In every monetary system, there is interest – the price to be paid for using someone else money. In this article, we will focus on the fiat interest rate.

Fiat interest rate

We focus here on two topics:

- Which factors influence the fiat interest rate in the fiat economy?

- How much should be the fiat interest rate in the fiat economy?

The drivers for the fiat interest rate are:

- Consumption preferences

- Time preferences

- Rate of base-money production/destruction in the economy

- Rate of credit-money production/destruction in the economy

- The proximity of individuals to the “money creation” in society

- Store of the value function

First, we will analyze these factors and then we conclude how much should be the fiat interest rate in the fiat economy.

1. Consumption preferences

The output of the economy is expressed as GDP – Gross Domestic Product. There are multiple ways to define what the GDP is, but for this article, we use the following definition – GDP the sum of all income paid to persons (not to the companies, but the natural persons). So, the people are receiving an income, and then they decide how much to consume or to invest/save.

The interest is the price for the money, it’s the price, which has to be paid to someone else for delaying his consumption.

High interest would imply, that rather a small number of persons would like to delay their consumption – this results in the shortage of money in the economy – therefore the price for money – the interest – will be higher than equilibrium.

Low interest would imply, that rather a big number of persons are confident to delay their consumption – this results in the over-supply of money in the economy – therefore the price for money – the interest – will be lower than equilibrium.

By adding all these different wants of different individuals together we will get the fixed income markets, which intermediate between the “endpoints” – between the natural persons.

2. Time preferences

The time factor has its influence too:

- Some people want to save their retirement or the schooling of their children – these are long periods.

- Other people just want to finance a trip to a sunny beach – these are short periods

If the amount of money in the economy would be constant, then the consumption preferences and time preferences would determine the price for the money – the interest – in the economy.

But as we see in the following – the amount of money in today’s fiat economy is not constant, but it is continuously growing.

3. Rate of base-money creation/destruction

Central banks create/destroy base-money. It exists:

- In the form of notes and coins – one as an individual can use them

- In the form of electronic base-money – for the payment flows between the commercial banks and central banks (others have no access to the electronic base money)

The amount of base-money is not as stable as you might think. Federal Reserve increased the amount of base money after the 2008 financial crisis by 350%. Swiss National Bank did the same, but by 1’100%. This was called Quantitative Easing. We think Quantitative Perpetuity would be a better term to describe this.

If we look at the total base money growth of all central banks over the last 40 years, then we see the following:

We see continuous world-wide base-money production of ca 12% per year since the 1970s. If one asks, where is the inflation coming from, well – that’s one of the reasons here.

Increasing the amount of base-money lowers the interest rate – there is more supply of money in the economy, and the price of money – the interest – will go down.

Decreasing the amount of base-money decreases the interest rate – there is less supply of money in the economy, and the price of money – the interest – will go up.

Central banks influence interest as well with the interest they pay for the reserves of commercial banks on their central bank deposits. For example, in Switzerland, this rate is negative – 0.75%. Commercial banks have to pay interest to the Swiss National Bank (and not vice versa as one would think).

The hypothesis is that negative interest rates will stimulate bank lending – the idea being that banks would rather put the money into the circulation instead of paying interest to the central banks for their deposits. Well, the reality is, however, that these costs are just passed over to the consumers.

4. Rate of credit-money creation/destruction

The biggest part of the money is not the base-money but the credit-money. The amount of credit-money is changing even more than the amount of base-money.

Commercial banks create credit money when the loans are issued; commercial banks destroy credit money when the loans are paid back. In the relative terms – 90% – 97% of the money is credit money, created by private organizations – by the commercial banks.

The money that you have on your bank accounts is not the base-money from the central banks, it’s the credit-money created by the commercial banks. The only way for the non-bank-entities to use the base-money is to use the coins or the notes (they are issued by the central banks).

The amount of credit-money can grow and can decline in the economy.

If more loans are issued than paid back – then the amount of the credit-money is growing in the economy. This means there is more money supply, which leads to lower interest – the price for the money.

If more loans are paid back, then issued – then the amount of credit-money is declining in the economy. This means there is a declining money supply, which results in increasing interest – the pice for the money.

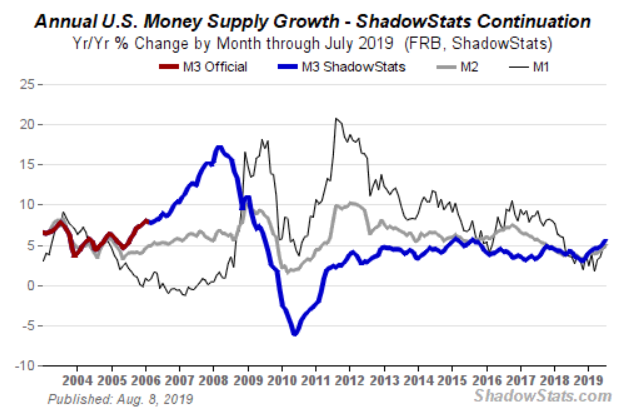

The amount of total credit money (so-called M3) is growing by 5% – 6% per year. One could say that every unit of credit-money is then devalued by the same ratio year by year (there is rather a constant amount of the real assets and continuously growing amount of the credit-money).

This continuos devaluation of the money-units means from another side the inflation for the end-users. The interest paid to the lenders should compensate for the continuous devaluation of money.

5. Store of the value function

The store of value function derives from the other parameters. It’s listed here because it’s very different for the fiat monetary system as compared to the crypto monetary systems.

The world economy had mainly deflationary scenario 1870 – 1910. After WWI it’s mainly the inflationary scenario. The deflationary scenario benefitted the savers – their money was worth more and more, the deflationary scenario enabled the middle class to emerge.

The inflationary scenario – our current fiat system scenario – benefits the debtors – they have to pay back less and less real value. This scenario hurts the middle class as well via pension fund mechanisms. The value of the pension funds should grow at least as much as the loss of value through inflation. But as this is not the case, then the pension funds pay-outs will be much smaller as required for keeping the life-standards of the middle-class.

Benefitting the savers is the store of value function of the money. Now, if the amount of credit-money in the economy is growing ca 5% – 6% per year – meaning every unit of credit-money is devaluing by the same ratio – then how is it possible to have a store of the value function in today’s fiat money?

Well, it’s clear, the current fiat monetary system does not possess any store of the value function. It’s an inflationary monetary system, where the wealth creators of the economy – the middle class – will discover the latest by their retirement that after working all their life, they have not created any wealth for themselves…

6. Proximity to the money creation

If a debtor has to pay less interest, then we have hidden wealth transfer to the debtors. It’s because of the following – if inflationary money is losing more value than the interest, which the debtor has to pay than the debtor is benefitting financially from this transaction.

The wealthy have to pay little interest, which is less than the fair interest in the economy. This results in the hidden wealth transfer to the wealthy.

The non-wealthy have much higher interest, which usually higher than the fair interest in the economy. This results in the hidden wealth transfer away from the non-wealthy.

Why are there different interest rates for the wealthy and the non-wealthy? Well, it’s the proximity to the money creation, it’s the proximity to the commercial banks’ lending, which counts. The wealthy, which are closer to the commercial banks, will do better and the non-wealthy, which are definitively not close to the commercial banks, will do not so well.

Wealthy individuals and big corporations have easier access to credit creation via commercial banks. They have to pay much lower interest. Consumer segments, however, have reduced access to the credit. They have to pay much higher interest for the same nominal values.

Central banks quantitative easing, which started after the Lehman crisis, set the goals to facilitate the lending. But it didn’t work – the QE landed in the bank accounts of corporations or big banks. Little of this trickled down to the general population, to the non-wealthy.

It’s the proximity to money creation, which counts in the current financial system. If commercial banks don’t want to lend to the Small Medium Enterprises or consumers, then they will not do this. Pushing QE into the economy, will not force private organizations (banks) to do more lending. Pushing QE means only, that the wealthy are becoming more wealthy.

7. How much should be the fiat interest rate based on inflation?

Inflation is defined as a loss of purchasing power of money. Mainstream macroeconomy presents the orthodox view that healthy inflation is always required and healthy for the economy. U.S. Fed for example targets 2% inflation per year.

This struggles us because the productivity increases continuously due to the innovation, which should lead to the decline of the prices, i.e. to the deflation (opposite of the inflation). This healthy deflation is beneficial to the savers because they will be able to consume more real assets (opposite to today’s situation, where money buys less and less).

However, as central banks are using monetary instruments to create inflation, then we have inflation in the economy.

Back to the interest – the base interest in the economy should be at least as much as the inflation, i.e. it should compensate for the loss of the purchasing power of the money.

This leads us to the question – how much is the inflation in today’s economy? We have to distinguish between the:

- Official inflation and

- Real inflation

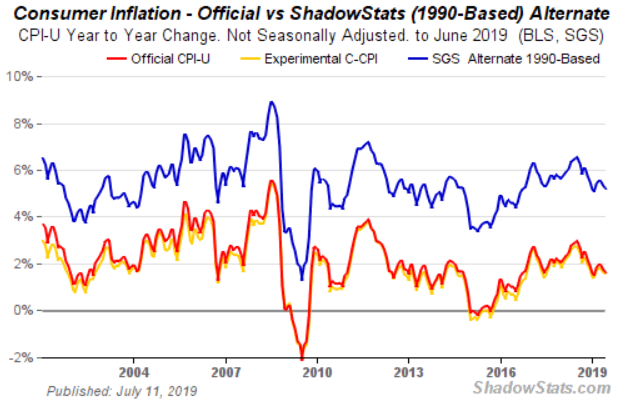

Official inflation calculation is “kind of optimized” – let’s think here on the transfer costs (health insurance costs are not included) and substitution effects (one should eat chicken if beef prices grow too much). The fact is that the official inflation calculation was changed in the 1990s. It is now circa 2.5% in the U.S.

Real inflation, based on the before 1990’s method, should be around 6% per year in the U.S. (please have a look at the www.shadowstats.com for the backgrounds).

This implies that the base interest should be ca 6% in today’s economy.

8. How much should be fiat interest rate based on the rate of total money growth?

There is a total output of the economy (GDP) and there is a total amount of the money in the economy (so-called M3).

There are two scenarios for the base interest:

- Inflationary scenario – The amount of money is growing faster than the output of the economy. Money can buy less and less – the purchasing power of money will decline.

- Deflationary scenario – The amount of money is growing at a slower speed than the output of the economy. This would be a natural scenario due to the continuous productivity increase through continuous innovation.

The first scenario helps the party’s with huge liabilities – for example, our governments. Having higher inflation allows to reduce nominal liabilities, it allows to “inflate” the debt away.

The second scenario helps anyone, who is borrowing for investing in the real assets – either for buying a house or for the retirement or the kid’s education. This scenario is the best for the middle class.

The rate of credit money growth is circa 6% in the U.S, based on the discontinued government M3 statistics, however, recalculated by ShadowStats:

This implies the base interest should be as well ca 6%. Otherwise, the money would lose his value just by staying on the bank account.

9. Why are the central bank interest rates so low?

Central banking is driven by the philosophy that there has to be inflation in the economy. Negative inflation (or deflation), which would be beneficial for the savers, is considered something very bad by the central banks…

Central bankers will explain their view in the following way – if the value of money will increase over time, then the consumers start to delay consummation decisions; enterprises will not invest, and all economy will become to a standstill.

Well, central bankers forget that, for example, the U.S. economy before the creation of the Fed was deflationary – it was economic boom time and it was the time where the savers become wealthier.

But why then this misconception in today’s central banking? Well, the trigger is the amount of credit money in the economy. Today’s economy is significantly over-leveraged by debt. The pre-Fed economy had much lower debt ratios. There was a clear separation of the base money (gold) and credit money in the pre-Fed area. Credit money was temporary and was always reversed back into the base money (gold). This system didn’t allow to create debt bubbles.

It’s not the fear of deflation, it’s the fear of the debt bubble, which keeps the central bankers inflating the system. Our current system doesn’t have a clear separation between the base-money and credit-money. Credit-money was supposed to be temporary and always reversed back to the base-money. But this is missing – we have not temporary but a permanent credit-money, which leads through inflationary policies to an ever-growing bubble.

By lowering the central bank’s short-term interests, by Quantitative Easing, by lowering the balance sheet requirements to the commercial banks – all these instruments are there to create an additional amount of credit-money and via this additional inflation and to prolong the status quo.

10. Reflection

Let’s reflect the key points from here:

- Fiat interest rate based on the credit-money growth should be around 6% (if lenders receive less than they lose value)

- Fiat interest rate based on real inflation today should be around 6% (if lenders receive less than 6% then they lose value)

- Access to credit is challenged to the majority of the population. The banking system should bring financing to the end-points of the economy, but the “money does not arrive in the real economy”. The ones, who have higher proximity to the money-creation, have access to the credit. The others (the 99%) are in a challenging position.

- The wealthy, who have high proximity to the money creation, have to pay lower interest rates than the real base interest in the economy. The un-wealthy, with their low proximity to the money creation, have to pay higher interest rates than the base interest.

- The results in continuous wealth transfer from the un-wealthy to the wealthy, from the ones who are not close the financial institutions to the ones who have high proximity to the financial institutions – year by year, generation by generation.

The current fiat money intermediation system is “kind of de-functional” in the current state.

It is not designed to keep and expand the middle-class. It’s current design and implementation leads to a continuous wealth transfer from the non-wealthy to the wealthy. It leads to a society with 1% and the rest.