How will crypto and the Blockchain impact banks, what will happen to the banks in the future, will cryptocurrency replace banks?

Let’s find out!

Many banks are participating in a range of Blockchain consortia and are looking for ways to apply Blockchain technologies to improve their internal processing. Here, the approach is to essentially carry on “business as usual” but achieve efficiency gains. Banks can increase their effectiveness with the help of Blockchain technologies.

Crypto Impact on Banking

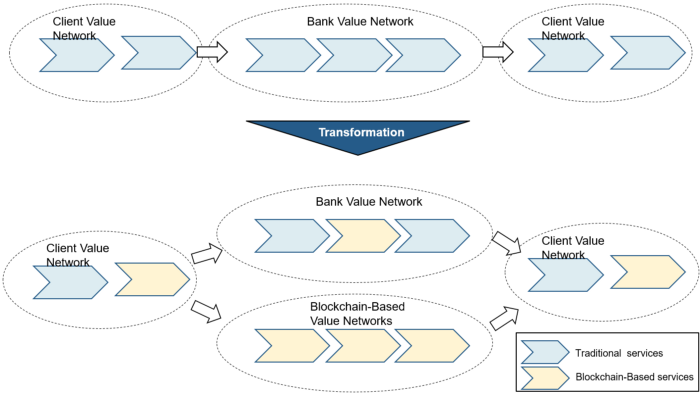

The changing ecosystem means that client will get service alternatives. Clients will receive Blockchain-based service alternatives and require fewer traditional banking services for their value networks.

In current value networks, clients have very much been tied to their banks. The cost of changing a banking relationship is relatively high, and this has made it quite easy for banks to generate revenue. The changes facing value networks will significantly reduce exit costs for clients, while the cost models of banks will become more transparent. Clients will be able to switch easily between financial services providers and select the best fit for their needs.

The following figure visualizes this change to value networks. As discussed, banks lie in the center of clients’ value networks at present. But as alternative blockchain-based services emerge, clients will start to use these alternatives, thereby they will reduce their dependency on banks.

This results in a revenue decline of the banks. But how big is this impact and what will be the timeline of this impact?

This analysis looks on:

- How are banks generating revenues at the moment?

- How will Blockchain-based business models will disintermediate banking revenues?

- What will be the timeline of this transformation?

How do banks generate revenue?

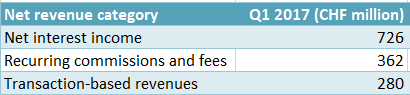

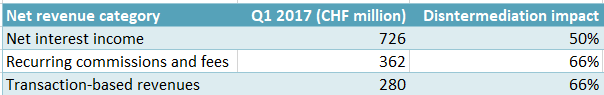

Let us evaluate the key components of banking revenue based on the Swiss unit of Credit Suisse. This division encompasses retail banking (for clients domiciled in Switzerland), private banking (wealth management), and commercial banking (one-third of companies in Switzerland maintain a banking relationship with Credit Suisse).

The revenue figures are publicly available in the investor section of the Credit Suisse website. Here are the revenues for the first quarter of 2017:

The key components of banking revenue are as follows:

- Net interest income

- Recurring commissions and fees

- Transaction revenues

Net Interest Income

This refers to the revenue from money lending. At this point, we will not discuss the degree to which banks lend depositors’ funds or create new money during the lending process. However, we can assume that approximately 97 percent of electronic money in Switzerland is created by commercial banks during the lending process; the other 3 percent is created by the Swiss Central Bank.

Lending incurs a cost to banks; reserve ratios have to be applied, parts of loans have to be covered by core capital and/or high-grade capital instruments, high-grade financial instruments, and so on. These guidelines are defined by the regulator and are binding for the banks. Thus, although banks create money in the lending process, this money creation is not free for the banks. There are costs associated with lending money which are determined by banking regulations and capital markets.

Now let us return to net interest income: It comprises the difference between the price of money which the clients pay and the cost of lending. This is the category in which banks generate most of their revenues (assuming client risks are properly assessed). If the economy is booming, there is more money creation and more revenue in this category. In the event of an economic slump, the reverse is true.

Recurring commissions and fees

These concern the revenues raised from custodial accounts, banking packages as well as portfolio management fees. Banks love recurring revenue, following the idea of “sell once, collect revenue over many years”. As the exit costs for clients are relatively high, clients are locked in, thereby providing a stable stream of revenue for banks with relatively low maintenance costs.

Transaction revenues

Transaction revenues refer to payment fees, fees for buying and selling shares, mutual funds, and ETFs. Essentially, these fees are connected with either the business or investment activity of bank clients.

Banks Revenue disintermediation through blockchain business models

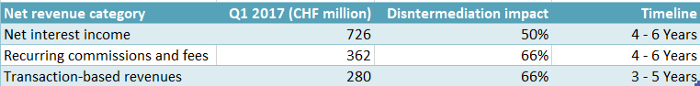

Net interest income will be substituted by smart contracts. In this scenario, clients would not need a bank. Lending would be conducted using automated lending facilities. However, some lending is performed based on advice, and this advice-based revenue will remain available to banks. Nonetheless, this would only account for a small part of net interest income. We estimate a conservative level of around 50-percent revenue disintermediation in this respect.

In the case of recurring services, clients will hold their assets as digital tokens on Blockchains, rather than in custodial bank accounts. Banking packages will not be required, as they will be replaced with Blockchain-based products (the cost of which is close to zero). Only advice-based services will continue to generate revenue for the banks. In this context, our conservative estimate is a degree of revenue disintermediation amounting to two thirds.

Transaction revenues for payments and trading will reduce significantly. Clients will no longer need banks for these services. However, advice-based fees for complex transactions will remain unaffected. But again, this only represents a small part of current transaction revenues. Here, we conservatively estimate a degree of revenue disintermediation of around two thirds.

Advice-based services will remain intact. Most other services, however, could be replaced with blockchain-based smart contracts or digital tokens. The disintermediation impact is shown in the following table:

Timeframe for the impact of crypto on banks revenue

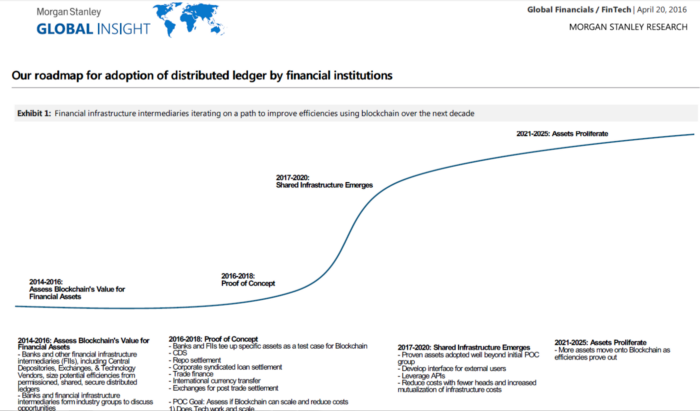

The timeframe of the change in value network can be expressed using an S-curve. JPMorgan published an S-curve in its assessment, which can be used as a basis for the analysis here.

The next three years will be used to establish and develop shared infrastructure (i.e. service-specific blockchain offers). The mass adoption of these new services will start after three years and this is also when the disintermediation of banking revenue will commence.

Transaction revenues: impact in 3–5 years.

This revenue position will be the first to be impacted by blockchain technologies. Transaction revenues are currently collected as payment fees or fees for trading securities; this will be disintermediated by blockchain-based solutions.

Recurring commissions and fees: impact in 4–6 years.

Infrastructure development could require more time here. For example, in the case of custodial services, we will also need a digital representation of financial assets.

Net interest income: impact in 4–6 years.

In this context, we need digital asset infrastructure as well as smart contract-based solutions for debt products.

Summary of crypto impact on the banks

Banks are currently focusing on using Blockchains to improve internal processes. However, as Blockchains will enable changes to client value networks, banks will have to prepare to lose significant portions of their revenue to new blockchain-based financial services providers. That’s how crypto will impact banks.

The following table shows the expected disintermediation impact and associated timeframe using the example of the Credit Suisse banking unit in Switzerland:

Banks will begin to lose revenue on basic transactions. Most of these services will be free, almost free, or subject to significantly lower service fees. Advice-based services will remain within the purview of banks; this includes portfolio management, risk management, and the management of special transactions and products. Indeed, these concern services where specialist expertise is required, and banks will still be required to offer them in the future.

Additional information

- Credit Suisse 2017 Q1 Results: https://www.credit-suisse.com/corporate/de/investor-relations/financial-and-regulatory-disclosures/annual-and-quarterly-reports/quarterly-reports.html

- How will blockchain disintermediation impact banking?

- Combining traditional finance with the crypto finance

- SmartCredit.io Application

- Top Crypto Lending Platforms for Fixed Income (Guide)

- Why Borrowers need Low Collateral Ratio?

- Blockchain-based financial system – Are we ready?