I was presenting about the Crypto monetary system on the 28th of November 2018 at the moontec.io conference in Tallinn, Estonia about the monetary systems and about why one will need credit-money in the Crypto sector.

This was a very high-quality conference, especially by the quality of the participants.

Here is a one-pager of the presentation:

Here are the slides of the presentation: https://www.slideshare.net/martinploom/programmable-elastic-credit-money-ver-2

In the following are the key messages of the presentation:

How does a monetary system work?

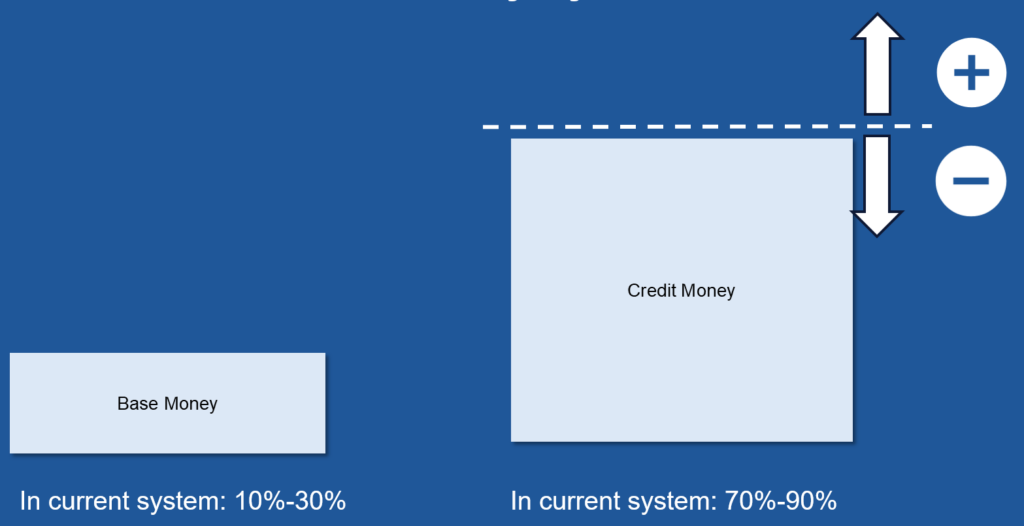

Every monetary system has two components:

- Base-money, which is the monetary base of the monetary system, nowadays created/destroyed by the central banks. In the earlier versions of the monetary system, the base-money was usually a non-manipulatable commodity (gold or silver)

- Credit-money, which is the elastic part of the monetary system, nowadays created/destroyed by commercial banks. In the earlier versions, the credit-money was created de-centrally by the borrowers and lenders

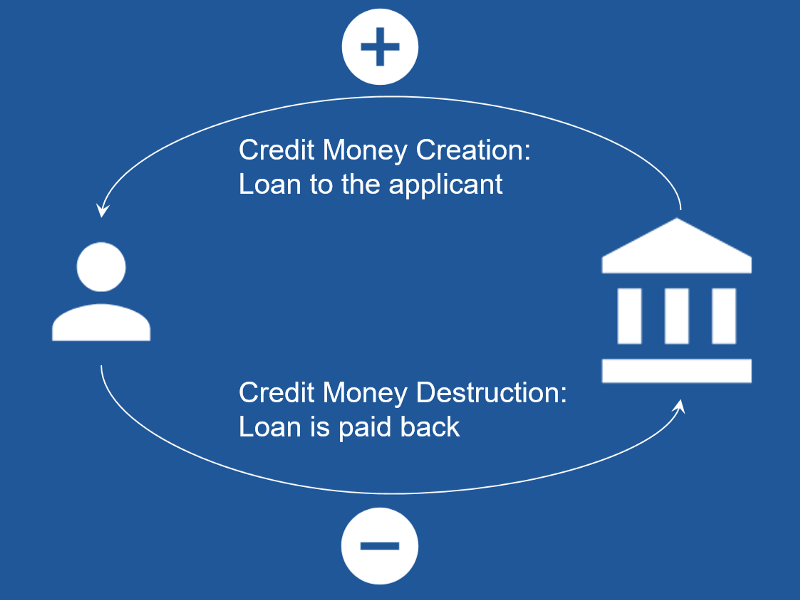

Credit-money is created every time a commercial bank is issuing a loan. Credit-money is destroyed every time a borrower is paying back the loan to the commercial bank. The following drawing visualizes this process:

The same principle – credit-money creation via the lending/borrowing – has been used for the last 5’000 years:

- Initially, the credit-money was created in the decentral lending/borrowing transactions

- Later, private banks emerged. They started to issue their own private credit money (for example “free banking area” in the U.S. )

- Since the central banking era, commercial banks started to issue the credit-money, which we call “central credit-money”. It’s so because the central credit-money is protected by the deposit insurance from one side. And from the other side, the central banks are monitoring that no commercial banks are going into the liquidation – either central banks are giving liquidity help to the commercial banks. Or they force them to merge with healthier banks.

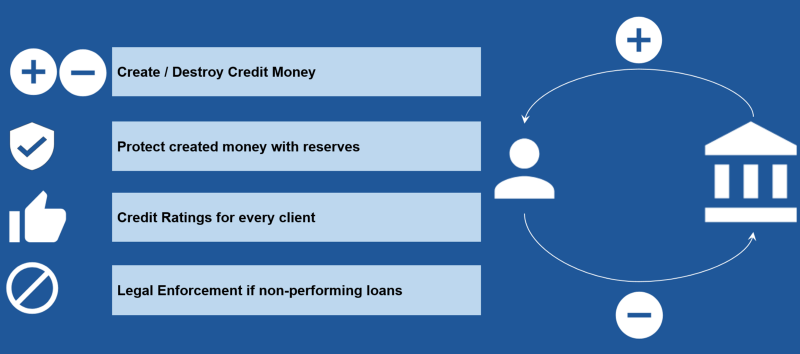

What are commercial banks doing?

Commercial banks need to do the following four things:

- Create/destroy credit-money in the lending/borrowing process

- Protect created credit-money with the reservers

- Have credit-ratings for every client

- Legal enforcement, if the loans should become non-performing (the borrower will default(

That’s the key activity of the commercial banks and they are creating ca 40% of their profits via lending/borrowing (credit-money creation/destruction). The additional 30% of profits come from the wealth management (in the case of universal banks) and the remaining 30% are coming as transaction fees (for the payments, safekeeping accounts, for buying/selling securities).

Practically speaking, commercial banks have a franchise from the central banks to create credit-money. Central banks are monitoring the commercial banks heavily and commercial banks earn the seigniorage fees (the profits from the money creation).

Why do we need Credit-Money?

One could say, there is no need to have credit-money, it’s enough to have the base-money. i.e. the Bitcoin is enough and there is no need to have credit-money on top of the Bitcoin. Is it so?

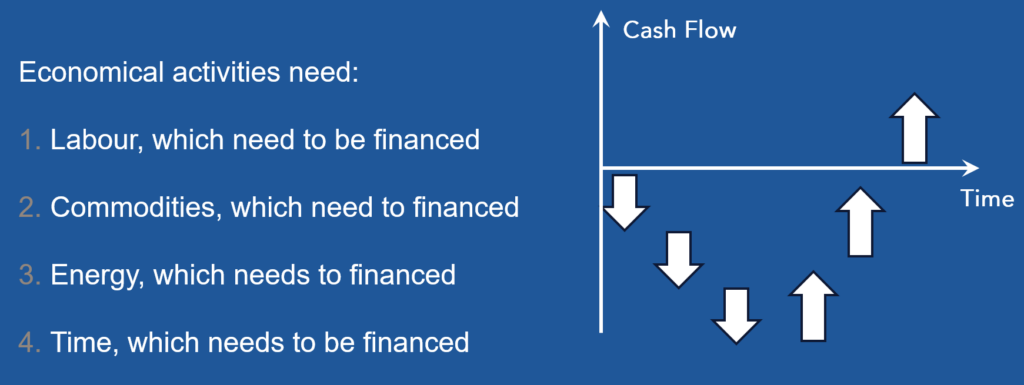

Economical activities need to be pre-financed – the labor, materials, energy needs to be pre-financed before one can sell the products. At first, there is negative cash-flow because the activities need to be pre-financed and later there is positive cash-flow when the products can be sold. The delay between the initial spending and the sale can be short (servicing products) or long (production products). This delay needs to be financed – that’s why we have credit-money.

Increased economic activity will need an additional supply of money, and decreased economic activity will need less money. That’s the key idea of the credit-money, that it’s elastic – it’s increasing and decreasing.

Why is the credit-money created via the lending, why not by some other means? It’s because lending is the best indicator of economic activity – lending is directly interconnected with economic activity. Increased lending means more economic activity and vice versa.

What would happen if there is no credit-money? Increased lending demand would result in the increased interest rate – the price for the money. This would suffocate economic activity because production needs to be pre-financed.

That’s why the credit-money exists for 5’000 years ago – it’s because of supporting the economic activity. The initial version of credit-money was not connected by the banks at all. The credit-money was created decentrally, it was created from the people for the people. It was created for supporting economic activities. It is one of the key innovations of humanity.

What types of monetary systems have existed in the past?

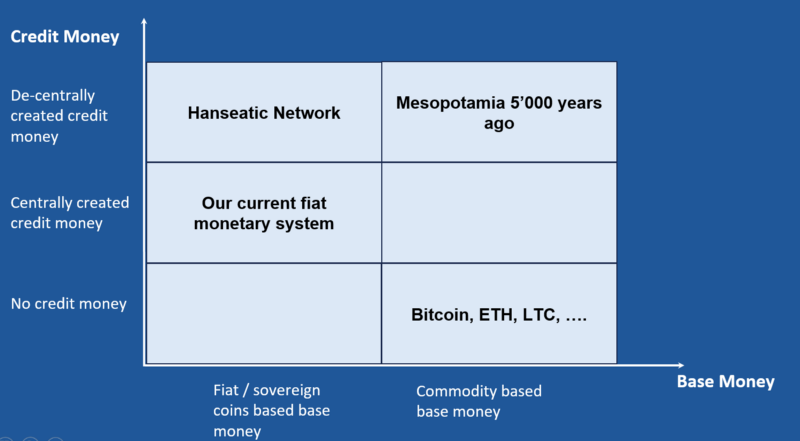

Monetary systems can be classified by a matrix:

- The first dimension is showing how the credit-money is created

- The second dimension is showing how the base-money is created

The Base-money dimension can be either:

- Fiat base-money – our current central banking system) or

- Commodity based base-money – like it existed for thousands of years)

The Credit-money dimension can be either:

- No credit-money – like in the crypto sector

- Centrally created credit-money – like in our current central-banking system

- De-centrally created credit-money – like it has existed for ca 4’500 years, starting from Mesopotamia 5’000 years ag0

The monetary systems without the credit-money do not survive – it’s because the raising interest rate will suffocate the economic activity. The economies, which use credit-money will prosper and will develop faster than their surrounding economies. Let’s think here on the Mesopotamia civilization, Phonecia civilization, Islamic Trade Network, Hanseatic Trade Network, England with the tally-stick system, etc.

Perhaps the best example is England with the tally stick system from 1200 BC till 1660 BC – the country without economic resources (compared to their competitors) succeeded to develop into an advanced economy. One of the key factors for this success was the decentral credit-money creation via the tally-stick system.

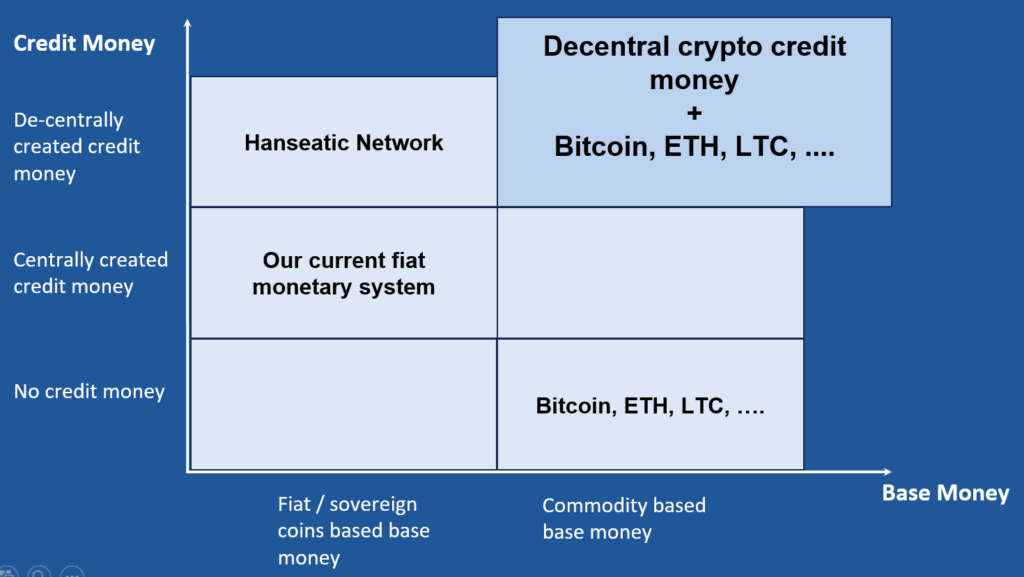

Where is the crypto credit-money?

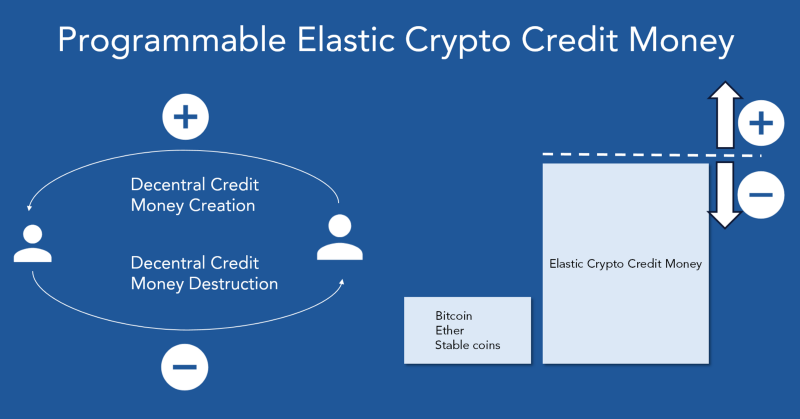

Crypto credit-money can be placed as following into the monetary systems classification matrix. Crypto credit-money would be based on the crypto base-money and it would be created de-centrally via the lending/borrowing.

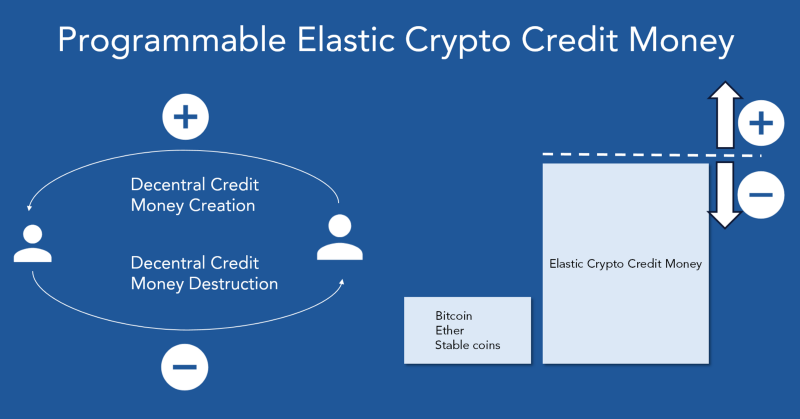

How should the Crypto Monetary System work?

The Crypto monetary system would work in a similar way as all monetary systems before in the last 5000 years. Crypto credit-money would work in a very similar way to the current fiat credit-money, except it would be created decentrally. It would be created in de-central lending transactions. It would be destroyed when the borrowers are paying back their loans plus interest.

Summary of Crypto Monetary System

The Crypto monetary system has emerged, but it is lack of so far the credit-money. This article focused on why do we need credit-money in the crypto sector and it described how to implement the credit-money for the crypto sector.