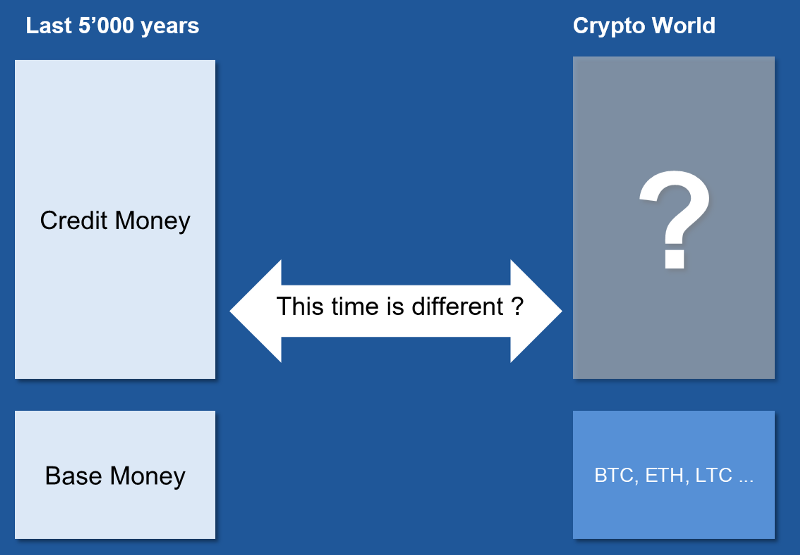

Credit money has existed for 5ÔÇÖ000 years ÔÇô will there be crypto credit money?

In the previous article, we looked at the two dimensions of moneyÔÇèÔÇöÔÇèbase-money and credit-money. We also looked at the different kinds of monetary systems that existed in the last 5ÔÇÖ000 years and possible scenarios for the future.

What will happen in the future? Will it be different this time? Will we enter a phase of crypto-based money without having some form of crypto-credit money or will credit money be included in the crypto sector?

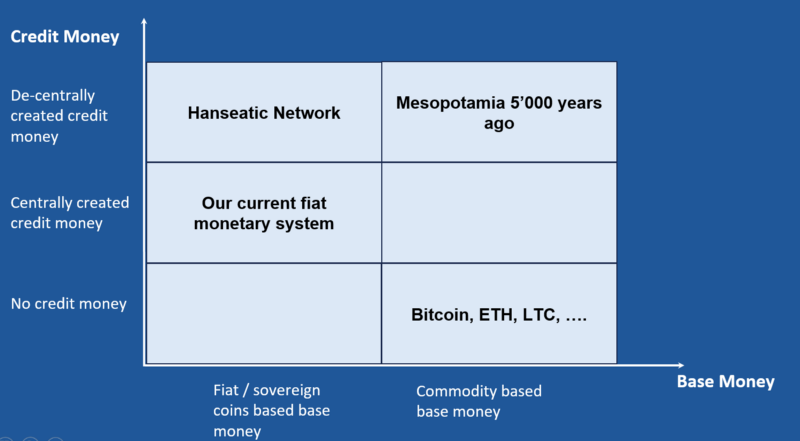

Classification

Here is the summary of the monetary systems from the last 5ÔÇÖ000 years on the matrix of credit-money versus base-money:

The first conclusion from the previous article is that monetary systems are not static, but are ever-evolving:

- The monetary system started with commodity-based money and decentralized credit money

- The next phase was sovereign coin-based money and decentralized credit money

- National based money followed (either from the sovereign or central bank) and private credit-money

- This was followed by our current central banking base-money and central credit-money system via the commercial banks

The second conclusion is that the decentralized credit money system has existed for thousands of years without central intermediaries.

How did decentral credit money work in the past?

As we are in the crypto age, letÔÇÖs analyze how decentralized credit systems worked in the past.

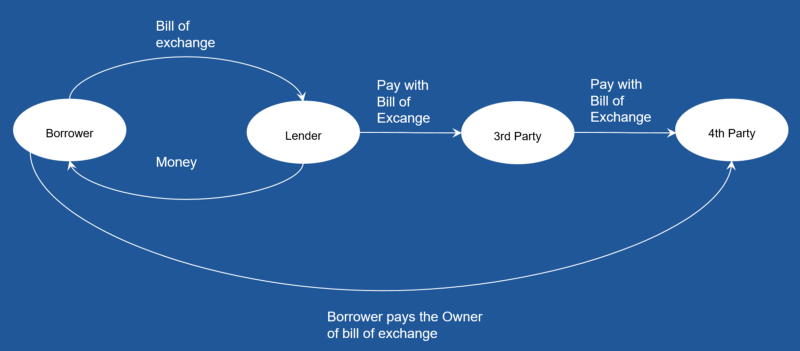

It was all based on the bill of exchangeÔÇèÔÇöÔÇèthese are legal documents enforced by the court system. Anyone can issue a bill of exchange, it has only 8 attributes, including the wet signature of the borrower. The borrower has to pay, not to the issuer, but the owner of the bill of exchange. This gives value to every bill of exchange as they are backed by the borrowerÔÇÖs obligation to pay. This allows the use of bills of exchange as a mean of payment:

Bills of exchange are enforced by the court systemÔÇèÔÇöÔÇèthere is no court hearing, but there is a validation of the evidence, analysis of who has to pay whom, and a court decision. It is as simple as that.

The bill of exchange system is a P2P system backed by the court system. Every lender can create new credit moneyÔÇèÔÇöÔÇèthe bills become the credit money, till they are paid back to the holder. One doesnÔÇÖt need banks to create the credit money, every person can do this via a bill of exchange.

This system works as well today, even without the blockchain. This system has been the basis of all decentralized credit money systems in the last 5ÔÇÖ000 years.

But there are limitations to this system:

- Wet signature has to be usedÔÇèÔÇöÔÇèdigital signatures are not accepted by the court system.

- Nominations of the bills were arbitraryÔÇèÔÇöÔÇètokenization was not possible.

- Periods on the bills of exchange were different.

- Insurance mechanisms were missing, except the strong support from the court system.

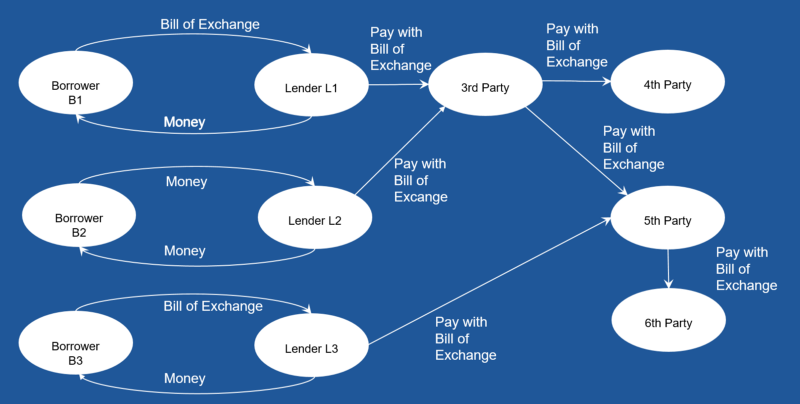

Bill of exchange networks could become arbitrarily complex, with multiple borrowers, lenders, and holders. But without central middlemen:

How could it work in the future

Here is a more detailed view of how it could work:

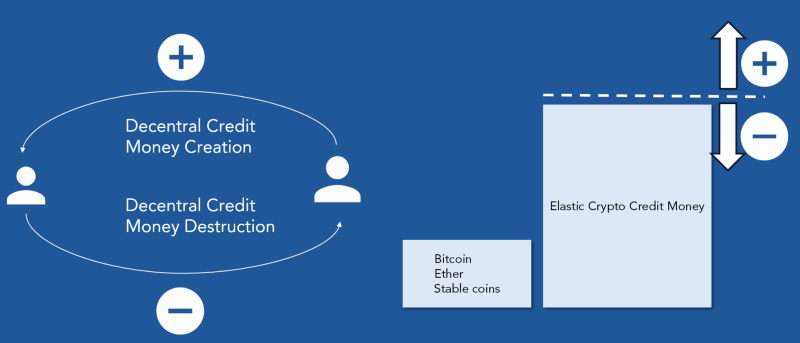

- Elastic crypto credit money is created in P2P borrowing/lending transactions.

- Elastic crypto credit money is destroyed when the loan time is finished.

- Bitcoin, Ether, and stable coins serve as base money.

- A pulsating supply of elastic crypto credit money is placed on top of the base money.

It would work very similar to the bill of the exchange system, but it has to address the weaknesses of the previous systems:

- Bills of exchange cannot be used because of wet signaturesÔÇèÔÇöÔÇèWe have to use standard contract law.

- Different nomination issuesÔÇèÔÇöÔÇèTokenization of loan obligations via standard ERC20 contracts.

- Different periods of the bills of exchangeÔÇèÔÇöÔÇèTokenization via standard ERC20 contracts help here.

- The insurance mechanism is missingÔÇèÔÇöÔÇèDecentralized insurance mechanism will be introduced.

Forecast

Our forecast for the future is the following:

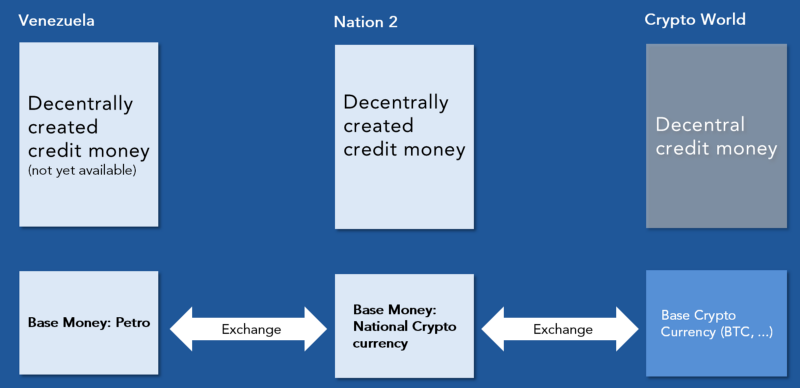

- There will be national crypto base-money like VenezuelaÔÇÖs Petro.

- There will be a decentrally created crypto credit-money on top of the national base money.

- In parallel, there will be a global base-money (BTC, ETH, ).

- In parallel, there will be a global decentralized credit-money.

This future does not depend on a central bank base money creation or commercial bank credit money creation. Instead, it will be an alternative financial system. However, it will not be fully new as it has existed for the last 5ÔÇÖ000 years already. Only this time it will be empowered by the blockchain.

Roadmap

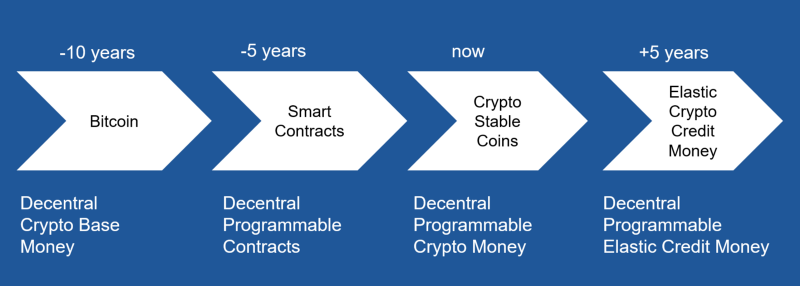

Our forecast roadmap:

- It all started 10 years ago with the creation of decentralized crypto-based moneyÔÇèÔÇöÔÇèBitcoin.

- 5 years ago, decentralized programmable smart contracts were added.

- Now we are in a phase where stablecoins are emerging.

- In 5 years, there will be decentralized elastic crypto credit money

Summary

This time will not be different, there will be crypto credit money as well. ItÔÇÖs not yet there, but it might be there faster than anyone is anticipating. For more info please have a look at other articles in our blog or on our YouTube channel with presentations and webinars.