SmartCredit.io Demo – our Application is available and everyone can use it – https://appv2.smartcredit.io

Before using it, let’s look at what the key problems are in crypto lending and how SmartCredit.io provides a solution to these problems.

Key problems in the Crypto Lending

- Too high collateral requirements – Maker and Compound have ca 350% – 400% collateral to the loan ratio. This means the borrowers can borrow little relative to their collateral

- Limited choice of collateral – Borrowers on Maker or Compound have limited choice of collateral (just 4 to 8 different ERC20) – i.e. borrowers don’t have an only high collateral ratio, but they have little choice of collateral too

- Variable loan maturities (loan terms) – as most of the DeFi solutions are based on the money-market-fund concepts, then loans are not fixed maturities, but variable maturities. Although this is easy to implement and convenient for the borrowers – this results in too high collateral requirements for the borrowers. Using fixed-term maturities would enable to reduce the collateral requirements

- Fluctuating interest rates – most of the DeFi solutions are implementing the money-market-fund concepts. Money market funds have fluctuating interest rates. There are always herd movements in the markets. If the market thinks Ethereum is moving up, then users are borrowing DAI to buy Ethereum. This drives the interest rate of Ethereum down and DAI up. If the market thinks that Ethereum is moving down, then users are borrowing Ethereum to short it. This drives the interest rate of Ethereum up and of DAI down.

- Other platforms would like to earn revenues with value-adding services for example via offering credit via an API to their clients and to earn additional revenues via this

- Investors would like to earn passive income

SmartCredit.io solution to the Crypto Lending

- Non-custodial lending – only borrowers/lenders control their assets; no-one else has access to the borrowers/lenders assets

- Smaller collateral requirements for the borrowers than the industry standard

- Wide choice of collateral for the borrowers

- Fixed-term loans – this allows borrowers to reduce the collateral requirements

- Fixed Interest loans – this protects borrowers and lenders aginst the herding movements on the markets

- Lenders receive loan tokens (Credit-Coins). Lenders can use these loan tokens as a mean of payment (loans are tokenized and transferable)

- Holders of Credit-Coins will receive interest for the loan tokens – Credit-Coins are interest-bearing to the holder

- Personal Fixed Income Funds, enable a passive income for passive investors

- Non-custodial API for the other platforms – wallets, payment engines, marketplaces.

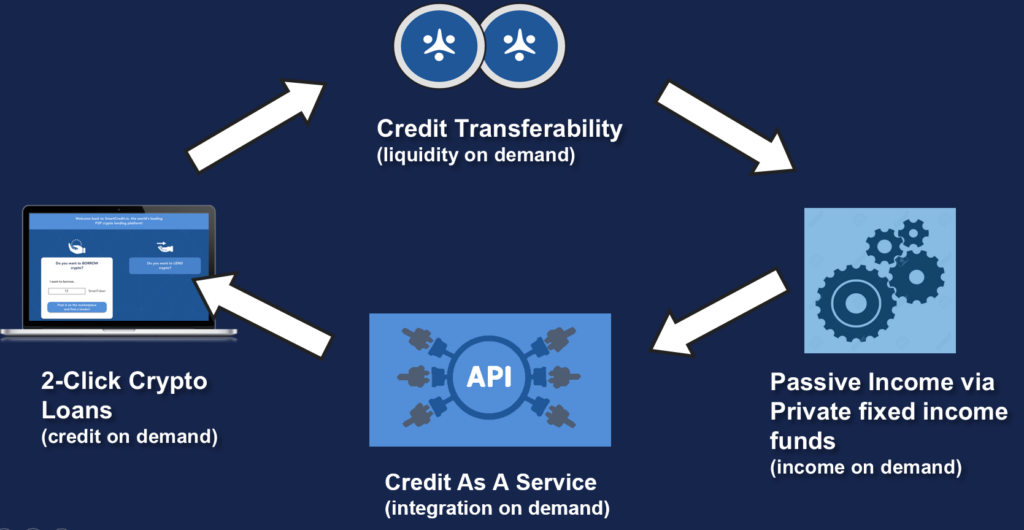

Self Re-Inforcing Ecosystem

Every marketplace needs to create supply and demand. SmartCredit.io ecosystem is doing this via four key components. The interplay of these components results in the self-reinforcements and positive feedback loop. These are the key components and the benefits to respective users:

- 2-click crypto loans to the borrowers

- Private fixed-income funds to the investors for earning passive income on their crypto holdings

- Credit tokenization and transferability to the lenders, so that they have immediate liquidity

- Credit As A Service API for other platforms, which want to offer credit to their users

The interplay of these components is visualized on the following picture:

Please note – the client will always be in control of his private keys. The platform can never control or influence client assets!

For more information about the SmartCredit.io Self Re-Inforcing Ecosystem have a look at our blog article.

SmartCredit.io Demo Scenario

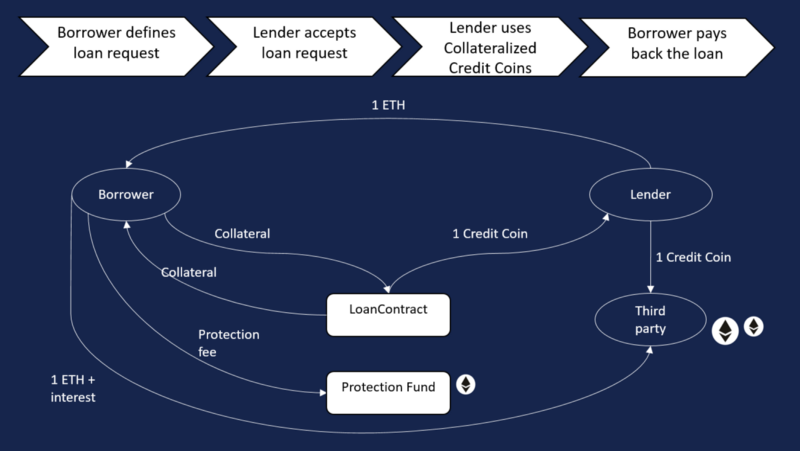

The demo videos below have 4 steps:

- Borrower defines loan request

- The lender accepts a loan request

- The lender uses collateralized credit coins

- The borrower pays back the loan

Detailed Video Overview

The video explains the concepts and shows the full demo. It’s 10 minutes long – enjoy:

How to use the system

- Go to the https://appv2.smartcredit.io

- Register in the platform

- Create two accounts — one for the borrower and the other one for the lender

- Use Google Chrome and Metamask

- Create in Metamask two accounts — one for the borrower and the other one for the lender

- Access http://appv2.smartcredit.io as a borrower

- Access http://appv2.smartcredit.io as a lender

If you have questions, please send us a message via https://smartcredit.io. Many thanks!