The landscape of decentralized finance (DeFi) has evolved dramatically over the past few years, with artificial intelligence emerging as a transformative force in how we approach trading, risk management, and asset protection. AI trading agents are no longer futuristic concepts—they’re actively reshaping the financial ecosystem, bringing unprecedented levels of automation, precision, and security to both individual traders and institutional participants.

As DeFi platforms continue to mature and attract billions in total value locked (TVL), the need for sophisticated risk management tools has never been more critical. Traditional manual approaches to monitoring positions, managing collateral, and executing liquidations simply cannot keep pace with the 24/7 nature of cryptocurrency markets. This is where AI trading agents step in, offering a solution that combines real-time data analysis, predictive modeling, and autonomous decision-making.

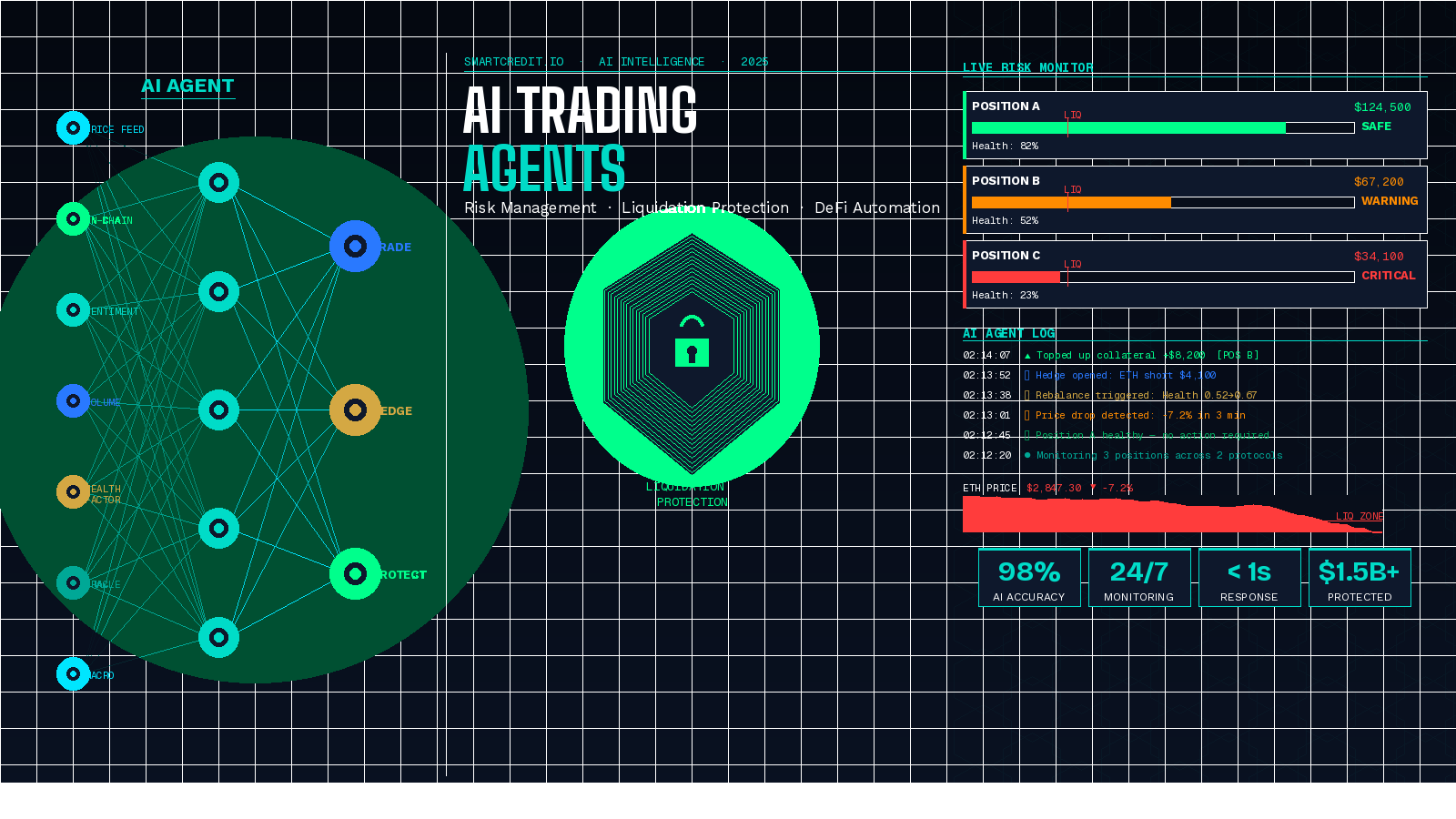

Understanding AI Trading Agents in the DeFi Ecosystem

AI trading agents are sophisticated software systems powered by machine learning algorithms that can analyze market conditions, execute trades, and manage risk parameters without human intervention. Unlike simple trading bots that follow predetermined rules, AI trading agents continuously learn from market patterns, adapt to changing conditions, and optimize their strategies based on historical performance data.

These agents leverage various AI technologies including neural networks, reinforcement learning, and natural language processing to interpret market signals. They can process vast amounts of data from multiple sources—price feeds, on-chain analytics, social sentiment, news events, and macroeconomic indicators—all in real-time. This comprehensive approach allows them to identify opportunities and risks that human traders might miss.

In the DeFi context, AI trading agents serve multiple functions beyond simple buy-and-sell operations. They monitor lending positions, manage collateral ratios, optimize yield farming strategies, and most importantly, protect users from liquidation events through proactive risk management.

The Critical Role of Risk Management

Risk management in DeFi presents unique challenges compared to traditional finance. The permissionless nature of blockchain networks, combined with high volatility and complex protocol interactions, creates an environment where risks can materialize quickly and cascade across platforms. A sudden price movement can trigger liquidation events that affect thousands of positions simultaneously, leading to substantial losses for unprepared participants.

Effective risk management requires constant vigilance and rapid response capabilities. AI trading agents excel in this domain because they never sleep, never experience emotional decision-making, and can process information at speeds impossible for human traders. They monitor health factors, collateralization ratios, and market volatility indicators continuously, adjusting positions before problems arise.

These systems employ sophisticated risk models that consider multiple variables simultaneously. They assess correlation risks between different assets, evaluate protocol-specific risks related to smart contract vulnerabilities or governance changes, and factor in broader market risks related to regulatory developments or macroeconomic shifts. By maintaining a holistic view of risk exposure, AI trading agents can make informed decisions about position sizing, leverage levels, and hedging strategies.

One particularly valuable aspect of AI-driven risk management is scenario analysis. These agents can simulate thousands of potential market scenarios, stress-testing portfolio positions against various outcomes. This allows them to identify vulnerabilities before they become actual problems and implement protective measures proactively rather than reactively.

Automated Liquidation: Protection Through Prevention

Liquidation is perhaps the most feared event in DeFi lending and borrowing. When a borrower’s collateral value falls below the required threshold, their position is automatically liquidated to protect lenders from losses. While this mechanism is essential for protocol solvency, liquidations can be devastating for borrowers who lose their collateral and often face additional liquidation penalties.

Traditional approaches to avoiding liquidation rely on manual monitoring and timely intervention—a strategy that’s prone to failure due to human limitations, especially during volatile market conditions or when users are unavailable to respond. Automated liquidation protection through AI trading agents offers a far more reliable solution.

AI trading agents implement automated liquidation prevention through several mechanisms. First, they continuously monitor the health factor of lending positions, tracking how close each position is to the liquidation threshold. When risk levels increase, they automatically top up collateral by transferring additional assets or reducing debt by repaying portions of the loan. This proactive approach maintains a comfortable buffer above liquidation levels.

Second, these agents can execute sophisticated hedging strategies to offset price risk. If a user has borrowed against volatile collateral, the AI agent might establish opposing positions in derivatives markets or other protocols, creating a natural hedge that stabilizes the overall position value regardless of price movements.

Third, AI trading agents optimize the timing and sizing of protective actions. Rather than maintaining excessive collateral at all times (which reduces capital efficiency), they dynamically adjust buffer sizes based on current market volatility, upcoming events that might affect prices, and the user’s risk tolerance preferences. This optimization allows users to maximize their capital utilization while maintaining adequate protection.

During extreme market events, AI trading agents can implement emergency protocols. They might rapidly unwind positions across multiple protocols, execute complex multi-step transactions to rebalance portfolios, or temporarily shift assets to more stable positions until volatility subsides. These complex operations would be nearly impossible to execute manually during times of market stress.

Machine Learning and Predictive Analytics

The most advanced AI trading agents incorporate machine learning models that improve their performance over time. These systems don’t just react to current market conditions—they predict future movements and position accordingly.

Predictive models analyze historical price patterns, trading volume trends, order book dynamics, and numerous other factors to forecast short-term price movements. While no model can predict the future with perfect accuracy, even modest improvements in predictive capability translate to significant advantages in risk management and liquidation prevention.

Natural language processing models scan news sources, social media, and community forums to gauge market sentiment and identify potential catalysts before they’re fully reflected in prices. This early warning system allows AI agents to adjust positions ahead of major market moves.

Reinforcement learning algorithms allow AI trading agents to optimize their strategies through trial and error in simulated environments before deploying real capital. They learn which actions lead to the best outcomes under various conditions, developing nuanced decision-making capabilities that improve continuously.

Integration with DeFi Protocols

For AI trading agents to function effectively, they must integrate seamlessly with DeFi protocols. Most advanced agents interact with multiple protocols simultaneously, allowing them to optimize positions across the entire DeFi ecosystem rather than being confined to a single platform.

These integrations involve interacting with lending protocols like Aave, Compound, and Maker, accessing liquidity on decentralized exchanges such as Uniswap and Curve, utilizing derivatives platforms for hedging, and leveraging cross-chain bridges to access opportunities on multiple blockchains. The ability to execute complex multi-protocol strategies is what sets sophisticated AI trading agents apart from simple automation tools.

Smart contract interactions present both opportunities and risks. AI agents must be programmed with deep understanding of protocol mechanics, including how flash loan attacks might be executed, how oracle manipulations could affect positions, and how protocol upgrades might impact existing strategies. Security is paramount, as any vulnerability in an AI agent’s smart contract interactions could be exploited by malicious actors.

Real-World Applications and Case Studies

The practical impact of AI trading agents can be seen across various DeFi use cases. Yield farmers use these agents to automatically migrate capital between protocols as yields shift, optimizing returns while managing risks associated with smart contract vulnerabilities and impermanent loss.

Large liquidity providers deploy AI agents to manage their positions across multiple pools, automatically rebalancing when price ranges shift and protecting against loss of funds during extreme volatility. These agents help maintain capital efficiency while minimizing downside risk.

Institutional participants increasingly rely on AI trading agents to manage substantial DeFi positions that would be impractical to monitor manually. These systems provide the enterprise-grade risk management and reporting capabilities that institutions require while operating within the decentralized environment.

Individual users benefit from AI trading agents that act as personal financial advisors, automatically optimizing their DeFi portfolios based on predefined risk parameters and financial goals. These agents democratize access to sophisticated trading strategies previously available only to professional traders.

Challenges and Considerations

Despite their advantages, AI trading agents face several challenges. Smart contract risk remains a concern—even the most sophisticated AI agent cannot fully protect against protocol exploits or vulnerabilities. Users must carefully evaluate the security of both the AI agent itself and the protocols with which it interacts.

Over-optimization presents another risk. AI models trained on historical data may develop strategies that worked well in past market conditions but fail when market dynamics change. Robust AI systems must incorporate safeguards against overfitting and maintain adaptability to new market regimes.

Regulatory uncertainty affects how AI trading agents can operate, particularly regarding compliance with emerging cryptocurrency regulations. As the regulatory landscape evolves, these systems must be designed with flexibility to adapt to new requirements.

Cost considerations also matter. Operating AI trading agents involves transaction fees, particularly on Ethereum mainnet where gas costs can be substantial. Users must ensure that the benefits of automated management outweigh the operational costs.

The Future of Intelligent Risk Management

Looking ahead, AI trading agents will become increasingly sophisticated and accessible. We can expect to see more advanced models that incorporate additional data sources, more nuanced risk assessment capabilities, and improved predictive accuracy.

Cross-chain AI agents will become standard, seamlessly managing positions across multiple blockchains and layer-2 solutions. This will allow users to access the best opportunities regardless of where they exist while maintaining unified risk management across all positions.

Collaborative AI systems may emerge, where multiple agents share insights and coordinate actions to benefit communities of users. These systems could identify systemic risks before they materialize and coordinate defensive actions across thousands of users simultaneously.

Integration with traditional finance will likely increase as the boundaries between DeFi and TradFi blur. AI trading agents might manage hybrid portfolios that span both ecosystems, optimizing for opportunities in each while maintaining balanced risk exposure.

Conclusion

AI trading agents represent a fundamental evolution in how we approach DeFi participation. By combining real-time monitoring, predictive analytics, and autonomous execution, these systems address the most critical challenges facing DeFi users: managing risk effectively and protecting against liquidation events.

The integration of artificial intelligence into DeFi risk management isn’t just about automation—it’s about creating systems that are more resilient, more efficient, and more accessible than what preceded them. As these technologies mature, they will play an essential role in DeFi’s continued growth and mainstream adoption.

For users, the message is clear: the complexity of modern DeFi demands sophisticated tools. AI trading agents provide the intelligence, speed, and reliability necessary to navigate this ecosystem successfully. Whether you’re an experienced trader managing substantial positions or a newcomer seeking to participate safely in DeFi, these intelligent systems offer protection and optimization that manual approaches simply cannot match.

The future of DeFi is intelligent, automated, and secure. AI trading agents are leading this transformation, one optimized position at a time.

Follow us on Social Media

- Twitter: https://twitter.com/smartcredit_io

- Gitbook: https://learn.smartcredit.io

- Telegram: https://t.me/SmartCredit_Community