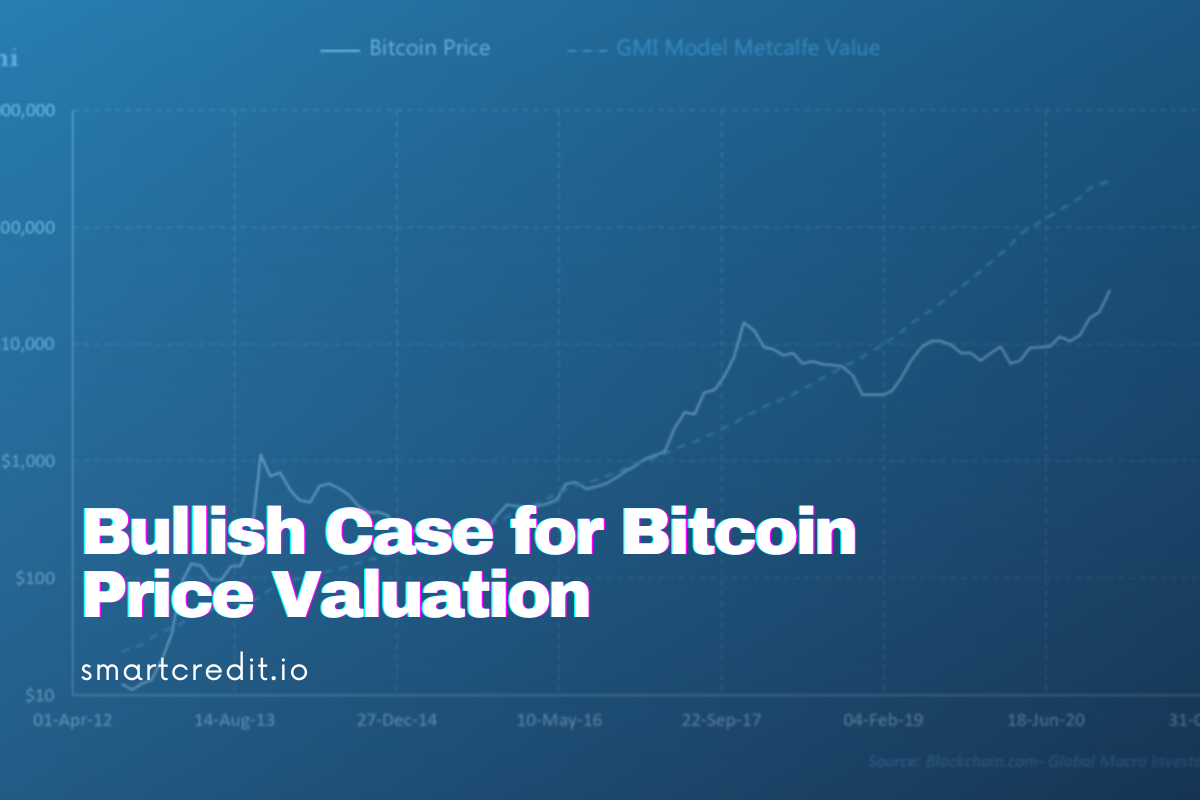

Bitcoin price development from Aug 2010 till Jan 2014 is described on the following graph. It follows a linear trend on the logarithmic graph.

There have been several price corrections, which have received quite some media attention:

- In 2011 from 31 to 2 USD per BTC

- In 2013 from 266 to 50 USD per BTC

- In 2013 from 1242 to 455 USD per BTC

However, we hardly recognize these price corrections on the logarithmic scale.

Will this logarithmic growth continue? Where will be the price of one Bitcoin in one year? How to calculate the fair value of Bitcoin? This article evaluates approaches for Bitcoin valuation.

Bitcoin Network has currently 2’400’000 addresses. One person can have more than one address.

The value of the network is not growing linearly but in the square with the growth of network members (Metcalfe’s law). I.e. if we have 2 times more participants, then the value of the network grows 4 times; if we have 10 times more participants, then the value of the network grows 100 times, and so on.

Currently, the network grows by 7000–8000 addresses per day. If we assume the same constant growth for the year, then the number of addresses will double this year, implying the value of Bitcoin Network will grow 4 times this year.

As we are speaking of ca 2 million people using the network then we are still in the early phases of the Bitcoin Network development. It can be compared to the “pre-Mosaic browser” phase of the Internet — there were many enthusiasts on the Internet, but most of them were “techies”. The breakthrough happened when Netscape introduced the Mosaic Browser. The rest is history.

There are several discussions about the intrinsic value of the Bitcoin Network. One side has the opinion that Bitcoin Network does not have any intrinsic value; the other side has the opinion that there is high intrinsic value.

Bitcoin Network is like an Internet network. It’s not the Internet that has the value, but its diverse products and services on top of the Internet network, which creates the value of the Internet. It’s the same with Bitcoin Network — it’s the products and services on top of Bitcoin Network, which create value for Bitcoins.

The most exposed intrinsic value is the Bitcoin Network as a Payment Processor:

- Bitcoin Network allows instant Bitcoin transfers between any locations in the world practically at no cost.

- The service fees of Payment processors (Visa, Mastercard, Paypal) will become obsolete

- Micropayments worldwide will be supported; mobile payments worldwide will be supported too.

The additional intrinsic value of Bitcoin Network is the “base money” functionality and “value-added services”.

Bitcoin enables payments just in time between any countries in the world it practically no fees. Bitcoin is the current 9th biggest payment processor worldwide. Additional adoption of the Bitcoin Network will result in reduced demand for the services of companies like Visa, Mastercard, or Western Union.

Visa’s market capitalization is 140 B USD, Mastercard’s capitalization is 100 B USD, and Western Union is 9 B USD.

Let’s assume the total market cap of these payment processors is 250 B USD, If Bitcoin Network would replace 1/3 of their businesses, then this result in the price of 3929 USD per BTC.

Payment Processors total Market Capitalization (in B USD) 250

Substitution ratio with Bitcoins 33%

Total Bitcoin Network Valuation (in B USD) 82.5

Final Number of Bitcoins (in B USD) 21'000'000

Value per 1 BTC (in USD) 3'929

Bitcoin can be considered as “base money”, it can be considered as gold — “crypto gold” in this case. One way to value Bitcoins is to compare the money supply of Bitcoins to the U.S. money supply.

The current market capitalization of Bitcoins is 12 B USD. The current monetary base of the U.S. is 4’000 B USD.

If Bitcoins would substitute U.S. monetary base, then their value should increase 4’000 / 12 times. However, let’s assume 10% of the US monetary base will be substituted with Bitcoins. The money velocity of Bitcoins is much higher (let’s say 10 times higher than the velocity of fiat money); this would reduce the demand for the Bitcoin base money. This would result in the following valuation:

U.S. Base Money (in B USD) 4'000

Substitution ratio with Bitcoins 10%

Increase in money velocity (in times) 10

Total Bitcoin Network Valuation (in B USD) 40

Final number of Bitcoins 21'000'000

Value per 1 BTC (in USD) 1'905

However, Bitcoin is not a national currency; it’s a supra-national currency. If we repeat the same exercise for the world monetary base and if we use the substitution ratio of 5% then we get the following valuation:

World Base Money (in B USD) 26'903

Substitution ratio with Bitcoins 5%

Increase in money velocity (in times) 10

Total Bitcoin Network Valuation (in B USD) 135

Final number of Bitcoins 21'000'000

Value per 1 BTC (in USD) 6'405

Levers for valuation:

- The higher the substitution ratio of base money, the higher the valuation.

- The higher the Bitcoin velocity, the less demand for Bitcoin base money, resulting in lower valuation

- The more QE, the higher price per Bitcoin

Bitcoin is not only a payment mechanism; it allows building a stack of additional services and products on top of the Bitcoin protocol.

It’s the same as the Internet — what started initially as simple web browsing with Netscape Browser, developed into Google search and Web 2.0 — Facebook, LinkedIn, and Twitter. All these products are based on an Internet stack. However, it took 10+ years, till these Web 2.0 products emerged.

Bitcoin protocol allows moving asset ownerships into the Bitcoin network — for example share registries and custody solutions can be implemented as part of the Bitcoin network. Ownerships of any assets (real estate, shares, and cars) can be stored in the Bitcoin network. Most public registries will become obsolete as all this information can be mapped into the Bitcoin network.

We are still in the very early phase of Bitcoin adoption; we are in the “pre-Mosaic Browser” phase. We can expect many new applications on top of the Bitcoin network — in the same way as it happened with the Internet network. However, we are not able to quantify the value of these additional services. We just say — there will be many additional services.

We looked at three valuation approaches. All of them are complementary.

Ergo Bitcoin valuation is:

Bitcoin as Payment Processor 3'929

Bitcoin as Base Money 6'405

Bitcoin as Additional Services NA

Value per 1 BTC (in USD) > 10'334

We foresee continuing network growth (based on Metcalfe’s law) and we foresee the significant potential for Bitcoin price appreciation.

We recommend allocating part of alternate assets in investment portfolios into Bitcoins.

(This article was first published in Swiss CFA Society Magazine 2014 January Edition)

- Bitcoin live market data: https://www.tradingview.com/x/0JIHqWR4/

- Bitcoin Wiki: https://en.bitcoin.it/wiki/Main_Page

- The daily transaction volume of payment networks: http://www.coinometrics.com/bitcoin/btix

- Monetary base of national economies: http://www.coinometrics.com/bitcoin/bmix

- Exchange volume comparison by Currency: http://bitcoincharts.com/charts/volumepie/

- Bitcoin and Digital Banking 2.0

- A bullish case for Bitcoin price valuation 2.0

- How will the Bitcoin halving impact Bitcoin price and crypto markets?

- Bitcoin and upcoming recession