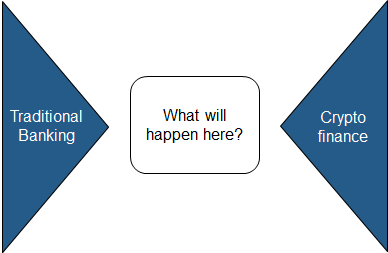

Crypto Finance is based on crypto assets. The traditional banking is based on fiat currencies. In the previous article and article, we looked at how traditional banking revenues will be intermediated with blockchain technologies and how the key banking processes will be impacted by blockchain disintermediation.

Now let’s consider the big question: How will traditional banking react to emerging crypto finance?

Strategic choices

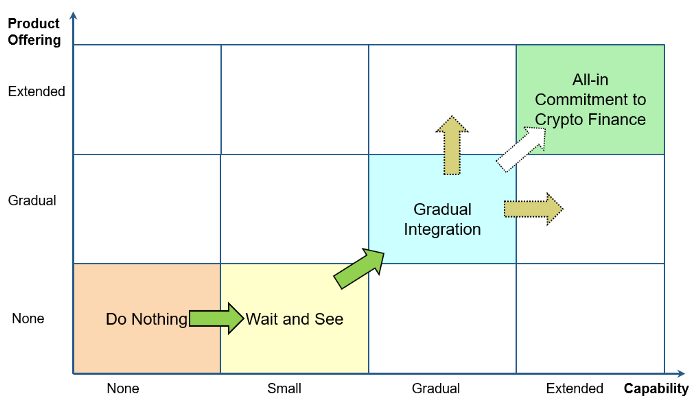

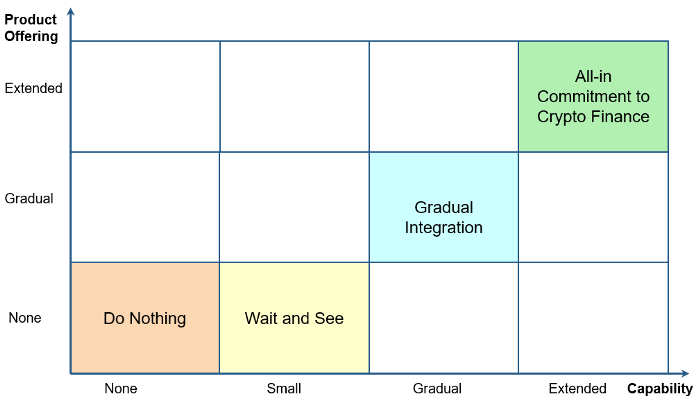

Four response strategies are possible and this article will explore these options in greater detail:

· Do nothing — continue to run the business without adjusting course

· Wait and see — monitor the situation on an ongoing basis and develop internal capabilities

· Gradual integration — try to selectively integrate crypto-finance products into traditional banking

· All-in commitment to crypto finance — shift fully to crypto finance

These strategies can be positioned on a product offering/capability matrix as follows. Here, the product offering dimension describes how advanced the crypto-product offering is, while the capability dimension indicates the degree to which advanced crypto-finance capabilities have been developed and are available to the banking organization:

This article will explore each of these strategies in further depth.

Strategy 1: Do nothing

This strategy involves taking no action at all. Essentially, it represents the delegation of decision-making on an active response strategy to a point in time in the future.

This response strategy can be considered concerning the client base of a given traditional bank:

- For private banking, i.e. the wealth management branch of traditional banking, most clients are found in the 50+ age group. All private banks have online banking channels, but usually, less than a third of the client base is using these online channels. It could be difficult to explain the benefits of crypto products to technology-adverse clients, which in turn would result in this strategic choice.

- However, retail banking is different. This branch of banking serves everyday needs; it’s about payments, credit cards, and small loans. These are the financial services that 95 percent of people regularly use. The retail client segment also has a greater affinity with technology. For this reason, it is possible to explain to them the benefits of crypto finance, including inexpensive and fast cross-border payments in the remittances, use case.

This is also associated with a “copycat” strategy. Sometimes it can be a good idea to let other banks make the first moves — to become the pioneers and also to make costly mistakes. This would allow others to learn from their mistakes and imitate successful strategies. Nonetheless, the total market capitalization of crypto-assets is approaching USD 150 billion; this market cannot remain ignored for much longer.

Strategy 2: Wait and see

An extension of the “do nothing” strategy would be the “wait and see” strategy. This entails monitoring the market, analyzing competitors’ strategies, and incrementally developing the internal know-how.

This offers a strategic option for traditional banks. If cryptocurrency adoption increases and if clients’ demand for crypto products grows, then a crypto offering can be developed on existing internal capabilities.

Implementing new products in traditional banking is relatively complicated and costly. However, if initial frameworks are already in place in traditional banks, this will result in smoother implementation.

Strategy 3: Gradual integration

Bridging the gap between the fiat and crypto world and developing these two sectors in concert is key to this strategy.

According to this strategy, crypto products are gradually integrated into the existing offering of respective banks. For instance, this could start with the following simple products:

- The topic of remittances is often discussed, but thus far this service has not been supported by traditional banks. The “cannibalization” of respective strategies is one reason for this. However, offering remittance products would enable banks to include additional client segments as well as profit from additional offerings beyond this segment, for example through credit card revenues.

- International fiat-crypto proxy accounts could be useful products for international companies. International companies need international banking accounts, but transferring funds between these accounts take time and incur considerable costs. These transfers could be accelerated while reducing the associated costs by using fiat-crypto proxies.

- Another example of possible products includes smart contract-based lending. Banks would earn revenue from the usual interest rate, but the additional margin on top of this interest rate would be almost zero since the operating costs of this form of lending would be eliminated. Corporate clients who use this lending facility would benefit from lower interest rates than usual (due to the eliminated margin).

- Investments products like funds for crypto assets are also conceivable. Because crypto-assets exhibit valuable performance characteristics as well as valuable volatility characteristics, they would represent a useful addition to the alternative assets category within client portfolios.

Examples of this strategy include:

-

- SwissQuote, a Swiss bank, is cooperating with the fiat/cryptocurrency exchange Bitstamp to offer its clients the possibility to trade directly with Bitcoin.

- Falcon Private Bank, likewise a Swiss bank, offers to its wealth management clients the possibility to invest in Bitcoin products.

So far, these are the first two examples in Switzerland — in a country with around 250+ regulated banks. We assume that additional banks will follow suit.

On the one hand, the banks can present themselves as innovative, and, on the other, they offer meaningful products to their clients, which also generates revenue for the banks. Banks can develop their internal capabilities for crypto-product offerings and achieve quite a competitive advantage in the process.

Strategy 4: All-in commitment to crypto finance

This would imply dropping traditional banking and converting the bank into a fully-fledged crypto institution that would offer the following products:

- Payments (already available in crypto finance)

- Custody (already available in crypto finance)

- Credit cards (already available in crypto finance)

- Lending (not yet fully established in crypto finance)

- Wealth management (not yet available in crypto finance)

At present, this strategy might be challenging for traditional banks, especially because of their current client base. Around 99 percent of clients do not own any crypto assets and those who do own crypto assets would rather not go through the traditional banking system.

However, since several key cornerstones of traditional banking are already available in crypto finance, we can anticipate that solutions for remaining areas will also be developed, which in turn would enable this “all-in” strategy.

Summary

The distribution of these strategies are currently as follows:

- Most financial institutions are currently pursuing the “do nothing” strategy

- A limited number of institutions are applying the “wait and see” strategy

- A very small number of institutions are following the “gradual integration” strategy

- The “all-in commitment to crypto finance” strategy cannot be observed currently

We can anticipate the following strategic moves towards increasing blockchain capabilities in traditional banking:

- Progression from the “do nothing” strategy to the “wait and see” strategy

- Progression from the “wait and see” strategy to the “gradual integration” strategy

It will probably take a while until the “all-in commitment to crypto finance” strategy is implemented. The main factor for this will be the mass adoption of crypto-assets. However, if this strategy is implemented, we will see the increasing erosion of traditional banking revenue.