вҡ пёҸ CRITICAL WARNING: Over $1.5 billion in cryptocurrency was liquidated in just 24 hours during the May 2022 market crash. DonвҖҷt let your crypto become part of the next liquidation wave. Learn how to protect your positions with the right collateral ratio.

The world of cryptocurrencies and digital assets often seems riddled with technical jargon and complex concepts. Among these, the idea of a вҖңCollateral RatioвҖқ stands out for its crucial role in the ecosystem вҖ“ and for good reason. Your collateral ratio can mean the difference between protecting your assets and losing everything to liquidation.

Comprehending the Collateral Ratio and its significance is paramount for anyone who wishes to navigate through the cryptosphere safely. This comprehensive guide will delve deep into the concept, show you exactly how to calculate and maintain a safe ratio, and provide you with actionable strategies to protect your DeFi positions from liquidation.

Defining Collateral Ratio

The Collateral Ratio (also called Loan-to-Value or LTV ratio) is a measure used to determine the percentage of a borrowerвҖҷs total value of collateral relative to the amount they wish to borrow. ItвҖҷs the single most important metric in crypto lending that determines whether your position is safe or at risk of liquidation.

ItвҖҷs calculated using the following formula:

Example Calculation:

- Collateral deposited: $15,000 in ETH

- Amount borrowed: $10,000 in USDC

- Collateral Ratio = ($15,000 / $10,000) Г— 100% = 150%

This ratio is essential as it signifies the financial soundness of a position in any lending or borrowing scenario, especially in the realm of decentralized finance (DeFi). A higher ratio means more safety buffer; a lower ratio means higher liquidation risk.

The Intricacies of the Collateral Ratio

In the context of DeFi and crypto lending platforms like SmartCredit.io, a user will typically over-collateralize their loans to maintain a secure position. This over-collateralization acts as a safety buffer against market volatility.

For instance, if you wish to borrow $1,000 worth of stablecoins, you might need to deposit collateral worth $1,500 in cryptocurrency (like ETH or BTC), resulting in a Collateral Ratio of 150%.

Why Over-Collateralization is Required

Over-collateralization protects both lenders and borrowers:

- For Lenders: Ensures they can recover their funds even if collateral value drops

- For Borrowers: Provides a safety buffer against market volatility

- For Platforms: Maintains system solvency and prevents bad debt

However, itвҖҷs essential to remember that the value of collateral and loans are calculated in real-time based on current market prices, and these values can fluctuate dramatically based on market conditions. A position thatвҖҷs safe at 9 AM could be at risk of liquidation by 9 PM during volatile markets.

Therefore, users must constantly monitor their collateral ratio to ensure they are not at risk of liquidation вҖ“ or better yet, use automated monitoring tools.

рҹ’Ў Pro Tip: Set up automated alerts that notify you when your collateral ratio drops below a safe threshold. SmartCredit.io offers smart alert systems that can save you from liquidation.

Why Does a 100% Collateral Ratio Matter?

A 100% Collateral Ratio is the critical threshold in DeFi вҖ“ itвҖҷs the line between safety and disaster. Understanding this benchmark is essential for protecting your crypto assets.

The 100% Threshold Explained

At exactly 100%, the value of your collateral equals the value of your outstanding loan. This is the absolute minimum before liquidation, but you should never let your ratio get this low.

HereвҖҷs what different ratio levels mean:

| Collateral Ratio | Status | Risk Level | Action Required |

|---|---|---|---|

| 200%+ | вң… Very Safe | Low Risk | Continue monitoring |

| 150-200% | вң… Safe | Moderate Risk | Monitor regularly |

| 120-150% | вҡ пёҸ Warning | Elevated Risk | Add collateral soon |

| 100-120% | рҹҡЁ Danger | High Risk | Add collateral NOW |

| Below 100% | вқҢ LIQUIDATION | Critical | Too late вҖ“ liquidated |

Understanding Under-Collateralization

If the Collateral Ratio falls below 100%, it signifies that the collateralвҖҷs value is less than the value of the loan. This state is called вҖҳunder-collateralizationвҖҷ and triggers automatic liquidation on most DeFi platforms.

Understanding Over-Collateralization

If the Collateral Ratio is above 100%, it means that the collateralвҖҷs value exceeds the outstanding loan value. This is referred to as вҖҳover-collateralizationвҖҷ and provides a safety buffer.

Keeping a Collateral Ratio at 100% or above is critical to avoid liquidation, which is the process where the borrowed assets are automatically sold to pay off the outstanding loan. This is an essential risk management protocol incorporated by most DeFi platforms to ensure that lenders do not lose their assets due to borrowers defaulting on repayments.

рҹӣЎпёҸ Protect Your Position with Automated Monitoring

Never worry about liquidation again

The Real Cost of Liquidation: What YouвҖҷll Lose

Liquidation isnвҖҷt just about losing your collateral вҖ“ itвҖҷs about losing significantly more than you might expect. HereвҖҷs what happens when you get liquidated:

Liquidation Penalties Explained

- Loss of Collateral: Your crypto assets are sold at market price

- Liquidation Fee: Most platforms charge 5-15% liquidation penalty

- Slippage Loss: Selling large amounts causes price impact

- Opportunity Cost: Missing out on future gains if market recovers

- Gas Fees: Transaction costs for the liquidation process

Real Example: LetвҖҷs say you deposited 10 ETH (worth $20,000) as collateral to borrow $15,000. If ETH drops 30% and triggers liquidation:

- Your 10 ETH is now worth $14,000

- Liquidation penalty (10%): -$1,400

- After repaying $15,000 loan and penalties: You lose everything

- Total loss: $20,000+ in original value

вҡ пёҸ REAL LIQUIDATION EVENT: During the March 2020 crash, MakerDAO experienced over $8.3 million in bad debt from liquidations. In May 2022, over $1.5 billion was liquidated across DeFi protocols in a single day. DonвҖҷt become a statistic.

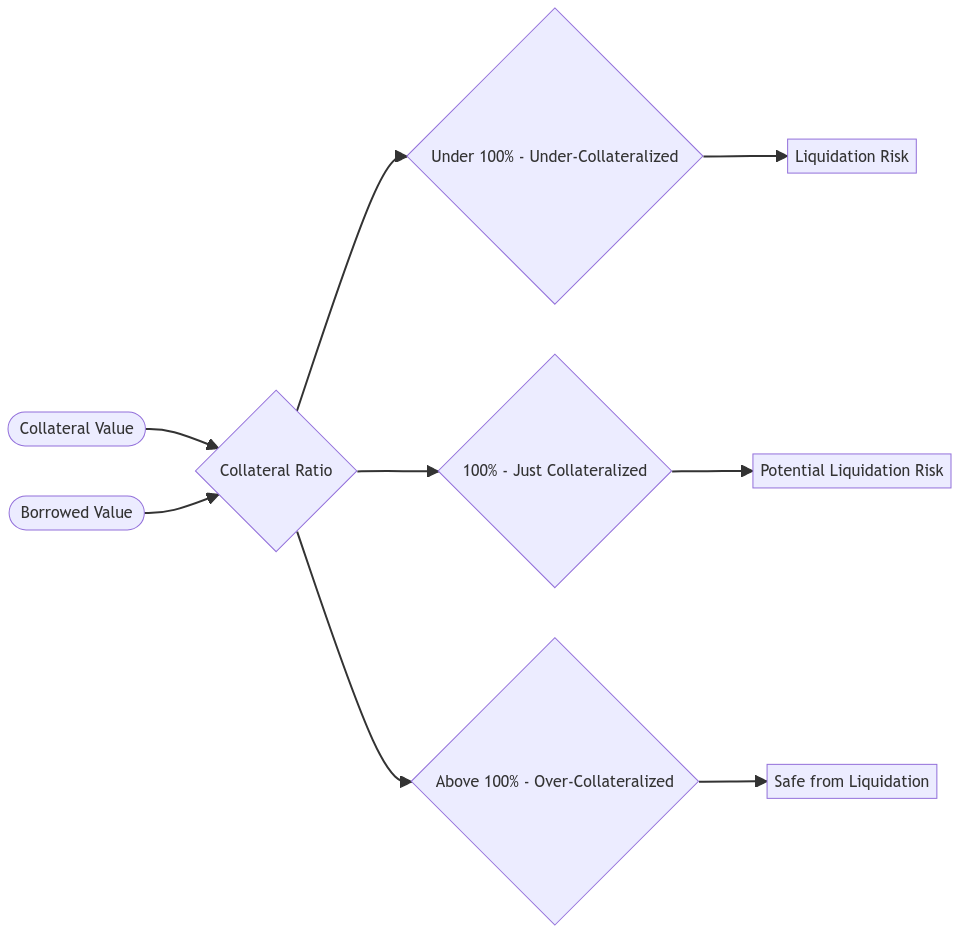

Diagrammatic Representation of the Collateral Ratio

The following diagram illustrates the relationship between the value of collateral, borrowed value, and the collateral ratio, showing the safe zones and danger zones:

Consequences of Not Maintaining a Safe Ratio

In cases where the Collateral Ratio falls below the liquidation threshold (typically 100-110% depending on the platform), the system automatically triggers a liquidation event. This event means that a portion, or all, of the borrowerвҖҷs collateral is sold off automatically to repay the loan.

The Liquidation Process Step-by-Step

- Ratio Drops Below Threshold: Market volatility causes your collateral value to decrease

- Liquidation Triggered: Smart contract automatically initiates liquidation

- Collateral Sold: Your crypto is sold at current market price (often during a crash)

- Penalties Applied: Liquidation fees (5-15%) are deducted

- Loan Repaid: Borrowed amount plus interest is repaid to lenders

- Remaining Balance: Any leftover collateral is returned (often nothing remains)

This process protects the lenders but can lead to devastating losses for the borrower вҖ“ especially during market crashes when liquidations cascade across the entire DeFi ecosystem.

For this reason, it is always advised to maintain a Collateral Ratio significantly above 150% to protect against market volatility and prevent the risk of liquidation.

Ways to Maintain a Healthy Collateral Ratio

Protecting your position requires active management and the right tools. Here are proven strategies to keep your collateral ratio safe:

1. Monitor the Market Regularly (Manual Method)

Keep a close eye on the value of your collateral and borrowed assets. As these values can fluctuate dramatically, regular monitoring can help you react swiftly to any adverse changes.

Best Practices:

- Check your ratio at least twice daily during normal markets

- Check hourly during volatile markets

- Set price alerts for your collateral assets

- Track major news events that could impact prices

2. Use Automated Monitoring Tools (Recommended)

Instead of manually checking, use platforms like SmartCredit.io that offer:

- вң… Real-time ratio monitoring

- вң… SMS/Email alerts when ratio drops

- вң… AI-powered liquidation protection

- вң… Automatic rebalancing options

3. Rebalance Your Portfolio

If the value of your collateral decreases, take immediate action:

- Add More Collateral: Deposit additional crypto to boost your ratio

- Repay Part of Your Loan: Reduce your borrowed amount

- Swap Collateral: Replace volatile assets with more stable ones

4. Opt for Stable Collateral

Use stable or less volatile assets as collateral to avoid massive fluctuations in value:

- Best Options: BTC, ETH (relatively stable large caps)

- Moderate Risk: Top 20 cryptocurrencies by market cap

- High Risk: Small-cap altcoins, memecoins, new tokens

5. Maintain High Safety Buffers

Never operate close to the minimum ratio:

- Minimum Safe Ratio: 150% for stable markets

- Recommended Ratio: 200%+ for volatile markets

- Conservative Ratio: 250%+ for maximum safety

6. Plan for Worst-Case Scenarios

Always assume the market could crash 30-50%:

- Calculate what your ratio would be in a 50% crash

- Ensure youвҖҷd still be above 120% in that scenario

- Keep emergency funds ready to add collateral if needed

рҹ’Ў Success Story: вҖңI maintained a 200% collateral ratio and enabled SmartCreditвҖҷs automated alerts. When ETH dropped 25% overnight, I got notified immediately and added collateral before liquidation. Saved my entire $50K position!вҖқ вҖ“ Alex M., SmartCredit user

Advanced Protection Strategies

Strategy 1: Diversified Collateral

DonвҖҷt put all your eggs in one basket. Spread your collateral across multiple assets to reduce risk from any single asset crashing.

Strategy 2: Partial Position Management

Instead of one large loan, split into multiple smaller positions. If one gets liquidated, you donвҖҷt lose everything.

Strategy 3: Hedging Your Collateral

Use options or futures to hedge against price drops in your collateral. While this costs money, it can save you from catastrophic liquidation.

Strategy 4: Automated AI Protection

Use AI-powered trading agents that automatically:

- Monitor your ratio 24/7

- Add collateral when needed

- Partially repay loans during crashes

- Execute protective strategies instantly

Collateral Ratio by Platform: Know Your Liquidation Threshold

Different DeFi platforms have different liquidation thresholds. HereвҖҷs what you need to know:

| Platform | Min. Ratio | Liquidation Penalty | Recommended Safe Ratio |

|---|---|---|---|

| SmartCredit.io | 110% | 5% | 150%+ |

| Aave | Varies | 5-10% | 150%+ |

| MakerDAO | 150% | 13% | 200%+ |

| Compound | Varies | 8% | 150%+ |

Frequently Asked Questions (FAQ)

What happens if my collateral ratio drops below 100%?

Your position gets liquidated automatically. The platform sells your collateral to repay the loan, charges liquidation fees (5-15%), and you lose most or all of your deposited collateral. This happens instantly and automatically вҖ“ you cannot stop it once triggered.

How do I calculate my collateral ratio?

Use this formula: (Total Collateral Value / Total Borrowed Value) Г— 100%. For example, if you deposited $15,000 in ETH and borrowed $10,000 in stablecoins, your ratio is 150%. You can use SmartCreditвҖҷs built-in calculator for instant calculations.

WhatвҖҷs a safe collateral ratio to maintain?

A minimum of 150% is considered safe for normal market conditions. For volatile markets, aim for 200%+ to provide adequate buffer against price swings. Conservative investors maintain 250%+ ratios for maximum protection.

Can I recover from liquidation?

No. Once liquidation occurs, your collateral is permanently sold. You cannot reverse the process. Prevention is the only strategy вҖ“ maintain safe ratios and use automated monitoring tools to avoid liquidation in the first place.

How often should I check my collateral ratio?

During normal markets: Check twice daily. During volatile markets: Check hourly or use automated monitoring. The best approach is to use platforms like SmartCredit that provide 24/7 automated monitoring with instant alerts.

WhatвҖҷs the difference between liquidation ratio and collateral ratio?

Collateral ratio is your current position (collateral value / loan value). Liquidation ratio is the minimum threshold before liquidation occurs (typically 100-110%). Always keep your collateral ratio well above the liquidation ratio.

Can automated tools really prevent liquidation?

Yes! AI-powered liquidation protection tools monitor your position 24/7 and can automatically add collateral or repay loans before liquidation occurs. These tools have saved billions in assets during market crashes.

What if I canвҖҷt add more collateral during a crash?

You have several options: (1) Partially repay your loan to improve the ratio, (2) Swap volatile collateral for stable assets, (3) Close the position entirely before liquidation hits. Having an emergency fund specifically for adding collateral is highly recommended.

Never Get Liquidated Again

Join SmartCredit.io and protect your crypto positions with automated monitoring, instant alerts, and AI-powered liquidation protection.

Start Protected Lending Now вҶ’

Free calculator вҖў 24/7 monitoring вҖў Instant alerts

Why Choose SmartCredit for Safe Crypto Lending

SmartCredit.io offers industry-leading protection features designed to keep your collateral safe:

Automated Protection Features

- вң… Real-Time Monitoring: 24/7 tracking of your collateral ratio

- вң… Smart Alerts: Instant notifications via email, SMS, or push notification

- вң… AI Protection: Automated agents that protect your positions

- вң… Lower Liquidation Penalties: Only 5% vs 10-15% on other platforms

- вң… Flexible Ratios: Starting from 110% minimum

- вң… Multi-Asset Support: Diversify your collateral across multiple cryptocurrencies

User-Friendly Tools

- рҹ“Ҡ Built-in collateral ratio calculator

- рҹ“Ҳ Visual dashboards showing your safety margin

- рҹ”” Customizable alert thresholds

- рҹӨ– Optional AI-powered auto-rebalancing

Get started with SmartCredit.io today and join thousands of users who trust us to protect their crypto positions.

Conclusion: Protect Your Crypto from Liquidation

Understanding and managing your Collateral Ratio is not just fundamental вҖ“ itвҖҷs essential for survival when participating in DeFi activities. By maintaining a ratio of 150% or more, using automated monitoring tools, and having a clear action plan for market volatility, you can mitigate risks and ensure the stability of your financial position.

Key Takeaways:

- вң… Always maintain a collateral ratio of 150%+ (200%+ for volatile markets)

- вң… Use automated monitoring tools вҖ“ manual checking isnвҖҷt enough

- вң… Understand your platformвҖҷs liquidation threshold and penalties

- вң… Have an emergency plan and funds ready to add collateral

- вң… Consider AI-powered protection tools for maximum safety

DonвҖҷt wait until itвҖҷs too late. The difference between a safe position and a liquidated position is often just a few percentage points вҖ“ and a few hours of monitoring. Take action now to protect your assets.

Related Articles

- AI Trading Agents: Revolutionizing Risk Management and Automated Liquidation in DeFi

- Using Crypto as Collateral: Crypto for Loan

- Crypto Lending Platforms: Earn with DeFi

- Why Do Borrowers need Low Collateral Ratio?

Additional Information

- SmartCredit.io вҖ“ P2P DeFi Lending Platform with Liquidation Protection

- Borrow with SmartCredit вҖ“ Start safe borrowing today

- Lend with SmartCredit вҖ“ Earn interest on your crypto

Follow us on Social Media

- Twitter: https://twitter.com/smartcredit_io

- Gitbook: https://learn.smartcredit.io

- Telegram: https://t.me/SmartCredit_Community