DAI interest rate is around 10% in DeFi. Considering the current low yield on most of the investment classes and the upcoming negative interest era, we can just say that these are good yields.

But why is DAI interest rate 10%?

Well, it’s about “following the money”.

The key question is– who are the biggest clients for borrowing. We suspect that these are the margin traders on the central crypto exchanges.

These exchanges with margin lending features have their P2P margin lending marketplaces, where lenders can lend assets and margin buyers can borrow the assets. These marketplaces have their interest rates and our thesis is that these margin trading loan interest rates are driving as well the DeFi interest rates.

We look at the following:

- Current DAI interest rates in DeFi

- Outstanding loans in DeFi

- Margin lending interest rates in BitFinex

- Outstanding loans in Bitfinex

After this initial number crunching, we will answer the question – why is the DAI interest rate 10%?

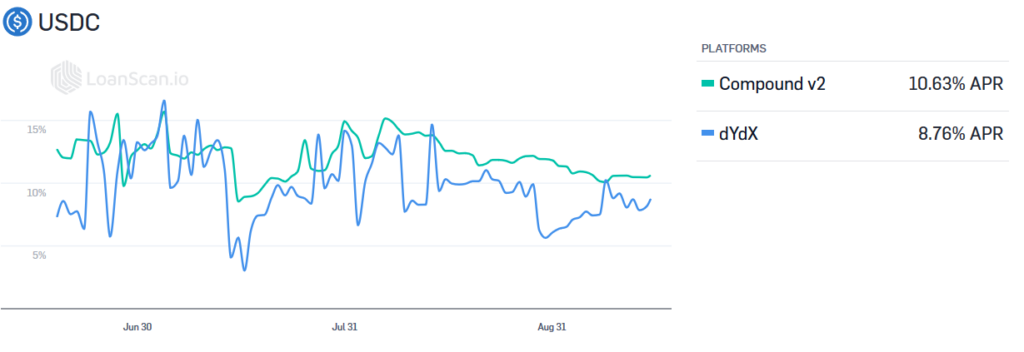

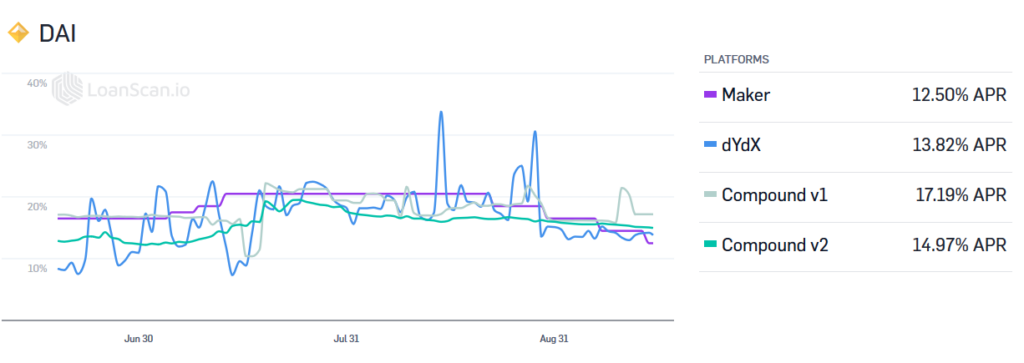

DAI Interest Rate and USDC Interest rate in DeFi

Here are the borrowing rates from the https://loanscan.io for the USDC (asset-backed USD stable coin, issued via Coinbase and Circle) and DAI (algorithmic USD stable coin, smart contracts created by the MakerDAO).

The borrowing rates are for the last 3 months:

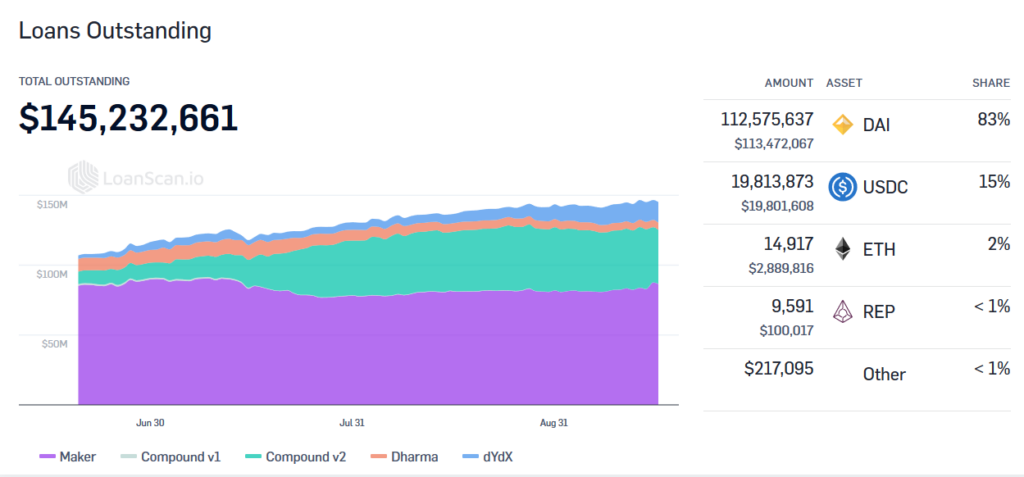

The current volume of outstanding loans in DeFi

Here is the amount of loans outstanding via https://loanscan.io:

So, there are 145 mUSD outstanding loans in the DeFi protocols as per now.

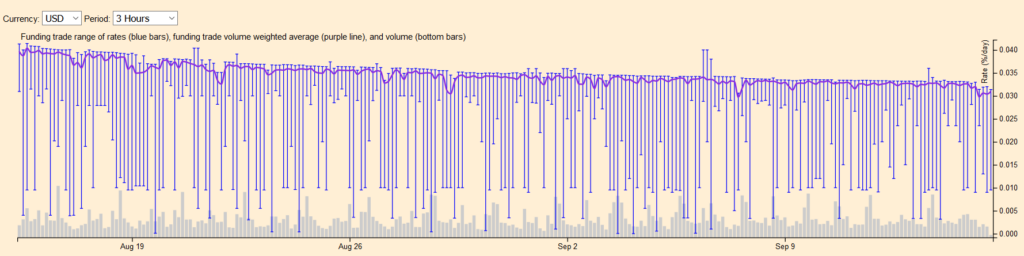

Margin Lending Interest Rates in Bitfinex

We use for the margin lending rates Bitfinex because this data is publicly available. The following chart shows the USD borrowing rates on the Bitfinex P2P margin lending/borrowing marketplace. The bold line shows the so-called “volume-weighted average” and the blue bars show the marketplace rates.

These are daily interest rates. To translate them to annual interest rates let’s multiply them with 365 and we get circa 10% annualized interest rates.

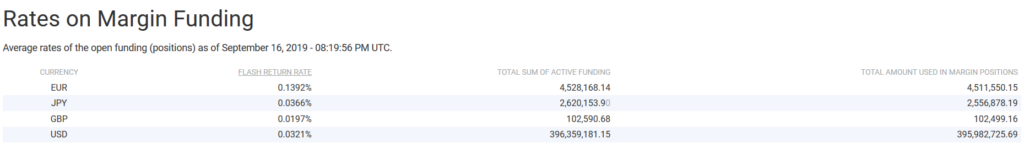

The Volume of Margin Lending in Bitfinex

The margin lending volume for Bitfinex is public. Here is the latest data:

We see ca 400 mUSD open positions. That’s only on Bitfinex. Adding data from other exchanges is difficult because this data is not public. But let’s calculate with 10 active margin lending programs from ca 250 exchanges listed in the CoinMarketCap and we can speculate that the total open position is between 1 Billion USD – 4 Billion USD.

Reflection

These are the key findings:

- The DAI interest rate and the USD interest rate are circa the same in DeFi and BitFinex

- The outstanding loans in BitFinex margin lending are 2.5 times bigger than all outstanding DeFi loans

- The outstanding loans of all crypto exchanges margin lending programs are ca 10 – 20 times bigger than the DeFi outstanding loans.

Which leads us to the key question of this article – why is the DAI interest rate ca 10%?

The answer is in “follow the money”. It’s because the leading market is the crypto margin lending market. That’s the market, which sets the interest rate. The DeFi market just follows the crypto margin lending market.

We speculate as well, that the biggest part of DeFi borrowing will be allocated into the crypto margin trading. This is done either via the central exchanges or the decentral exchanges.

If interest rates between the crypto exchange margin programs and DeFi would be different, then there would be arbitrage possibilities – the borrowers would borrow on the platforms, which offer less interest and the lenders would lend on the platforms, which offer more interest. This human behavior would move the markets back into equilibrium.