In this video, we discuss how everything started with the decentral credit-money, evolved then to our current central credit-money system and how it will go back to the 5’000 years old roots.

For the beginning, let’s recap how our current fiat monetary system works. We do have:

- Base-money (aka central bank money) – created by the central banks as notes/coins or by buying the government bonds from the commercial banks. Base money is ca 5% – 10% of the total money.

- Credit-money (aka commercial banking money) – created/destroyed by the commercial banks via the lending process: credit money is created when the loans are issued and credit money is destroyed when the loans are paid back. Credit-money is ca 90% – 95% of total money.

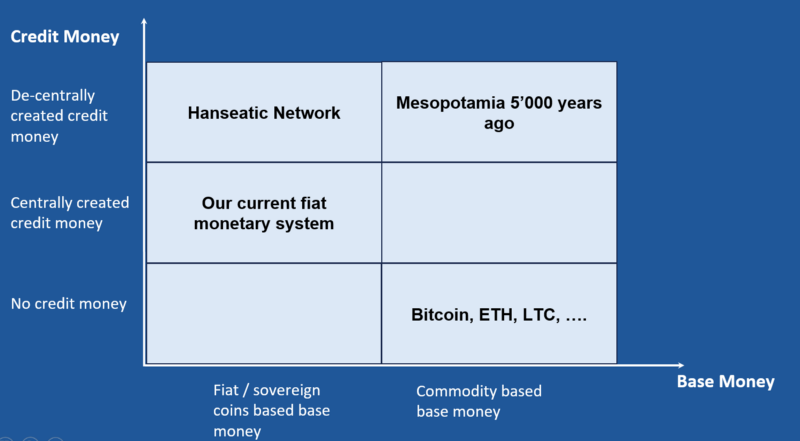

Base money has existed in different incarnations (commodities, gold, minted coins, and our current central banking money)

Credit money has existed in different incarnations as well (decentral credit money, private credit money and our current highly centralized credit money)

Credit-money is not so young, as one might think. Some think, that credit-money exists since the Federal Reserve was created in 1913, others think that credit money exists since central banking was created in the 1660s. Credit-money started 5’000 years ago in Mesopotamia.

On this picture we see different combinations of the credit money:

В The pendula will move now back from high centralization into the decentralization:

Our current credit-money is heavily centralized through the issuing process via commercial banks deposit insurance and central banking system

- However, for thousands of years, credit money was created via the decentral peer-to-peer lending process.

- Weare now in the one extreme – in the highly centralized credit money creation. The blockchain technologies allow moving back to the roots – to the decentral credit money creation.

Here is the transcript:

Hello guys, I’m Martin, Co-Founder of SmartCredit.io. We are here in Zurich, in the heart of one of the biggest financial centers. We will speak today about credit and credit-money.

Martin, how do world credit system work currently?

It’s a pretty simple system by design, but it’s made very-very highly complex, so that’s it difficult to understand. But let’s explain it in this way:

One one side there are central banks, they create the base-money and they try fo control the speed of monetary expansion. On one other side, we have commercial banks and commercial banks are creating the credit-money.

What is the exact role of central banks in this system?

Central banks are creating base money – these are the coins and electronic base money. In parallel, central banks, what they are trying to do is to control the speed of credit-money creation. Credi-money is created by the commercial banks, it’s ca 90% – 97% of the total money. The base-money is 3% – 7% of the total money.

And what central banks are trying to do is to manage this system.

And how successful are central banks in controlling the growth speed of credit-money?

That’s a point of a view, depending on whom do you ask. If you ask central bank guys, there are many of them, then they will tell you obviously that it’s very successful.

My comment on this is – economies are living systems. And to control living systems from a part of the living system is quite difficult. We see that the credit-money growth has been the cause for the most of economical crisis – the Russia economical crisis or Asia economical crisis. If credit-money is growing too fast, then there will be as well the phase where credit-money will be declining. The decline will result in a recession.

Central banks are saying that they are doing a perfect job, but there are different views about this topic.

You speak about the credit-money and you speak about the credit. What is the difference between these two?

Credit is so that anyone can give credit to anyone – it’s our basic right, it’s basic law – I can give credit to anyone. Credit is becoming credit-money if my counterparty is giving me a claim (I’m a lender in this scenario) and I can use this claim as a means to pay the next persons. That was the way how the earlier monetary systems worked.

Practically the credit-money was created decentrally, it was created peer to peer. And there was the base-money, which was then created by the kings, the sovereigns. On top of the base-money, was the credit-money, which was created by people for people.

And concerning credit-money – the amount of credit-money, why is the amount of credit-money important?

We have a base-money, that’s what central banks are creating. The economy is growing, it’s like a living organism – if a living organism is bigger, then the organism needs more blood in his body. If a living organism is smaller, then he needs less blood.

And the credit is like the blood in a human’s body. If there is fast economic growth, then we need automatically more credit. If there is low economic growth, then we need less credit. This problem cannot be solved with the base-money only, this problem has to be solved with the credit-money. That’s why the credit-money is very important for economic development.

If there is no credit-money, if there is only the base-money, then it will probably end up in the deflationary economy, because the price of the money will be too high for the fast growth phases. That’s the reason for the credit-money.

In today’s world, we have commercial banks and central banks. When did the commercial banks emerge?

People think that commercial banks have been there forever. It’s not so. The commercial banks started to emerge like 350 years ago. The first central bank was created in Sweden, it was around the 1660s; the second one was created in London around the same time.

And the first commercial bank was Netherlands Wechsel and Handelsbanken, the role of this bank was to trade the wechsels, because peer to peer money creation was based on the wechsel, in English: bill of the exchange system. That’s the first commercial bank was created.

However, the economy worked as well before, and it worked pretty nicely before the commercial banks were created.

And how did it worked before?

Commercial banks – they cam 350 years ago. But the peer-to-peer credit systems and credit-money systems they were there already 5’000 years ago in Mesopotamia. They were there in Phonecia 3’000 years ago, 2’500 years ago. They were used in the Islamic trading network, they were used in the Mediterranean trading network, they were used in the Hanseatic trading network.

So, peer-to-peer credit money has always been there in human history. And interesting is, that the peer-to-peer credit-money, which is 5’000 years old, is olden that the coins-based money, which was created by Greeks, by Romans, by Chinese and by Indian civilizations, at the same time – ca 2’500 years ago. But the peer-to-peer credit-money is older than the coins-based money.

Your question was – how did the economy then work before? It was a prosperous economy, we know the renaissance in Europe, we know how good the Hanseatic network developed, how good the Mediterranean network developed. We know as well Phonecia, how strong was their economic system; Mesopotamia – the very old country. So, these were the phases of pretty nice economical development.

But if the economy worked without the commercial banks, why did these commercial banks emerge at all?

Initially, when the commercial banks emerged 350 years ago, then at that time the peer-to-peer money system had some short-comings. For example bill of exchanges had different loan tenures – one can have one week, one can have one month, one can have one quarter. Additionally, there are different nominations.

It wasn’t standard money like it was today, where we have standard units of money. The units were arbitrary at this time, as well the loan tenures were ar at this time.

So, the commercial banks were like a marketplace to exchange different loan tenures, to exchange different nominations – 1 gulden in Holland, 5 guldens, or 99 guldens – that was the first role of Netherlands Handels- and Wechsel Bank.

What happened after that?

raryInitally commercial banks were created to enable the wechsel (bill of exchange) system, then the system developed so that the commercial banks started to issue their own fiat money, their credit-money. So, it wasn’t anymore the peer-to-peer credit-money, but the commercial banks took over.

Nowaday’s commercial banks taking over is very much connected with electronic money. If you have older systems if you go even back 50 years ago or 100 years ago, the peer-to-peer systems, the peer-to-peer credit-money systems, they were still used. But the more and more electronic money has appeared the less the peer-to-peer credit-money systems have been used.

That means the credit business is consolidated into the commercial banks.

So, you imply that all these central credit money systems emerged as a result of standardization?

It emerged as a way to deliver the scale effects. From one side you had this wechsel system with the limitations, which btw, can be solved very easily with the blockchain system, and from another side, the commercial banks had their scale effects.

These were scale effects, these were the effects of the transaction costs. They were able to process credit and credit-money much easier than the peer-to-peer systems. And that’s why the commercial banks emerged this way as they are. They just did this more effectively.

What if there is some other way to achieve this standardization you mentioned? With blockchain?

If you are looking back, then there are always these two competing systems – one is the peer-to-peer system (decentral credit system) and the other is the central credit system like it is today with the commercial banks.

The current commercial bank’s based credit system is more effective to create credit – there is a scale effect, there is processing the information and the transaction costs are lower.

However, if we are adding now the blockchain technologies, then this will enable the peer-to-peer credit networks and credit-money networks, it will give the same information to every participant. It will enable the alternative monetary system, which has been there much longer, than the coin based money.

Does it mean that with blockchain technology we can bring more emphasis again to the decentral credit-money-system?

Exactly, blockchain will be an enabler for the peer-to-peer decentral credit-money system. It takes away the advantage of commercial banks, the advantage being the scale effectsВ and the lower transaction costs. These advantages will be taken away from commercial banks as dis-intermediaries. Probably they are not so much required as they are required now. And the credit can be created in a peer-to-peer way and credit-money can be created in a peer-to-peer way.

Are you saying that we are going back to a decentralized future like we had a decentralized past?

Human history has been pretty much the decentralization fight with the centralization fight. There have been cultures, which have been more decentral and there are more central cultures. Central cultures try to control more things, than the decentral cultures, where the degree of freedom is higher.

There is always this question of how you process the information. If you are centrally processing information, like commercial banks are doing this today, then they have an advantage. But thanks to the blockchain technologies we can go again on this decentral route, we can start to do more and more in the decentral systems, meaning the degree of centralization of big organizations will go down.

Additional Info

Please have a look at our other blog articles or on our YouTube channel.