How much should be the Bitcoin price? In January 2014 we forecasted the Bitcoin price valuation of 10вҖҷ000 USD in the Swiss CFA Charter Magazine. The Bitcoin price reached a record high of $19,850 in December 2017. Given the hype surrounding the value of Bitcoin, what could we expect Bitcoin price to be in the future?

The Bitcoin price can be derived from the following:

- The store of value, like gold and other real assets

- Means of payment

- (Future) provider of smart contracts platform for disintermediation of todayвҖҷs big corporations.

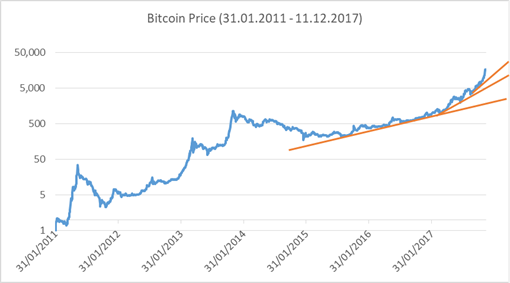

Bitcoin Price Development

The following graph shows the Bitcoin price on a logarithmic scale вҖ“ we see exponential Bitcoin price development. We see as well, that itвҖҷs moving too fast up, so the correction is expected in the next months.

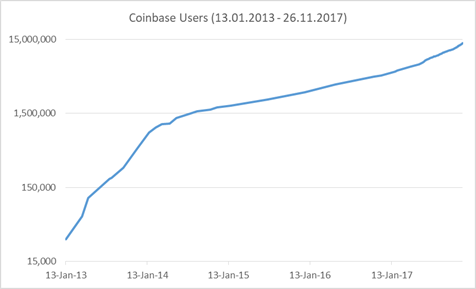

Number of Users in Crypto Sphere

Most users of Bitcoin will use the currency through the use of an вҖҳinternal blockchain walletвҖқ on the Exchange (e.g. Bitfinex, Bitstamp, Coinbase, etc.) rather than an вҖңexternal bitcoin walletвҖқ in the blockchain. After getting more experienced in Crypto, we expect these users will create their wallets on the public Bitcoin blockchain. In this situation, they will be real owners of their Bitcoins (as opposed to having a claim with the Exchange who owns the private keys for the Bitcoins).

There are no user numbers available for Bitfinex which is the largest crypto exchange. However, data is available for Coinbase (also known as GDAX), which is the second-largest crypto exchange вҖ“. Coinbase is growing at the moment by 50вҖҷ000вҖ“100вҖҷ000 users per day. The following graph shows the number of Coinbase users. The graph is on a logarithmic scale and so the straight line shows exponential user growth:

Coinbase trades 10% of the total global Bitcoin volume and there are over one hundred exchanges. If Coinbase is growing 50вҖ“100,000 users per day and blockchain.info by 50вҖ“80,000 users per day, then we estimate conservatively daily growth rate of 200,000вҖ“300,000 users per day (users usually register not only on one exchange but multiple exchanges).

We estimate approximately 20 million direct users of Bitcoin blockchain and an additional 15 million users who use Bitcoin through their exchange wallets. Not all of these users own Bitcoins many of them have moved into other cryptocurrencies. Many of the users own more than one address as well and we estimate 35 million active cryptocurrency users at the moment.

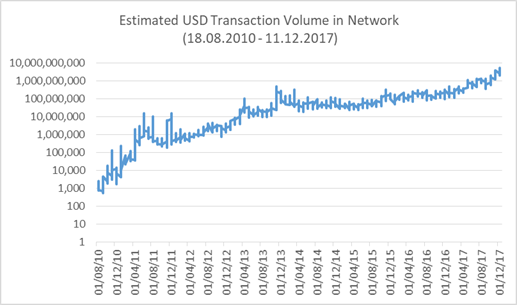

Transaction Volume

On 11.12.2017 there were approximately 400вҖҷ000 transactions on the network and the total transaction value was 4.3 Billion USD. The following graph shows transaction volume on a logarithmic scale and exponential growth

Network Effect

One can see exponential growth in Bitcoin Price, in the number of Bitcoin users, and the transaction value over the Bitcoin blockchain.

To consider how to translate the growth into Bitcoin value, I consider the application of MetcalfeвҖҷs law, which states that the value of the network is not growing linearly but to the square of the number of users. The number of users has been growing more than two times every year. Currently, the network grows by 200,000вҖ“300,000 users per day. If we assume doubling the number of users of Bitcoin per year, this translates into value growth of two and four times.

Many cryptocurrency platforms (like Bitcoin and others) are instances of the вҖңnetwork economyвҖқ. These are not like traditional companies that grow through scale but where the value is linear to capital used. The network economy value is not driven by capital used and by scale effects but rather two parameters:

- Number of users

- Number of transfers/ relations/transactions between the users

Number of transactions

Bitcoin network received major re-design in August this year when the so-called SegWit protocol was initialized. The next step is to initialize the Lightning Network protocol. These protocols increase the throughput of the network by introducing вҖңtwo-layerвҖқ transactions. There are transactions on the main blockchain and light transactions settled later on the main network. This will lead to a massive increase in transactions on the Bitcoin network because current transaction fees which can exceed 50 USD are relatively expensive for users.

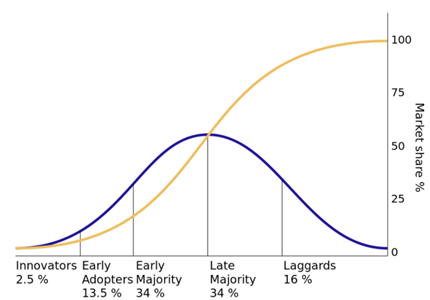

Adoption Curve

Every new technology such as fax, e-mail, internet, and even Bitcoin can follow the adoption curve. The following graph shows the Gauss bell-curve and the S-Curve, which both can be used for adaption.

Our analysis above estimates approximately 35 million active cryptocurrency users. The world population is 7.6 billion less young children, the elderly, and people in state institutions. And if we assume half of the world population would be potential Bitcoin users, this translates into a worldwide adaption rate of 1%.

However, we could expect most of the cryptocurrency users are in OECD countries and contribute to 80% of its use considering that 80% of the number of Bitcoin nodes are deployed in OECD countries. Given the OECD population is 1вҖҷ154 million, from which the economically active population is 700вҖ“800 million people, the OECD adaption rate is 3.5%.

This implies that the Bitcoin network has entered the early adopterвҖҷs phase on the S-Curve in OECD countries. This phase will be characterized by the development of real-world business use cases, by emerging вҖңkiller appsвҖқ and by increasing the rate of adoption.

Value Adding Services on the Bitcoin Network

Bitcoin is a highly secure network, but it does not support вҖңsmart contractsвҖқ, which are supported by about ten different crypto-platforms. Smart contracts allow us to build value-adding business applications on top of the crypto-platforms and generate additional usage on the platform. This translates into higher valuation given the value of the network depends on the number of nodes and the number of transactions on the network. For example, the Ethereum platform has thousands of so-called вҖңdecentral appsвҖқ which are often financed through Initial Coin OfferingsвҖҠвҖ”вҖҠICOвҖҷs.

However, through emerging sidechain technology it will become possible to connect Bitcoin with Smart Contract platforms such as the вҖңRootstock projectвҖқ. This would build вҖңdecentral appsвҖқ which are connected to Bitcoin blockchain security and translate into a higher number of transactions on the network and higher value.

The Coordination Problem in Economy

вҖңDecentral appsвҖқ offer the potential to build new business models through disintermediation. TodayвҖҷs big corporations, which enjoy oligopoly or monopoly positions have been built through solving the coordination problem with hierarchical and process-based methods rather than through a market mechanism outside of the banks.

If one is dealing with digital goods, like in banking, media, or insurance sectors, and if coordination mechanisms can be solved through blockchain and decentral app-based marketplaces, then the need for big corporations, as we know them today, will reduce.

Adam SmithsвҖҷ вҖңWealth of NationsвҖқ describes the model of free-market capitalism but was based on companies that would today classify as small companies. However, the coordination problem led to the emergence of large corporations, and through their oligopoly and monopoly market positions have moved away from the concept of free-market capitalism as defined by Adam Smith.

Disintermediation of centralized business models through blockchain and decentral apps will lead to significant value creation in new business models and at the same time to value the destruction of todayвҖҷs big corporations.

Bitcoin Price Estimation

We consider the valuation has three components:

Network value as a store of value

The number of Bitcoin users doubles every year and if we take the base price in 2017 at approximately 1вҖҷ000 USD, then the price by the end of 2018 should be 2вҖҷ000 and 4вҖҷ000 USD.

The current price is higher and will lead to a short-term correction over the coming months. However, by taking 3вҖҷ000 USD as the current fair price and projecting exponential growth of the network, the price in four years would be expected to be between 50вҖҷ000 and 750вҖҷ000 USD.

Network value based on the possibility to execute transactions between the users

The Bitcoin network has reached its current throughput limits. However full implementation of Segwit and Lightning protocols will lead to massive enablement of the smaller transactions on the network, which will increase the networkвҖҷs value.

This allows us to adjust the forecasted price in four years from 50вҖҷ000 to 80вҖҷ000 USD.

Network value through value-adding services on Bitcoin Network

The Internet boom beginning of this century focused first on technology (telecoms, broadband, etc.) and then emerging companies such as Facebook, Google, and Amazon. The same trend is happening in the crypto-sphere.вҖҠвҖҠThe current focus on underlying technologies will shift to network-based business models, which will result in newly created applications and lead to the major adoption of the platform.

Bitcoin enrichment with Smart Contract functionality facilitates further applications and will translate into additional Bitcoin network value increase at the same time.

This allows further adjustment of the Bitcoin price forecast in four years to 80вҖҷ000 to 100вҖҷ000 USD.

Summary

Blockchain technologies, which were first implemented with Bitcoin, will enable the вҖңCambrian explosionвҖқ of new blockchain-based business models, which started with simple use cases like вҖңstore of valueвҖқ and вҖңpaymentвҖқ. Adding вҖңdisintermediationвҖқ models allow real blockchain-based killer-apps, and a networked economy based business models. Bitcoin network will be the key beneficiary of this upcoming вҖңCambrian explosionвҖң.

Our forecast four years ago was that the Bitcoin price will be 10вҖҷ000 USD. Our new conservative forecast will be that the Bitcoin price will reach 100вҖҷ000 USD in the next four years.