Table of Contents

show

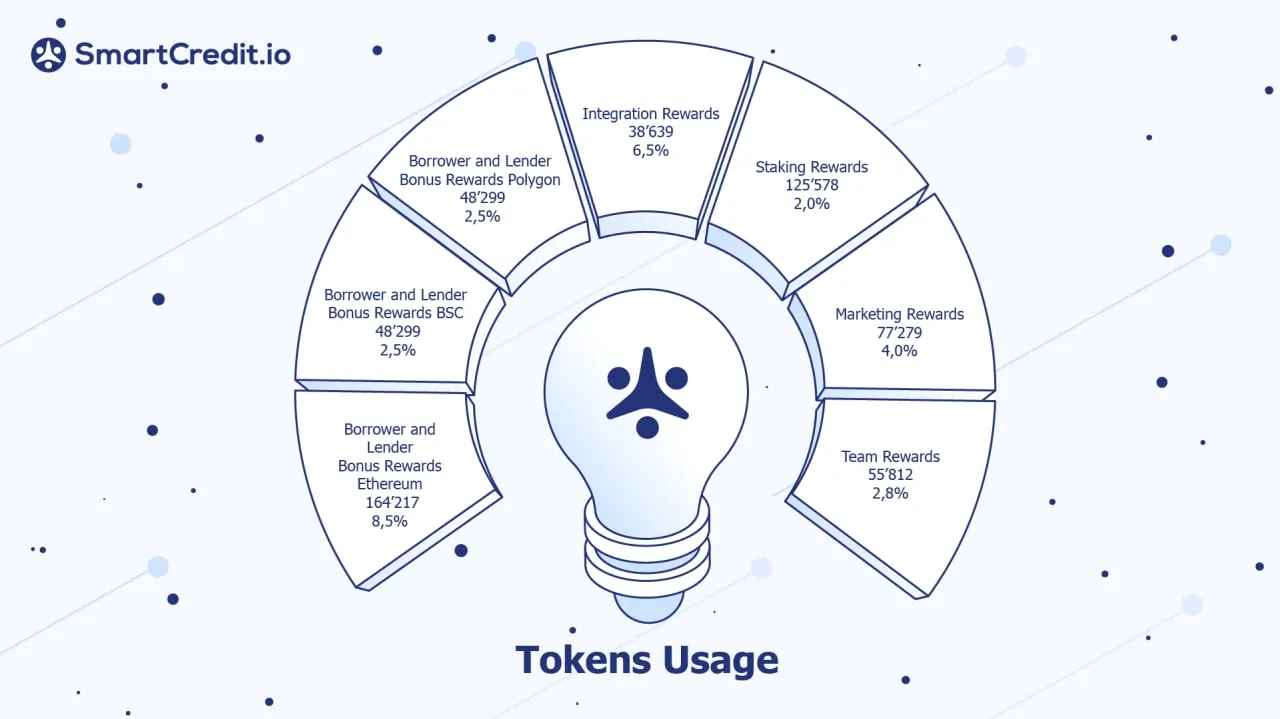

Tokens Usage for 4.11.2022–4.11.2023

We are happy to announce SMARTCREDIT token usage for 4.11.2022 to 4.11.2023.

But first, let’s review the tokens usage for the 4.11.2021–4.11.2022:

Tokens Usage in the Last Period

Statistics:

- Circulating tokens at 4.11.2021 — 1’511’381

- Tokens circulation on 4.11.2022 — 1’931’965

Tokens were used as follows:

- Bonus Rewards for the Borrowers and Lenders — 83’665 tokens

- Staking rewards for the Holders — 125’483 tokens

- Integrator Bonus Rewards — 30’000 tokens

- Marketing tokens — 90’000 tokens

- Team tokens — 36’572 tokens — 10% of the annualized inflation, allocated at 5.11.2022

- Unlocked treasury tokens — 54’864 tokens

- Last period inflation — 27.8%

Initially, planned inflation was 36%. However, bonus and staking rewards were activated only in April; therefore, the final inflation is 27.8%.

Tokens Usage in the Next Period

Statistics:

- Circulating tokens at 4.11.2022 — 1’931’965

- Tokens circulation on 4.11.2023 — 2’490’088

Tokens are used as follows:

- Bonus Rewards for the Borrowers and Lenders on Ethereum — 3’158 tokens per week, 164’217 tokens per year, 8.5% inflation

- Bonus Rewards for the Borrowers and Lenders on Binance Chain — 929 tokens per week, 48’299 tokens per year, 2.5% inflation (not yet launched)

- Bonus Rewards for the Borrowers and Lenders on Polygon — 929 tokens per week, 48’299 tokens per year, 2.5% inflation (not yet launched)

- Staking rewards for the Holders — 2’415 tokens per week, 125’578 tokens per year, 6.5% inflation

- Integrator Bonus Rewards — 38’639 tokens annually, 2.0% inflation

- Marketing tokens — 77’279 tokens annually, 4.0% inflation

- Team tokens — 55’812 tokens, 10% of the annualized inflation, to be allocated at 4.11.2023

- Total inflation per year — 28.9%

Motivation for the Token Model

- In the previous period (4.11.2021–4.11.2022), we gave the stakers and long-term holders more significant rewards.

- In the new period (4.11.2022–4.11.2023), we focus more on the platform’s usage. Therefore, we increase the rewards for the borrowers and lenders. And therefore we reduced the rewards for the stakers.

- The targeted inflation for the new period is 28.9%. However, as the Binance Chain is in testing and has yet to be deployed (the same is valid for the Polygon Chain, too), the final inflation will probably be less.

Additional Information

- SmartCredit.io website

- SmartCredit.io application

- How to earn with SmartCredit.io?

- SmartCredit.io introduces DeFi Fixed Income Funds

- Yield Farming with Fixed-Term-Loans via SmartCredit.io

- Potential of Fixed-Term-Loans in Bearish Market via SmartCredit.io

- Potential of Fixed-Term-Loans in Bullish Market via SmartCredit.io

Follow Us on Social Media

- Telegram: https://t.me/SmartCredit_Community

- Twitter: https://twitter.com/smartcredit_io