How to disintermediate the banks – here is our talk from the CryptoFin Conference from October 2019 in Tallinn and additional explanations:

Here is the talk:

Key components of the traditional banking

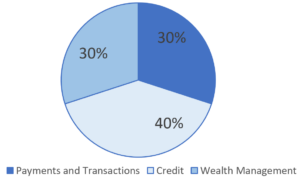

Universal banks are earning their revenues via:

- Payments and Transactions – that’s the money payments and asset transactions (buying/selling)

- Credit and Loans – that is the money given as loans to the businesses, consumers, and financial companies

- Wealth Management – that’s the service named as asset management for the wealthy individuals

The income ratio’s from these key segments are more or less like following:

If we want to disintermediate the banks, then we have to disintermediate the key functions of the banks, one by one.

Payments and Transactions

Banks are charging for doing the payments, either directly or indirectly. Banks are charging for doing the asset transactions (keeping assets in the safekeeping accounts, moving assets from one safekeeping account to another safekeeping account, buying assets, or selling assets). However, these transactions are nearly free in the Blockchain.

However, what is required is more asset tokenization. The more financial assets and real-world assets can be added to the blockchain, the more transactions can be handled via the Blockchain, too. Asset tokenization is related to the regulatory frameworks – some jurisdictions accept putting the “claims to the assets” to the Blockchain and accept the ownership transfers of these claims. However, real asset tokenization should go one step further – the primary source of the ownership records should be on the blockchain.

What does this mean? Bitcoin is a digital asset, which does exist only on the Blockchain. Let’s look at the company shares – they exist usually in the share registries, usually in the digital form. It is possible to create the claims to these digital forms and to transfer the claims on the blockchain from one address to another address. However, the initial digital forms of the assets should be stored on the Blockchain – so that the asset transfers would be with the primary assets and not with the claims.

Credit and Loans

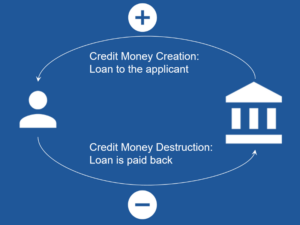

Banks lend money and they create /destroy money in this lending process. Every time a bank issues a loan, the credit-money is created. Every time when the borrower pays back the loan, the credit-money is destroyed. 90% of the total money is created via commercial bank lending, and all money on our electronic bank accounts is created via bank lending.

The equivalent of the traditional banking credit-money is required on the Blockchain, however; Blockchain-based credit-money is in the baby-steps. Practically all crypto lending systems are doing borrowing crypto or fiat against the crypto collateral. However, if we want to get real credit-money, then we need the transferability and tokenization of the crypto loans.

The following chart visualizes the decentral crypto credit-money. The Bitcoin and Ethereum would be used as a base-money. The lending process would create/destroy decentral credit-money:

SmartCredit.io is one of the very few systems, which offers decentral crypto credit-money. It works as following:

- Lenders receive for their loans the credit-coins, which are transferable

- Lenders can pay 3rd parties with these credit-coins

- Credit-coins will be replaced at the end of the loan with the underlying and with the interest

Wealth Management

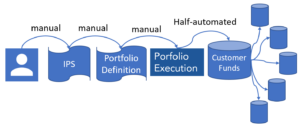

Wealth management has the following steps:

- IPS (Investment Policy Statement) creation

- Portfolio Definition

- Portfolio Execution

Most of these steps are performed manually in the traditional wealth management. Parts of the Portfolio Execution are automated.

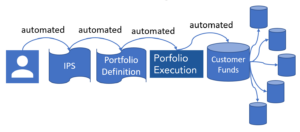

Blockchain-based banking requires automation of all these steps – Investment Policy Statements will be created via the automated questionnaires and psychometric profiles. Portfolio Definition and Portfolio Execution will be automated. This results in automated wealth management:

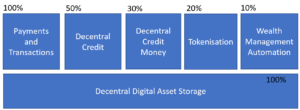

Decentral Bank Architecture

By disintermediating the key functions of the banks we will arrive at the “Decentral Bank Architecture”. The following image shows the key components of a Decentral Bank and their completion ratios.

This picture is the answer to the key question of this presentation.

How to disintermediate the banks?

Traditional banking disintermediation requires disintermediation of all key functions of the banks:

- Payments and Transactions

- Credit and credit-money creation

- Wealth Management

The following capabilities are required on the blockchain for this:

- Decentral Asset storage on the Blockchain – completed!

- Payments and Transactions on the Blockchain – completed!

- Decentral Credit Peer-to-Peer Crypto Lending Platforms – initial versions are there, more to follow

- Decentral Credit Money – initial versions are created and SmartCredit.io is adding new capabilities here

- Tokenization of the financial assets and real-world assets

- Wealth Management Automation

Having all these components means that the traditional banks and the central banks will not be required anymore. People would control their assets on the Blockchain and people would have their financial transactions via Blockchain-based solutions.

The key to the traditional banking disintermediation at the current stage is:

- More tokenization of the financial assets and real-world assets

- Crypto credit-money

- Wealth management automation