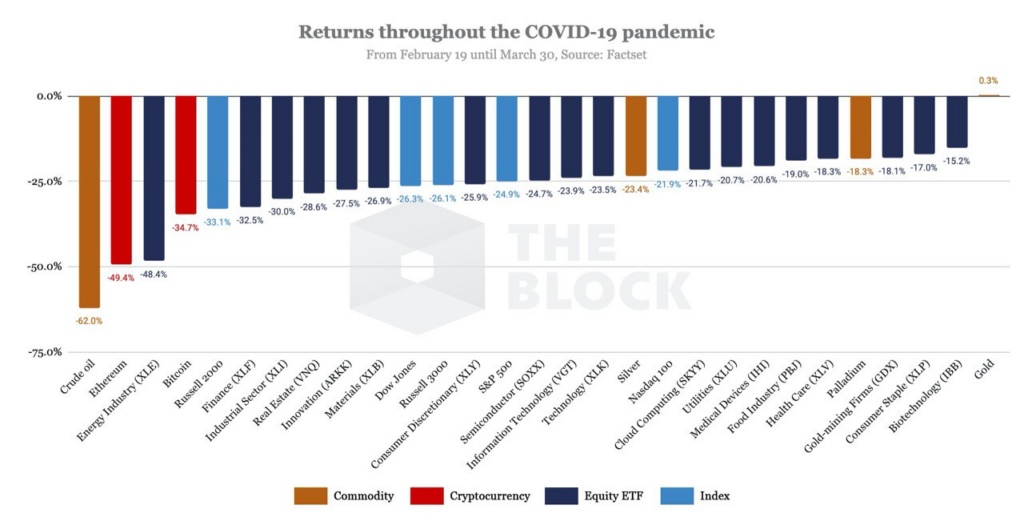

Coronavirus economic crash has followed the coronavirus lockdowns. The stock markets have crashed worldwide. It’s not only that the stock markets have crashed, but practically all asset classes have crashed:

Coronavirus crisis, rising unemployment, and economic crash cause fear. Many ask the question – is the economy going to crash? And if yes, then how close are we to total economic collapse? And how should we respond to the coronavirus crisis?

Every crisis is an opportunity. One needs to understand the root causes of the current market and to understand what will happen next. If one understands what is happening, then one will be able to respond.

We looked in the previous articles on the following topics and we recommend to read these articles for a better understanding of what is happening in the economy:

- Coronavirus and Bitcoin price – What’s next?

- Coronavirus crisis – Where to invest now?

- Blockchain-based financial system – Are we ready?

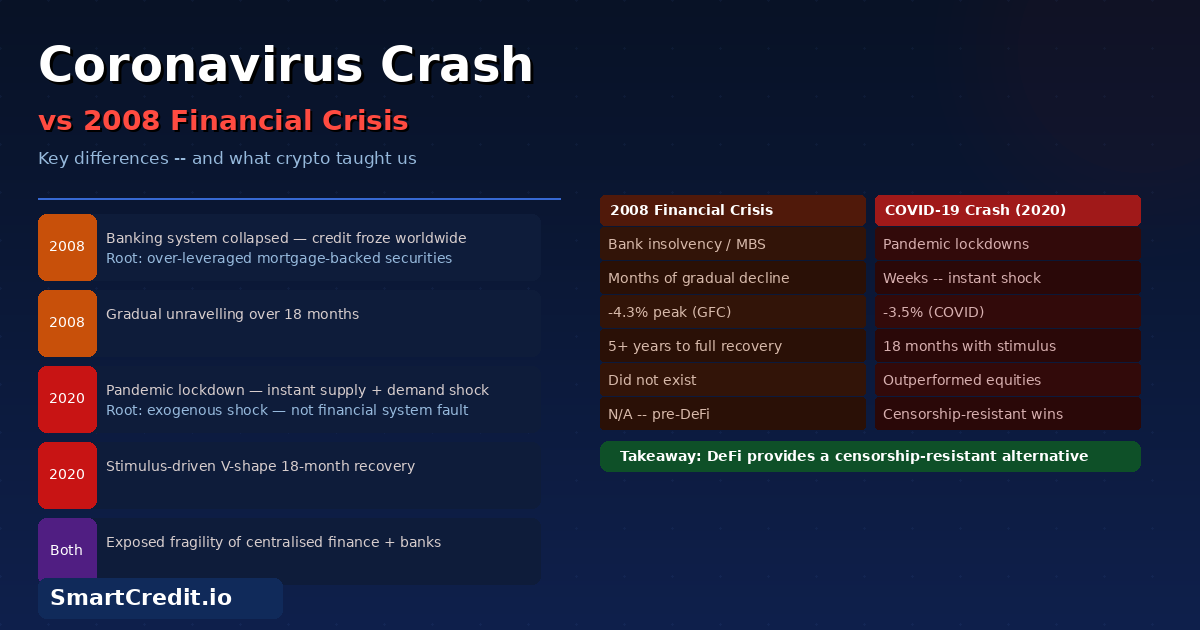

In this article, we compare the coronavirus crisis and the 2009 financial crisis. The 2008 financial crisis is the last financial crisis that many remember. But what is the difference between the 2008 financial crisis and the coronavirus economic crisis?

This article analyses the following:

- Where are we now?

- In which phases will the coronavirus economic crash play out?

- How did the 2008 financial crisis play out?

- What is the difference between the coronavirus crisis and the 2008 financial crisis?

- What’s next?

Please note, this is not financial advice. You need always to speak with your financial advisor before making any financial decisions.

Where are we now?

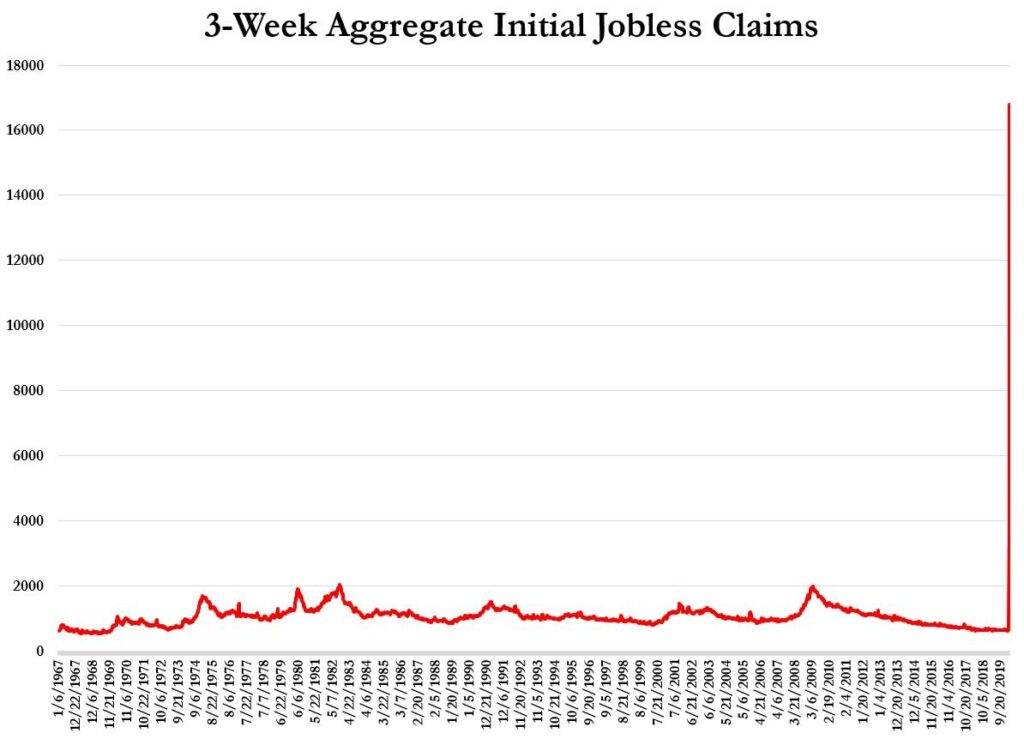

The U.S. new unemployment claims have a massive spike after the U.S. economy lockdown. U.S. total employment is ca 156 million. Within 3 weeks we have 10% of them registered as unemployed:

Why are the unemployment numbers important – because 70% of OECD economy is consummation driven. More unemployment means less GDP, which means the demand for the economy.

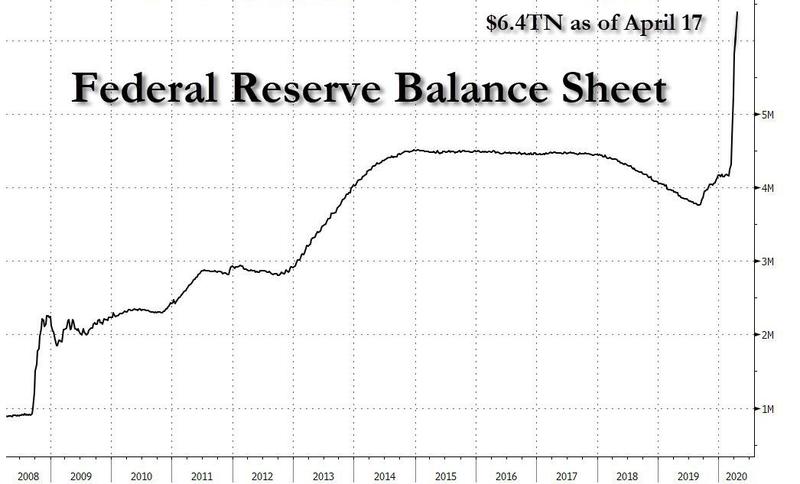

Federal Reserve has announced 2.206 trillion USD base-money creation, which is in total 59% of Federal Reserve’s balance sheet till now. Additionally, Federal Reserve announced a 4 trillion USD base-money stimulus for the corporates. This would result in a total in 150% growth of the USD base-money within the months. ECB has announced 0.75 trillion EUR base-money creation. They call it a “package” or “liquidity injection”, but in reality, it is the creation of new base-money.

Here is the growth of the Federal Reserve balance sheet (hint: we see significant growth …):

40 central banks in total have reduced their base interest rates or have launched the next phase of monetary expansion. The newly created base-money will be pushed into the economy via the banks. However, as the balance sheets of the banks will deteriorate, then we doubt that banks will help push this newly created base-money into the real economy.

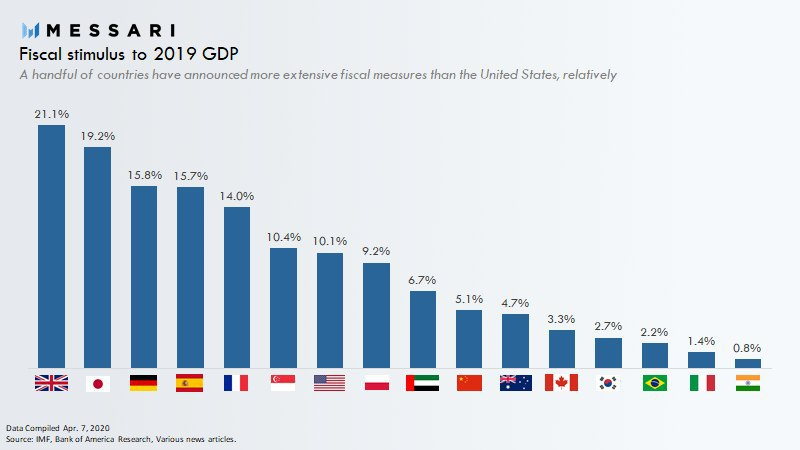

G20 countries have launched fiscal support programs in the size of 6% of the GDP.

And 80 countries have already requested emergency assistance from the International Monetary Fund…

This all means we are in a deep recession by now.

The stock markets have been waiting for a crash for several years. There have been some incidents on the markets, but the central banks have absorbed them with their standard tool – create more base-money and patch with the newly created base-money the places, where the markets start to blow off.

Central banker’s understanding of the networked financial markets is much better than it was during the Lehman crisis in 2007/2008. When the “repo crisis” started in September last year and culminated in December last year, then the central banks were fully committed to using their standard tool – creating more base-money.

However, the central bankers were prepared for everything except a black swan event of the coronavirus.

The declaration of the worldwide pandemic by WHO, the lockdowns, and the fear of people became the black swan event. The central bankers responded with their usual toolset (create more base-money), but they were not prepared for the scale of this event.

Our current event is not a monetary crisis, it’s a shock on the supply lines – the internetworked economy cannot deliver if just-in-time delivered parts are not available. And because of the supply shock, we get the demand shock on the economy, which leads to the deflationary environment.

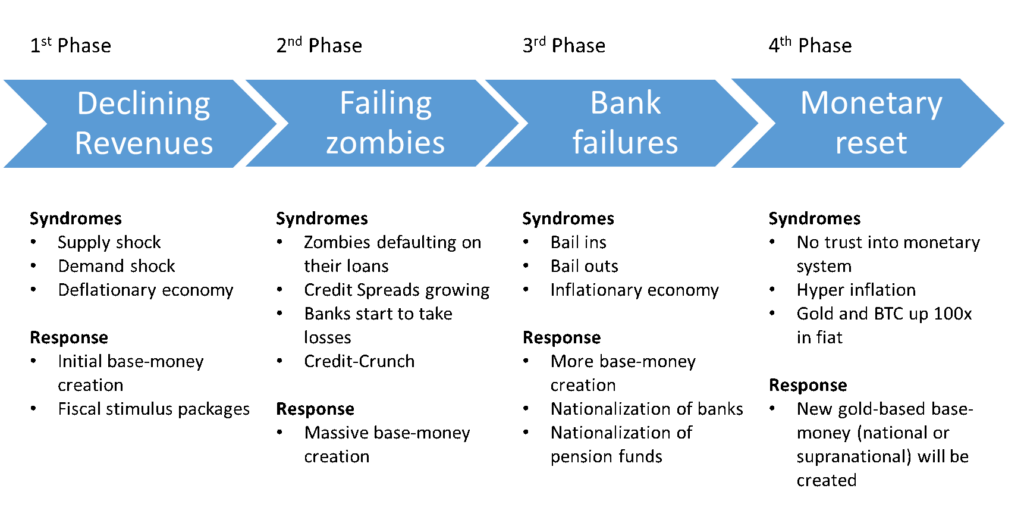

This economic shock will play out in the following way:

1st Phase – Declining revenues (we are here)

As the demand is declining, then the revenues of the companies will start to decline too. This leads to the decline in their earnings, which will then lead to the decline of their stock price. That’s the logical reasoning of the current stock market crash.

2nd Phase – Failing zombies

The quantitative easing (the creation of the new base-money by the central banks) has created in the last 10 years an army of the zombie companies. These companies are not able to cover their capital costs in the normal interest rate environment, their operational revenues are too small for this. These companies can exist now only in the current very low-interest-rate environment. If their interest rates would grow or if their revenues would decline, then they will end up in the bankruptcy.

The interest rate for the corporate credit will start to grow – because the banks are aware of the situation of the zombie companies, so the banks just start to charge more interest (higher risk premium). We will get a situation, where banks will start to give less credit to the economy, which results in the continuous defaults and bankruptcies of the zombie companies.

3rd Phase – Bank Failures

These bankruptcies will create the losses to the banks – the banks have loss provisions, but the anticipated losses from these zombie companies will be magnitude higher than the loss provisions. The banks have to pay these losses with their equity. As a result, the banks will start to give even less credit to the economy, there will be credit-crunch and this will lead even more zombie companies into the bankruptcies…

The banks will receive bail-in and bailout. However, there will be no more funds available after the excessive fiscal stimulus. This leads to even more massive base-money creation, which will be more as we see now.

The result will be the nationalization of the banking sector. The nationalization of the pension funds will follow. The taxes will be significantly increased as governments are looking for the funds. This will be the wealth transfer from the middle class to the government balance sheet black hole.

4th Phase – Monetary reset

Gargantua base-money creation will result in the hyperinflation, people will stop using the fiat currencies and they will move into the alternate blockchain-based financial system. The government will not tolerate this and they will respond with the monetary reset – the introduction of a new monetary system.

The next monetary system will be probably gold-based – gold still implies trues. As central banks possess still significant amounts of gold in their balance sheets and as the gold price will grow significantly due to the monetary debasement, then central banks will be well equipped to launch the new gold-backed monetary system.

How did the 2008 financial crisis play out?

In comparison – the 2008 financial crisis played out first in the banking sector and entered after that the real economy. It started with the subprime mortgage crisis, which triggered the collapse of Lehman Brothers in 2008.

The subprime mortgages took massive losses in the value, which created the holes in the banks’ balance sheets. The Credit Default Swap prices exploded and the investment banks, which were issuing them, had to cover the losses and created even bigger holes in their balance sheets.

This created the situation, where the banks did not trust each other. No one knew the exposures of their counterparties. Banks stopped lending money to each other and the interbank market came to still stand …

The central banks responded with massive bailout programs for the banks, the banks could lend their bad assets forever to the central banks, which handed over freshly created new base-money to the banks.

However, the credit-crunch followed, the banks started to push less credit into the economy and this took down the economies of most countries. Increased lending requirements resulted in the default of many mortgages and of the foreclosures. High unemployment followed.

The credit crunch was followed by falling stock prices. This created a negative wealth effect – growing stock prices stimulate consummation and vice versa. As most of the OECD economy’s GDP is created via the consummation, then the GDP started to shrink.

This resulted in fiscal stimulus programs from all bigger economies – the governments added massive debt and used this freshly created credit-money for the state programs, which were supposed to fill the gap in the consummation.

The key difference between the coronavirus crisis and economy collapse 2008 is the nature of the shock:

- Supply shock triggered the coronavirus crisis. Initial supply shock translated into the demand shock, which translates into a deflationary shock

- Subprime mortgages triggered the financial crisis of 2008. Subprime mortgages lost their value, and as a next, the banking crisis followed

The financial crisis of 2008 was at the first hand the banking crisis, which translated into the economic crisis because the banks started to lend less and less. The credit-crunch followed. The response to the financial crisis of 2008 was the typical response to the banking crisis – banks received fresh cash from the central banks and banks could hand over their bad assets to the central banks without discount.

The financial crisis of 2008 was contained by the central banks. However, the credit crunch followed, the 2008 recession followed and after two years the economy started growing again.

The difference between the coronavirus crisis and the 2008 financial crisis is that there is no banking crisis yet, but there is a crisis in the real economy. It’s because the real economy has stopped working, it’s in the resulting supply shock and the resulting demand shock. The 3rd Phase of the coronavirus crisis will be the banking crisis, however, the first two phases play out in the real economy.

The coronavirus crisis will be the crisis of the real economy, and this crisis will be deep. The financial crisis of 2008 developed fast, but the central banks contained it. Spillover to the real economy followed, but the banking crisis was contained.

It’s easier to contain the banking crisis versus the real economic crisis. There is a limited number of banks and central banks monitor the balance sheets of these banks in real-time. Additionally, there are central banking standard response mechanisms for the upcoming recessions.

However, containing real economic crisis is much more difficult – we are speaking of the globally interconnected enterprises via the supply chain networks. But, the choreography of these supply networks has been highly optimized. However, parts of this interconnected network have stopped working by now. And the other parts will reduce their output because of the missing demand.

On top of this, the credit crunch will follow. As a result of this, overleveraged companies start to fail. The interest and principal payments of these companies are too high compared to their revenues. All this results in declining demand. The deflationary shock will follow. Restarting the economy from this deflationary shock will take time.

The faster the zombie companies will fail, the faster the cleanup process in the economy, resulting in the faster the recovery. The slower the zombie companies will fail – for example, because of the massive fiscal stimulus packages – the longer it will take to recover the economy.

What’s next?

The coronavirus economic crash impact will be bigger than the financial crisis of 2008 impact because it will be a simultaneous crisis of the real worldwide economy and not a contained banking crisis. The economy will enter into the deflationary cycle. This deflationary cycle will clean all the miss-investments of the last 20 years and especially of the last 10 years since the 2008 financial crisis. This cleanup process will take 18-24 months.

Our coronavirus economic crash phase model forecasts that the central banks will respond with massive money printing to the upcoming deflationary cycle (because the governments are so high in the debt, that they are unable to borrow plus there will be credit-crunch). This money printing will lead to significant inflation, which will evaporate the trust in the fiat currencies.

The upcoming monetary reset will be accompanied by a total economic collapse. We will see massive wealth transfers and the savings of the middle class will evaporate. The value of the pension funds will deteriorate, and real estate prices will collapse. The illusion of wealth will disappear. This will be painful, but this will be necessary after the fiat money orgy, which started with the gold-decoupling of U.S. dollars in 1971.

So, how should we position ourselves in this situation? What should we do as next? We recommend the readers to look on these articles:

- Coronavirus and Bitcoin price – what’s next?

- Coronavirus crisis – Where to invest now?

- Blockchain-based financial system – Are we ready?

We recommend the readers to analyze the situation and the facts. And please consult with your financial advisor before making any investment decisions.