Most of crypto lending platforms advertise their interest rates, as the key benefit for the borrowers and lenders on their platforms. But are the interest rates all and everything? And, what does it matter to the users?

Our answer is – actually not. While interest rates and risk management are the key drivers for the lenders, there is one more parameter to be followed – the low collateral ratio for the borrowers, which translates into a high capability to borrow. That’s what the borrowers need.

So, here are the titles we will follow today:

- Current crypto interest rates

- Crypto collateral rates

- How does a low collateral ratio increase the capability to borrow?

- How does SmartCredit.io enable low collateral ratio?

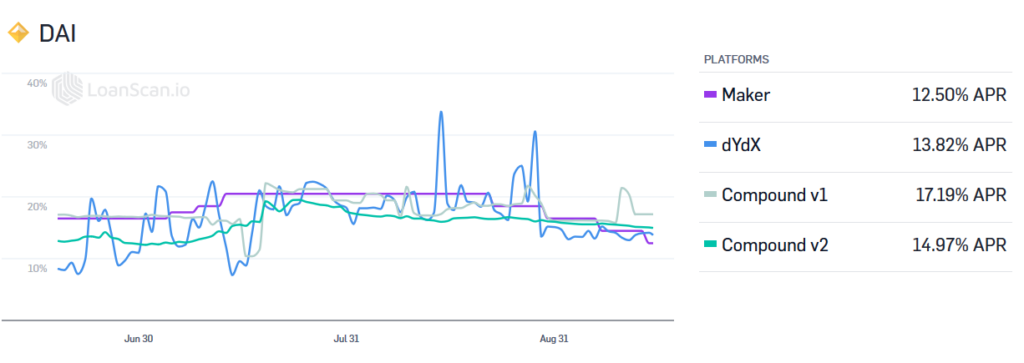

Crypto interest rates

Here are current interest rates for DAI (they are pretty similar to the USDC)

Source: https://loanscan.io/borrow/historical?interval=3m

The interest rates between custodial and non-custodial platforms are more or less the same. Non-custodial platforms are saying that custodial interest rates should be higher because of more risks (hacks, loss of assets, etc). Custodial platforms are saying the non-custodial interest rate should be higher because of potential mistakes in smart contracts.

Therefore, let’s use the https://loanscan.io data as a basis.

But why are the stable-coin interest rates around 10% or higher? We analyzed this in the article Why is DAI interest rate in DeFi 10%?

Crypto collateral ratios

DeFi has an average collateralization factor of 100%.

These collateral ratios are more or less the same on the custodian and non-custodian platforms. This shows, that the borrowers are OK to pay these high collateral ratios. Or even that the high collateral ratios have become the standard in the crypto lending industry…

How does a low collateral ratio increase the capability to borrow?

Let’s imagine two scenarios for the borrower:

Scenario A

- Loan amount: 100 units

- Collateral: 300 units

- Interest: 10%

Scenario B

- Loan amount: 100 units

- Collateral: 150 units

- Interest: 10%

The interest rates in both scenarios are the same, but the Loan To Value (LTV) is different:

- In Scenario A: 100 / 300 = 33%.

- In Scenario B: 100 / 150 = 66%, which is twice as much as in Scenario A.

The capability to borrow shows how much one can borrow on his given asset basis. If the borrower would have two similar offers with different LTV’s, then the borrower should choose the one with a higher LTV.

What does it mean?

The capability to borrow does not matter to the lenders. Lenders are interested in:

- Risk management (which is done fully with the collateral)

- Liquidity after lending out their funds (capability to call in the loans or tokenize the loans)

But the capability to borrow matter’s very much to the borrowers:

- It’s not only the interest payable, which is relevant

- It’s relevant, how much can the borrower borrow on a given asset basis

Capability to borrow with different interest rates

Let’s imagine further two scenarios for the borrower:

Scenario C (the same as Scenario A)

- Loan amount: 100 units

- Collateral: 300 units

- Interest: 10%

Scenario D

- Loan amount: 100 units

- Collateral: 150 units

- Interest: 15%

Loan to Collateral Value’s (LTV’s) is different. The interest rates are different too. The loan amounts are the same. But which option is better for the borrower?

Scenario C: LTV: 33%; Interest 10%

Scenario D: LTV: 66%; Interest 15%

The borrower will pay in Scenario C 50% more interest for 100% higher LTV – the borrower will have higher leverage on his assets. If the borrower needs leverage, then Scenario D is preferable for him – he would pay a little bit more interest for a much bigger loan.

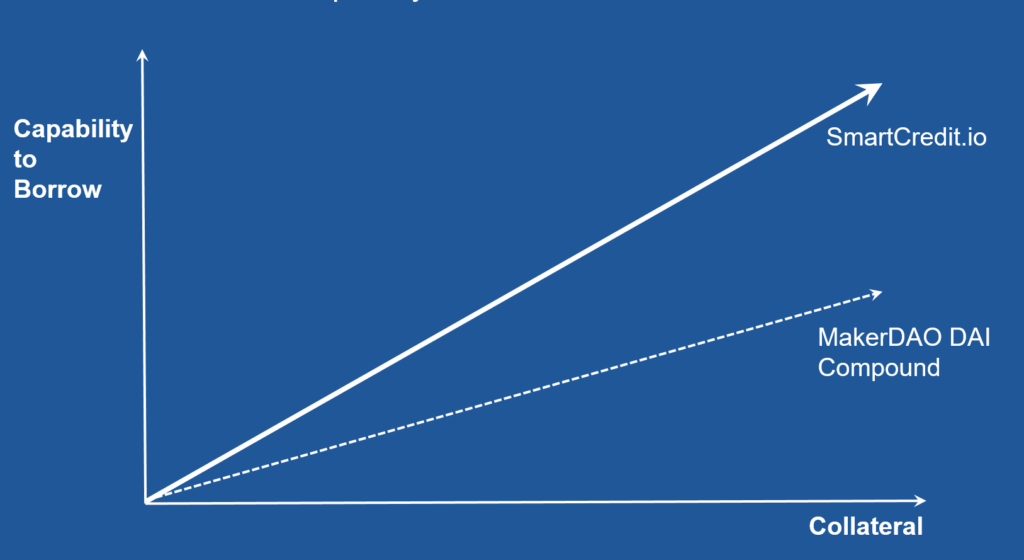

How does SmartCredit.io enable a low collateral ratio?

Two CFA’s (Chartered Financial Analysts) and ex-Credit-Suisse-Bankers co-founded SmartCredit.io. The key competitive advantage of SmartCredit.io is in credit risk management.

The credit-risk management should not be just a one-dimensional approach of over collateralizing the loans – that’s the standard in the crypto lending industry at the current moment. SmartCredit.io view is that credit-risk management is a network of different measures:

- The collateral ratios are driven by the market dynamic – they cannot be hardcoded into the smart contracts

- Fixed-term loans allow better collateral ratios as opposed to the unlimited loan maturities

- Crypto Credit Score for the borrowers allow separating good risks from bad risks

- Loss provision fund is there for the eventualities when the markets are moving too fast – for the flash crashes

- Enforceable legal contracts are created in the background – a defaulted loan will stay a defaulted loan, till all the obligations are fulfilled

This approach results in a low collateral ratio for the borrowers. SmartCredit.io collateral ratio is at factor 2 – 2.5 less than the current standard in the crypto lending industry. The importance of the low collateral ratio is very important for the borrowers – it increases the borrower’s capability to borrow by a factor of 2 – 2.5.

Summary

DeFi lending platforms and custodial lending platforms have very high collateral ratios. This is protecting the lenders.

We analyzed the reasons for the crypto lending high collateral ratios in another article Why are collateralization ratios so high in DeFi protocols?. Here is the summary.

- Standard risk management methods in most of the platforms are rather one-dimensional, which leads to high collateral ratios

- Additional risk management methods like crypto credit scores or loss provisions funds or fixed-term loans are rather seldom used.

- These additional credit risk management methods enable the low collateral ratio

However, the borrowers would be interested not only in the interest payable but about the low collateral ratio. It’s because the low collateral ratio enables the higher capability to borrow. The crypto lending market is very much driven by borrowers. Of course, one will need two sides (borrowers and lenders) for the marketplace, however, the lenders are coming to the marketplaces, where the borrowers are. If one can create a marketplace, which will offer significant advantages to the borrowers, then this marketplace will have a competitive advantage.