Here is the video recording of our pitch for the SmartCredit.io Investors from the Swiss Fintech Investor Day in Zurich:

If you have only 10 seconds — here is the 10 seconds version for SmartCredit.io investors:

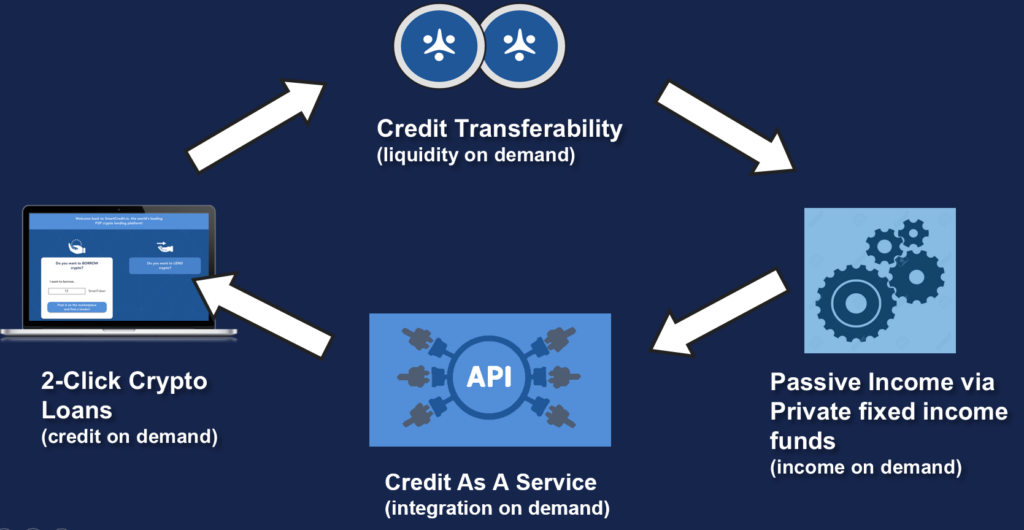

SmartCredit.io is offering:

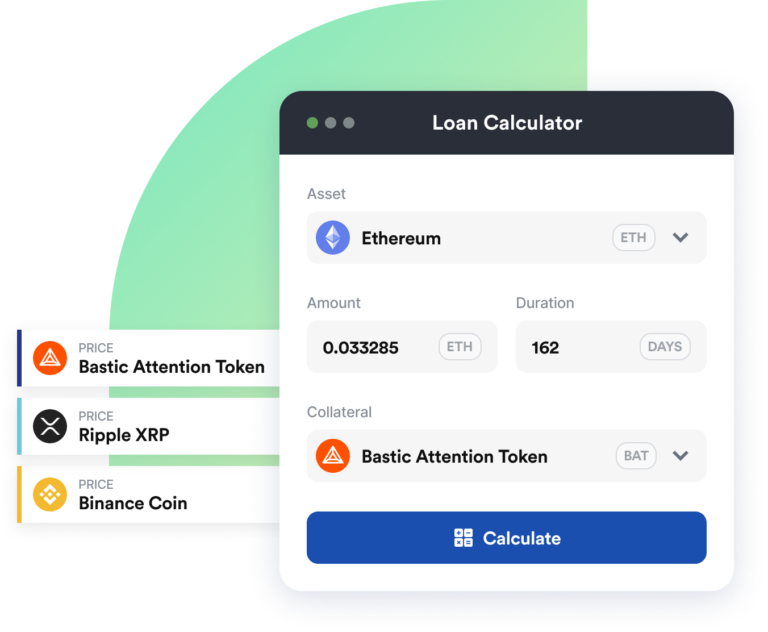

- 2-Click Crypto Loans (credit on demand)

- Credit Transferability (liquidity on demand)

- Passive Income via Fixed Income Funds (income on demand) and

- Credit As A Service API (integration on demand)

What’s the USP of SmartCredit.io?

SmartCredit.io Investors should ask – what is the Unique Selling Proposition of the crypto lending platform? Here we are:

- Non-custodial lending – only borrowers/lenders control their assets; no-one else has access to the borrowers/lender’s assets. An additional advantage of non-custodial lending is the regulatory simplification

- Borrowers to have 2x – 3x smaller collateral requirements

- Borrowers to have a wide choice of collateral

- Lenders to receive loan tokens after approving the loans. Lenders can use these loan tokens as a means of payment (loans are tokenized and transferable). Or the loans can be transferred and packaged into the Private Fixed Income Funds

- Passive Investors will have “Private Fixed Income Funds” – they just define the investment rules. All the investment process after that is automated.

- Holders of the loan tokens (ccETH, ccDAI, etc) will receive interest for the loan tokens (credit-coins are interest-bearing to the holder)

- Non-custodial API for the other platforms – wallets, payment engines, marketplaces – all of them can integrate Credit As A Service API

What is the Crypto Lending Market?

Crypto lending market segmentation

There are 3 main channels for crypto lending:

- Crypto Exchanges margin lending/borrowing. Crypto exchanges are the biggest player in the lending market. They offer the margin lending – that’s for the traders, which can leverage their positions via the margin lending. For example, the trader puts down 1 Bitcoin as collateral, he borrows 3 Bitcoins against this collateral and he has to pay daily interest for these 3 Bitcoins. This will take a long position with these 3 Bitcoins. When the market goes up, then the trader will earn a profit. However, when the market goes against his trades, then the traders’ positions can be liquidated.

- Custodial Lending Platforms (Nexo, Celsius, Genesis Capital) – they control your private keys (i.e. they control your assets). Some of them lend fiat (Nexo) and the others lend crypto (Celsius)

- Non-Custodial Lending Platforms (Maker, Compound, Ethlend, SmartCredit.io) – they do no control your private keys (i.e. they do not control your assets). The assets are kept in the smart contracts, which are un-accessible for the platforms. These smart contracts define when the collateral is moving back to the borrower or not. That’s the huge difference to the segment (1) and segment (2), which both control client assets.

Key use cases for crypto lending

- Using loans for trading – ca 80% of the market will feed into the crypto exchanges. Traders use their collateral to get the loans, because either the crypto exchanges do not support these collaterals or traders get better terms via crypto lending

- Liquidity creation – instead of selling crypto, which in most countries would be a taxable event, the users would rather monetize their crypto-assets via using them as collateral for the loans. This is approximately 15% of the market

- Crypto economy – borrowing crypto for using it in the crypto- sphere – 5% of the market

Market size

We estimate the market size of custodial and non-custodial lending platforms ca 20 Billion USD.

- Graychain estimated in Q2 2019 the crypto lending market size as 4.7 Billion USD (Source: https://reports.graychain.net/TheCryptoCreditReport-q2-2019.pdf)

- Celsius has originated loans for 4.25 Billion USD in 2019 (Source: https://www.prnewswire.com/news-releases/celsius-hits-4-25-billion-in-originated-crypto-loans-setting-the-bar-for-crypto-lending-industry-300956493.html)

- Genesis Capital did loans of 3.1 Billion USD in 2019 (Source: https://genesiscap.co/insights/q4-insights-2019/)

This results approximately in 20 Billion USD market size.

Transcript for SmartCredit.io Investors

Hello, I am Martin. I’m Co-Founder and CEO of SmartCredit.io. We are a crypto credit marketplace and we are creating programmable elastic crypto credit money.

Let’s start with the use-case. It’s about credit-markets. On one side we have Luiza from Poland, she needs credit. On the other side, we have Walter from Germany, 48 years old, established, a little bit gray hair – lucky one who invested early into the Ethereum.

These are the wants – by putting all these wants together we will get the crypto-currency credit-market. And it’s a global credit market for lending and borrowing.

What are the problems? We see the two key problems:

-

The first one: the current market, as it’s implemented is very over-collateralized. It’s a margin calls market with a very high probability of margin calls. We call it the cripple credit market. Although it’s a cripple credit market – the lending volume has been 1 Billion USD.

-

The second problem – if we speak of lending, if we speak of commercial banking, there is always the question – it’s lending and it’s creating money. In Switzerland, 97% of the money has been created by commercial banks.

Let’s look at the Federal Reserve. It provides the base-money supply and on top is the credit-money. Let’s look at ECB – it provides the base-money and on top of it the credit-money. The same in Switzerland.

The big question is – how is it working in the crypto sphere, who will create the credit-money for the crypto sphere. Are the commercial banks creating credit-money for the crypto-sphere or is the crypto-economy creating the crypto-sphere crypto-money? That’s where we are.

Let’s speak of the past. The credit-money has been there for 5’000 years. Created first in Mesopotamia, used in Phonecia, used in the Hanseatic network, in many times in history. It has been decentrally created credit-money. That’s what we want to achieve.

So, our solution – SmartCredit.io – is a two-step system – from one side decentral credit marketplace for ether and stable coin lending; from another side, we are creating programmable elastic crypto credit-money in the lending process – we call it Smart Money tokens.

What does this programmable elastic credit money mean? Concerning all our competitors – there are two boxes here – and all our competitors are here in the left box – they are lending, borrowing, they are just intermediating between them (between the lender and borrower).

On the right side, there is a bigger box – that’s where we are. That means we are in all these together – we are a marketplace and we are creating liquidity for the lenders, which they can pass on to the next persons, and so on and so on. We are creating decentral credit money.

So, how does it then work in the crypto? We take the loan agreements, we tokenize them, and these tokens can be passed on to the next persons, One Smart Money token is worth at least one Ether or one stablecoin, underlying currency, which we are using. We have a protection mechanism, it’s a decentral community-based protection mechanism. And this means the Smart Money tokens can be passed on to the next parties, next parties, next parties – we are creating credit supply for the lenders.

The market – there are now 130 million crypto users, by the end of this year it’s 150 million, by the end of next year it’s 500 million. It’s an exponentially growing market. We are focussing on millennials – these are 55% of this. And from them, it’s 10%, who have the financing needs. So, our market size is like 6 million people and exponentially growing.

Our Competition – with all respect to our competition – we did a lot of number crunching – the existing business models are over-collateralized, there are long processes, there are no insurance or protection mechanisms, no-one is providing the crypto credit-money. We are doing all of this. That’s a small difference.

The Go-To-Market – it’s three pillars. The first one is the community. If we are building decentral systems, then everything is about the community. We are building it through he ICO marketing, we are building it via airdrops, community market. Second, it’s viral marketing – because Smart Money tokens are free marketing for us. It’s are the lenders who are doing marketing for us, to create liquidity for themselves. The third one – the credit marketplace – it fits with any wallet, with any marketplace, it’s an integration.

Our Roadmap – we started one year ago. We have our Whitepaper, we have our Pilot running, actually now the Pilot Phase II, we are completing our MVP in December. We started with whitelisting to start to build up the community. And we are focusing now to get 10’000 whitelisting, to start with the ICO.

The Team – these are some of our pictures. It’s me – I have been working 10 years in banking, my twin brother – as well as 10 years in banking. There are many other people in the team – we have 100+ years of finance experience, 50 years of crypto experience, 10 years of artificial intelligence experience. That’s our team – we are the experts.

The Summary – the Bitcoin defined the base money for the Internet, the monetary systems don’t need only the base money, but they need the credit-money. So, what we will do is – we will create credit money for the Internet. We will create decentral programmable elastic credit money. Meaning our impact will be the same to the commercial banks as the impact of Skype to the telcos.

Thank you. I was a little bit faster. So, let’s move to the questions.