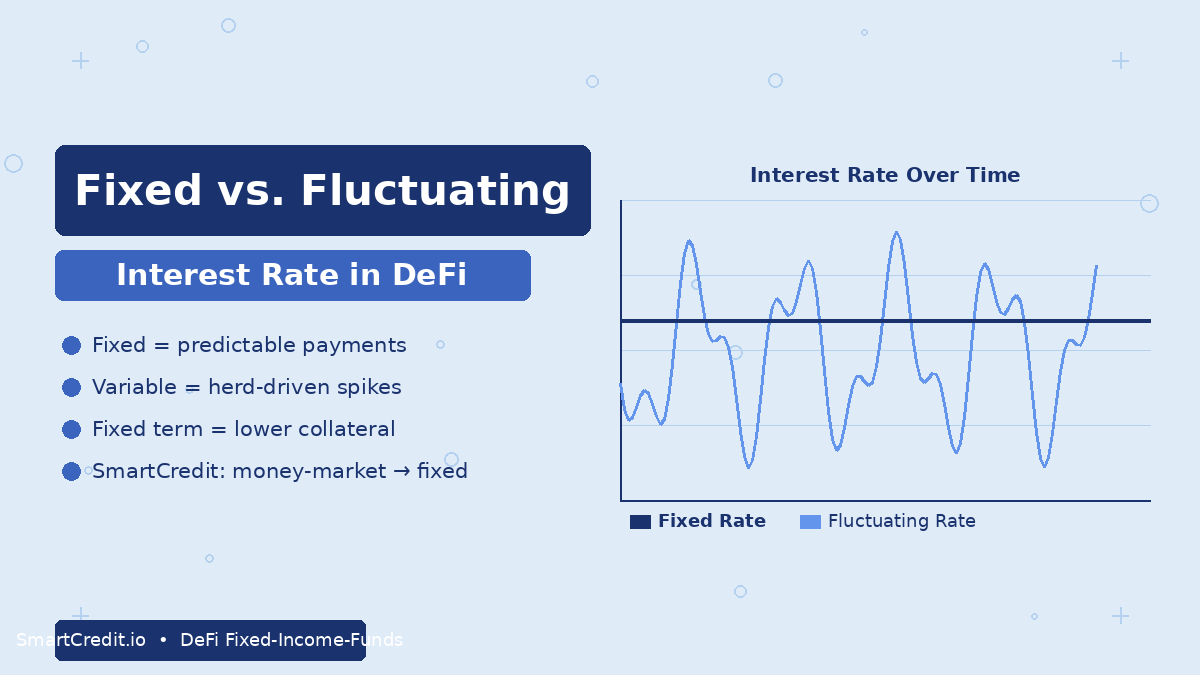

Fixed interest rate vs. Fluctuating interest rate

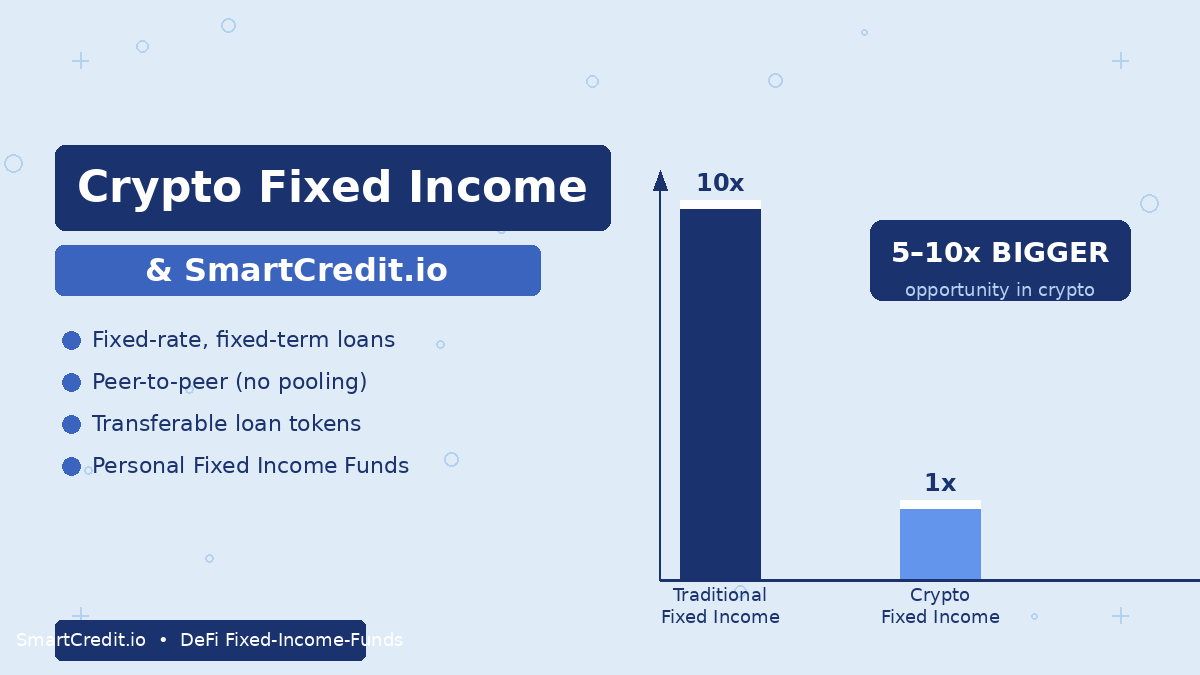

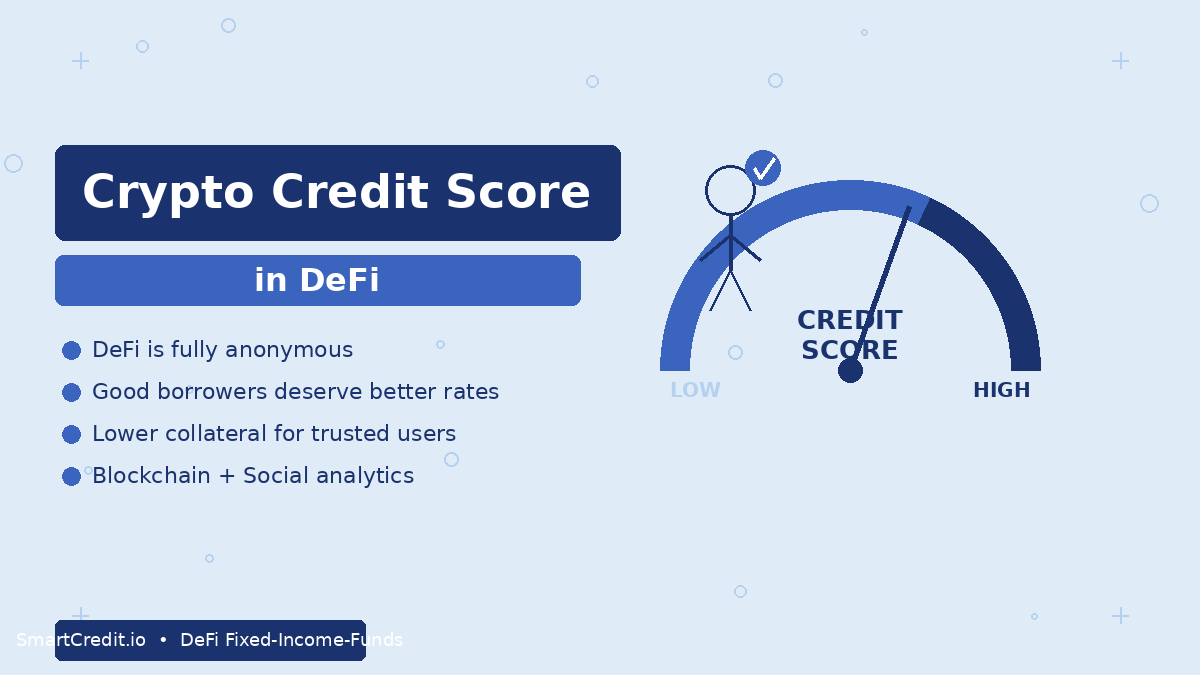

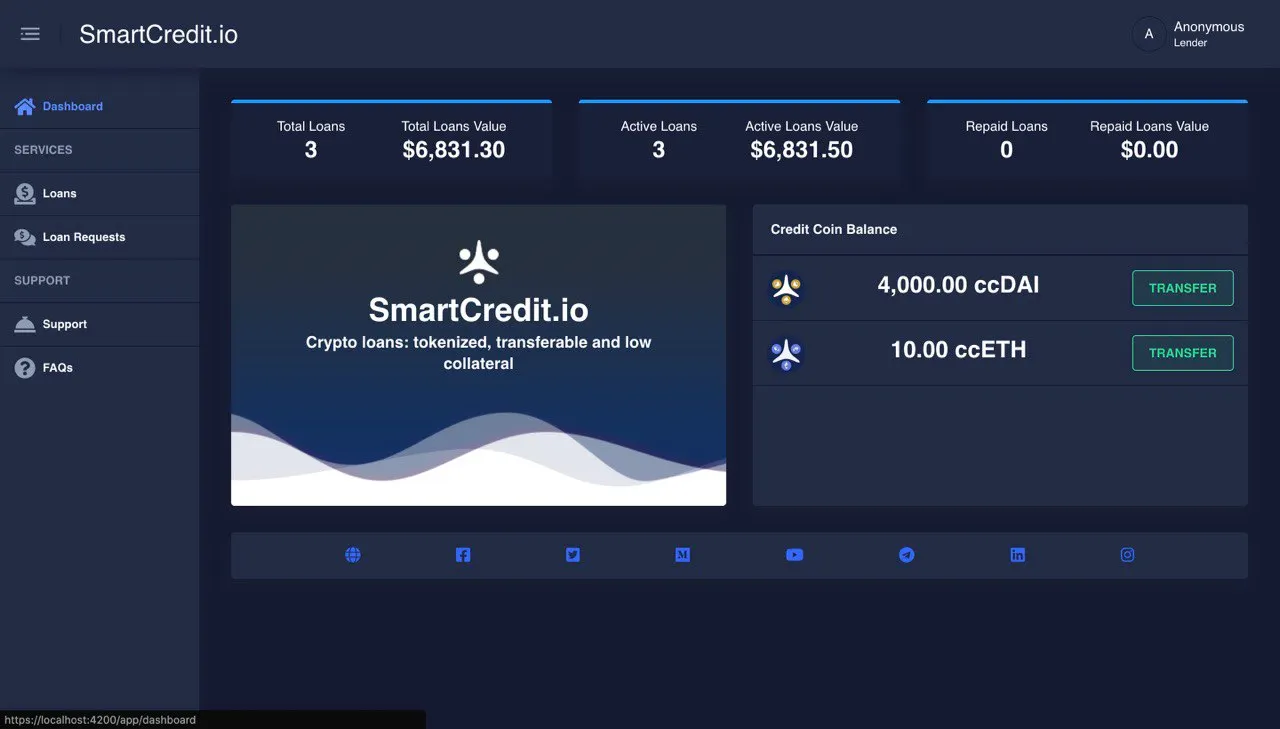

DeFi lending today is based on pooling, fluctuating interest rates, and variable loan terms. SmartCredit.io argues it’s time to move to fixed-term, fixed-interest loans — just as traditional finance did, where fixed income funds are 10x larger than money-market funds.