Every DeFi lending platform competes on interest rates. They broadcast APYs in bold, promise the lowest borrowing costs, and measure themselves against Aave, Compound, and MakerDAO on rate charts. But if you are a borrower—someone who actually needs liquidity from their crypto—there is a more important number hiding in plain sight: the low collateral ratio.

A low collateral ratio means you can borrow more from the same pool of assets. It is the difference between unlocking 30% of your crypto’s value and unlocking 70% or more. And yet, the industry obsesses over interest rates while quietly accepting collateral requirements that lock away two-thirds of every borrower’s capital.

This article explains why low collateral ratio is the metric that should drive every borrower’s platform decision, how it interacts with fixed versus variable interest rates, and how SmartCredit.io delivers 2–2.5× more borrowing power than the industry standard.

Most platforms waste 60–70% of your collateral capacity. SmartCredit.io offers up to 90% LTV with fixed-rate loans — so you unlock what your crypto is worth.

Calculate Your Loan в†’

What Is a Collateral Ratio — and Why Does It Define Your Borrowing Power?

The collateral ratio (also expressed as the inverse: Loan-to-Value, or LTV) measures what fraction of your deposited collateral you can borrow against. It is the foundational metric of every crypto-backed loan:

Collateral Ratio = (Total Collateral Value Г· Total Borrowed Value) Г— 100

LTV = (Loan Amount Г· Collateral Value) Г— 100

If you deposit $10,000 in ETH and borrow $3,333, your LTV is 33% and your collateral ratio is 300%. If you borrow $6,667 instead, your LTV is 67% and your collateral ratio is 150%. Same assets. Same collateral. Dramatically different borrowing power.

The DeFi industry has normalized collateral ratios of 200–300% — meaning LTVs of only 33–50%. This has become so standard that borrowers rarely question it. They should.

For a deeper dive into how collateral ratios work, the mechanics of liquidation, and how to stay safe, read our detailed guide: Collateral Ratio: Why 100%+ Ratio Matters.

The Industry Standard Is Costing Borrowers Billions

Most DeFi protocols — Aave, Compound, MakerDAO — require collateral ratios between 150% and 300% depending on the asset. This is not arbitrary: high collateral requirements exist because these protocols use blunt, one-dimensional risk management. Without the ability to model individual borrower risk or enforce loan terms off-chain, they compensate with overcollateralization.

But the cost is enormous. Consider the numbers across two common scenarios:

| Scenario | Collateral | LTV | Loan Amount | Interest Rate |

|---|---|---|---|---|

| A — Industry standard (Aave/Compound) | $30,000 | 33% | $10,000 | 10% |

| B — Low collateral ratio (SmartCredit) | $15,000 | 67% | $10,000 | 10% |

| C — Low collateral + higher rate | $15,000 | 67% | $10,000 | 15% |

Scenario B unlocks the same loan amount ($10,000) with only half the collateral. If you only have $15,000 in crypto, Scenario A is simply unavailable to you — the platform requires twice your entire holdings. Scenario B opens the door.

Even Scenario C shows the real calculation: paying 50% more in interest (15% vs 10%) in exchange for 100% more leverage on your assets. For a borrower who needs the capital to deploy at returns above 15%, the higher rate is worth paying. For a borrower who simply cannot produce $30,000 in collateral, the higher rate is irrelevant — without a low collateral ratio, there is no loan at all.

Interest Rates vs. Collateral Ratio: Which Matters More?

This is the question the industry avoids asking, because the answer challenges the dominant marketing narrative.

Interest rates matter — but they matter proportionally to the loan amount. On a $10,000 loan, a 5% rate difference costs $500 per year. On a $10,000 loan that you couldn’t take at all because the collateral requirement was too high, the cost is $0 — because the opportunity never existed.

The low collateral ratio is not just a metric. It is a gatekeeper. And the majority of retail DeFi borrowers are locked outside the gate.

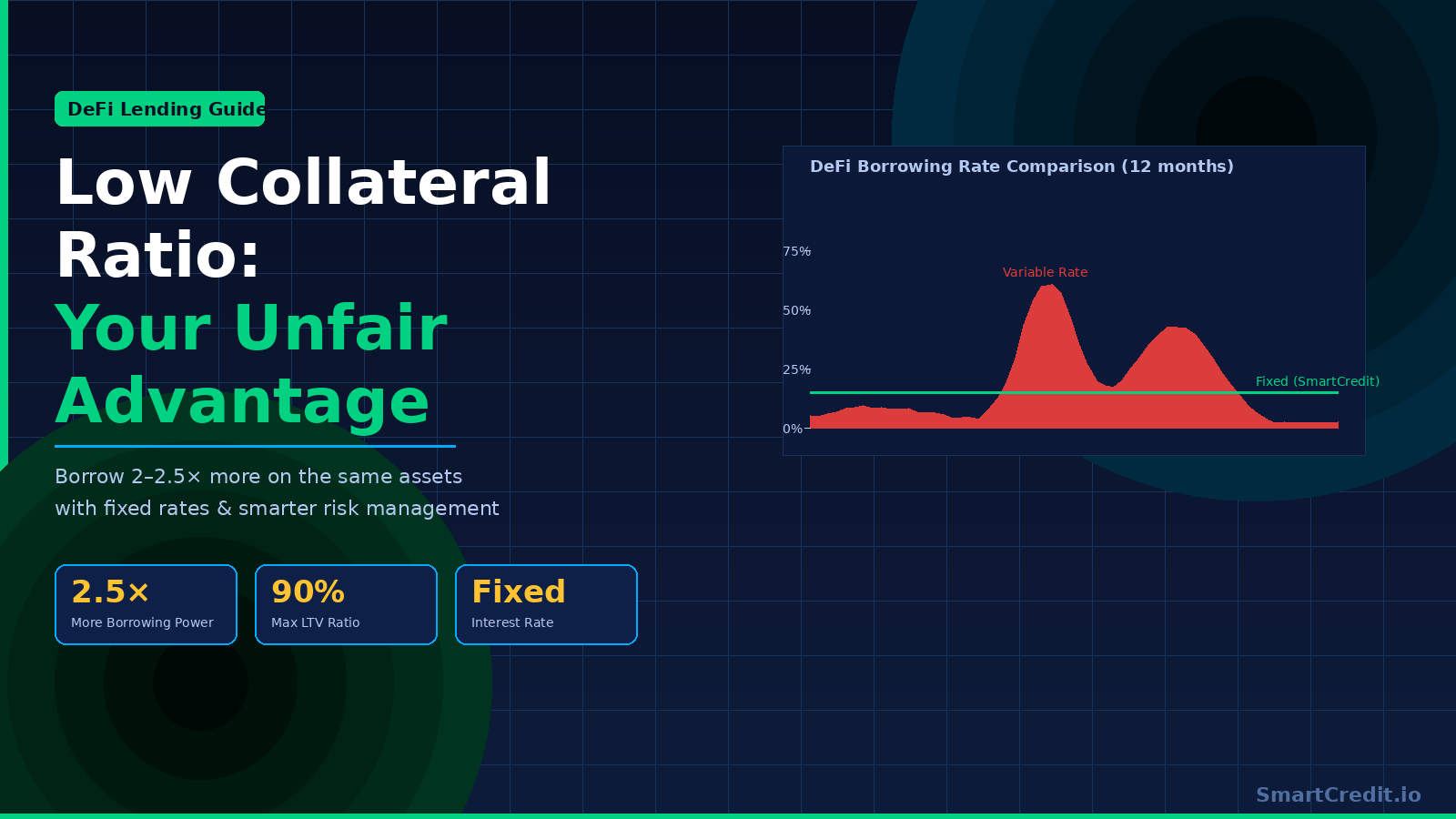

This is the same insight driving the move toward fixed-rate borrowing. Our analysis in DeFi Interest Rates Comparison: Why Fixed Rates Win for Real-Economy Borrowers — covering five years of daily rate data across SmartCredit, Aave V2, Aave V3, Compound V2, and MakerDAO — shows that variable rates spike dramatically at exactly the wrong moments: during bull markets when demand surges, and during crashes when stress is highest.

The combination of a low collateral ratio and a fixed interest rate is not two separate benefits — it is a unified philosophy of borrower-first design.

SmartCredit’s DeFi Interest Rates Comparison Tool shows daily historical rates across all major protocols. The variable rate spikes speak for themselves.

Compare DeFi Interest Rates в†’

Why Are Collateral Ratios So High Across DeFi?

The high collateral ratio norm in DeFi did not happen by accident. It emerged from three structural realities of how most DeFi protocols are built:

1. Pool-based lending removes individual risk assessment. When a borrower deposits ETH into Aave or Compound, they borrow from a pooled reserve with no individual credit history, no risk differentiation, and no way to distinguish a reliable borrower from a high-risk one — so the protocol applies the same overcollateralized requirement to everyone.

2. Unlimited loan duration forces large safety buffers. Without a fixed maturity date, collateral’s value can deteriorate over months or years without a defined repayment event. Fixed-term loans reduce this uncertainty, allowing lower required ratios.

3. No off-chain enforcement exists. If a borrower’s collateral drops below threshold, the protocol liquidates automatically. The only protection is a large collateral buffer. Platforms with enforceable legal contracts and crypto credit scoring can afford to run lower ratios.

For a comprehensive look at how to use your crypto as collateral effectively, see our dedicated guide: Using Crypto as Collateral for Loans: Complete Guide 2025.

How SmartCredit.io Achieves a Low Collateral Ratio

SmartCredit.io was co-founded by two Chartered Financial Analysts (CFAs) with backgrounds in institutional credit at Credit Suisse. The core insight: credit risk management is a multi-dimensional system, not a single blunt lever called overcollateralization.

SmartCredit’s approach rests on five pillars:

Dynamic collateral ratios driven by market conditions. Unlike protocols that hardcode collateral requirements, SmartCredit adjusts required ratios based on real-time market dynamics — tightening when volatility increases, loosening when markets stabilize.

Fixed-term loans instead of open-ended positions. A defined maturity date fundamentally changes the risk profile of a loan. Lenders know when they will receive repayment; borrowers know their exact cost of capital. Fixed-term loans allow collateral ratios to shrink because the uncertainty window is bounded.

Crypto Credit Score for borrower differentiation. SmartCredit maintains an on-chain behavioral scoring system that unlocks better LTV terms for higher-quality borrowers. This is impossible in fully anonymous pool-based protocols. Learn more in our deep dive into crypto credit scoring in DeFi.

Loss provision fund for flash crash scenarios. A dedicated backstop fund means SmartCredit can run tighter collateral requirements day-to-day, knowing extreme tail scenarios are covered separately rather than baked into every borrower’s requirement.

Enforceable legal contracts in the background. A defaulted loan creates a legally enforceable obligation that doesn’t disappear when a position closes — allowing the platform to extend more trust and lower collateral requirements.

The result: SmartCredit.io’s collateral ratios are 2–2.5× lower than the industry standard. For borrowers, this translates into 2–2.5× more capital from the same assets — with no additional risk to lenders.

Real-World Scenarios Where Low Collateral Ratio Changes Everything

The DeFi Yield Farmer with a Defined Strategy

A borrower holds 10 ETH (worth $30,000) and wants to deploy into an 18% APY staking strategy. At a 300% collateral ratio (industry standard), they borrow $10,000. At 150% (SmartCredit), they borrow $20,000. Their staking return doubles — not because the rate changed, but because the collateral requirement allowed twice the position. With a fixed borrowing rate, the spread between staking yield and cost of capital is locked in from day one.

For traders building systematic strategies around fixed-rate borrowing, our Crypto Portfolio Management guide provides a professional framework for optimizing capital allocation across DeFi.

The Entrepreneur Needing Working Capital

A business owner holds $50,000 in ETH and needs $25,000 in stablecoins. On a platform requiring 300% collateral, they can only access $16,667. On SmartCredit at 150% collateral, they access $33,333 — enough for the purchase and a margin of safety. The interest rate on the loan is secondary to whether the loan is possible at all.

The Crypto Holder Accessing Tax-Free Liquidity

Borrowing against crypto is not a taxable event — there is no sale, so no capital gains are triggered. But the value of this advantage scales directly with how much you can borrow. A low collateral ratio maximizes tax-free liquidity. For a full breakdown of the tax implications, see our Crypto Loans and Taxes 2025 guide.

No credit checks. No KYC. Up to 90% LTV. Fixed rate locked from the moment you borrow.

What the Industry Gets Wrong About Collateral Ratio Risk

A common objection is that a low collateral ratio is riskier for lenders. This conflates the collateral requirement with the overall risk management framework. In isolation, yes — a lower ratio means less cushion. But this reasoning only holds if all other risk management is equal, and it is not.

Traditional banks originate 80% LTV mortgages — a low collateral ratio by crypto standards — and these are among the safest products in finance, backed by credit scoring, legal enforcement, insurance, and regulatory oversight. The LTV is high; the risk management is rich. DeFi protocols requiring 300% collateral do so precisely because they have none of those supporting mechanisms.

SmartCredit.io adds quality risk management back into the system — which is why its lower collateral ratios do not translate into higher lender risk. External research from CoinDesk’s analysis of DeFi lending mechanics confirms that overcollateralization is primarily a compensation for absent risk infrastructure. And DeFiLlama’s lending protocol data shows that the platforms with the highest TVL are not necessarily those with the most borrower-friendly terms — a gap sophisticated borrowers increasingly recognize.

Frequently Asked Questions

What is a low collateral ratio in DeFi?

A low collateral ratio means you need to deposit less collateral relative to the amount you borrow. In practice, it is expressed as a high Loan-to-Value (LTV) ratio — for example, 67% LTV versus the industry standard of 33% LTV. A low collateral ratio directly increases your borrowing power on a fixed asset base.

Why do most DeFi platforms require high collateral ratios?

High collateral requirements compensate for the absence of individual credit scoring, fixed loan terms, off-chain enforcement, and loss provision funds. Without these mechanisms, protocols use overcollateralization as a blunt risk buffer. SmartCredit.io replaces this with multi-dimensional credit risk management, enabling a genuinely low collateral ratio for borrowers.

How does a low collateral ratio benefit borrowers compared to a low interest rate?

A low interest rate reduces the cost of a loan. A low collateral ratio determines whether the loan is possible at all — and how large it can be. For borrowers who cannot meet a high collateral threshold, the interest rate is irrelevant. And for those who can borrow more thanks to a lower ratio, the larger loan amount typically far outweighs any interest rate differential.

Is a low collateral ratio safe for lenders on SmartCredit.io?

Yes. SmartCredit.io’s lower collateral requirements are enabled by richer risk management infrastructure: dynamic market-adjusted ratios, crypto credit scoring, fixed loan terms, a loss provision fund, and enforceable legal contracts. Lenders are not exposed to more risk — they are protected by a more sophisticated system.

What LTV ratio does SmartCredit.io offer?

SmartCredit.io offers LTV ratios up to 90% on supported collateral assets — among the highest in DeFi. This is 2–2.5× more borrowing power than the industry standard of 33–50% LTV on most pool-based platforms.

Conclusion: Stop Leaving Capital on the Table

The DeFi lending industry has trained borrowers to optimize for interest rates while ignoring the metric that actually determines how much they can borrow: the low collateral ratio. Two borrowers with identical assets and risk profiles will have dramatically different experiences depending on which platform they choose — not because of rate differences measured in percentage points, but because of collateral requirements that gate them in or out entirely.

When you combine a low collateral ratio with fixed-rate borrowing — predictable, locked-in cost of capital — you have the conditions that allow real-economy use of DeFi: business working capital, tax-efficient liquidity, defined yield strategies, and disciplined trading leverage that doesn’t blow up when rates spike.

SmartCredit.io was built around this insight. The 2–2.5× improvement in collateral efficiency is not a marketing claim — it is the output of five years of multi-dimensional credit risk management that the pool-based DeFi model has never offered.

Your crypto should be working for you. A low collateral ratio is how you make that happen.

рџљЂ Ready to Borrow More on the Same Collateral?

Join SmartCredit.io — up to 90% LTV, fixed rates, no KYC, no credit checks. Start in 5 minutes.

Start Borrowing at SmartCredit.io в†’